By Contributing Editor: Jay Thompson, with significant support from contributing editors, the "Ortho Expert" and the "DMLS Expert"

Ortho Expert

A medical device industry specialist who served on 35+ orthopedic implant design teams for market leaders, including Zimmer and Stryker, over a 30+ year career. Played significant role in development of new standards of care for the industry that resulted in 15+ significant issued patents. Holds advanced degrees in multiple fields including molecular physiology. He currently advises surgeons throughout the U.S. on the benefits, drawbacks and improvements possible as they relate to products offered by every major orthopedic device manufacturer. We believe his experience qualifies him as an expert in the field in which ConforMIS, Inc. ("CFMS") operates, namely the total knee joint replacement market. He is unaffiliated with CFMS. He has not conducted business with CFMS in the past and has no plans to do so in the future. The Ortho Expert is an acquaintance of Mr. Thompson. SkyTides has agreed to compensate him in exchange for his expert opinions as they relate to CFMS products and the relevant competition.

DMLS Expert

A medical sales senior executive with 16 years experience in the precision tooling and manufacturing sector, specializing in Direct Metal Laser Sintering ("DMLS"). DMLS is the most advanced form of 3D printing with metal materials that is available today. In 2013, the DMLS Expert's employer was the first company in North Amercia to launch a custom metal implant design and manufacturing platform using DMLS for sales to medical device manufacturers. In 2016, his employer anticipates commercial launches of DMLS printed components for various U.S.-based major medical device manufacturers. We believe his experience qualifies him as an expert in the field in which CFMS operates, namely the total knee joint replacement market. He is unaffiliated with CFMS. He has not conducted business with CFMS in the past. The DMLS Expert is an acquaintance of Mr. Thompson. He will not be compensated in connection with this report.

ConforMIS Product Issues

1. Two (2) Significant Product Defects Definitively Identified by Medical Device Expert

1) ConforMIS, Inc.'s ("CFMS") primary product "cleared" by FDA under 510(k) process

The U.S. Food and Drug Administration (the "FDA") allows for certain medical device product offerings to enter the U.S. market without undergoing clinical studies as long as the products are determined to be similar or substantially equivalent to other products currently offered in the market.

Source: www.schmidtlaw.com/wp-content/uploads/conformis-knee-lawsuit.pdf

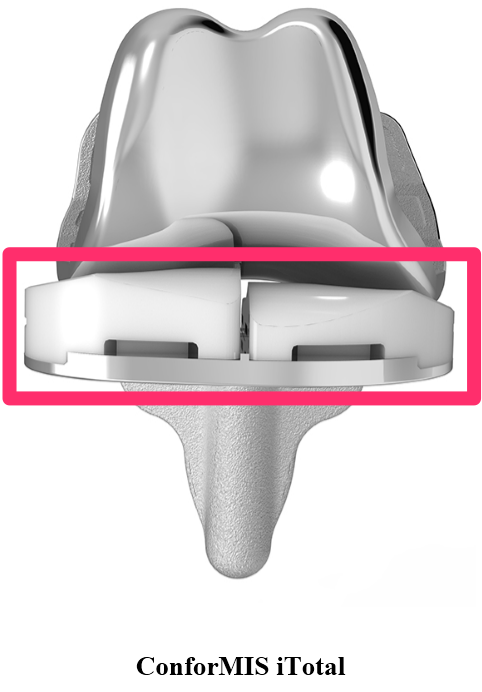

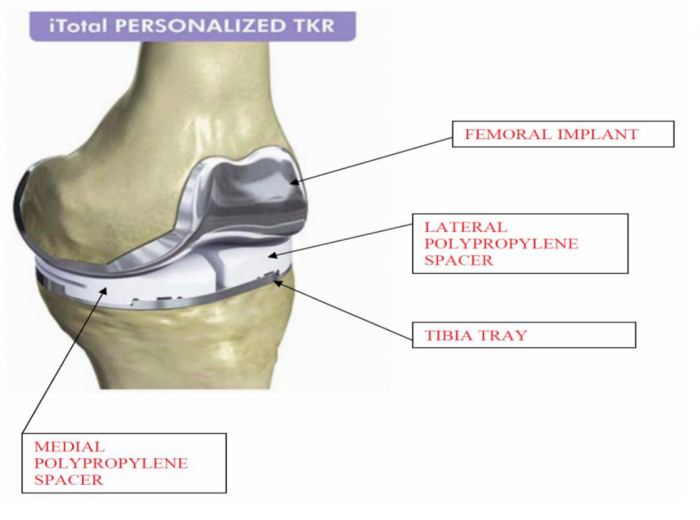

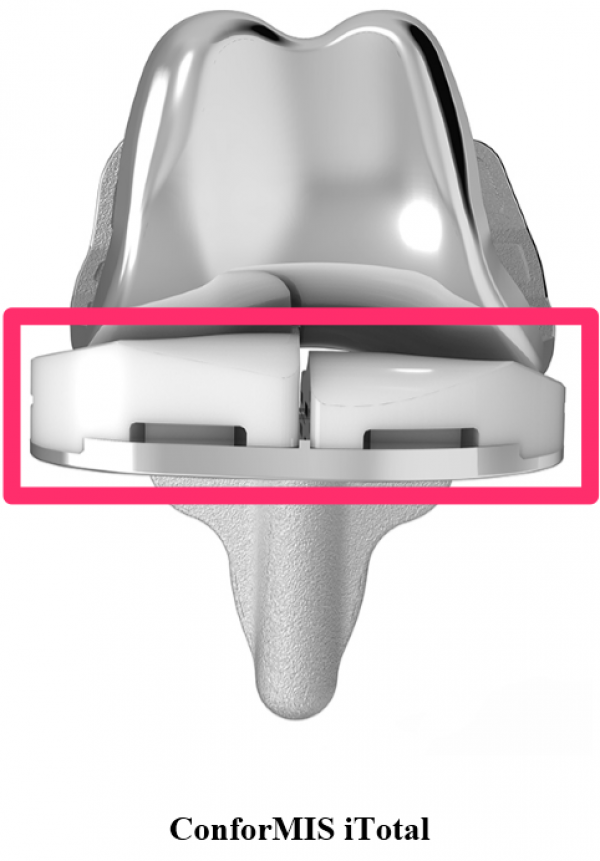

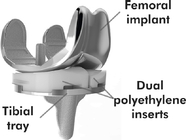

It appears the FDA was convinced that CFMS' primary product, the iTotal, was substantially equivalent in design to other products currently offered in the market. The FDA cleared the iTotal in January, 2011. The iTotal G2, which CFMS describes as a more advanced device, was announced in October 2012. A visual comparison of the iTotal and products it directly competes with in the marketplace is below. Note the obvious differences in the design of the portion of the device that is plastic. The iTotal is the only device in the comparison below that has a cavity or open space in between the left and right side of the device (the "First Product Defect"). In addition to that, the iTotal is designed to allow for significant differences in the height of the left and right side of the plastic portion of the device (the "Second Product Defect").

Sources: www.conformis.com, www.zimmer.com, www.stryker.com, www.depuysynthes.com, www.smith-nephew.com, www.biomet.com

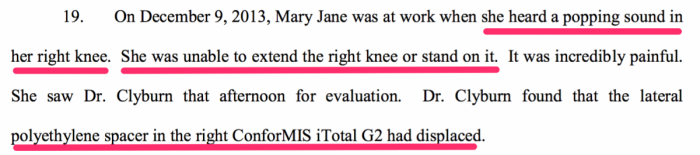

2.) Product Liability Lawsuit and First Medical Device Expert

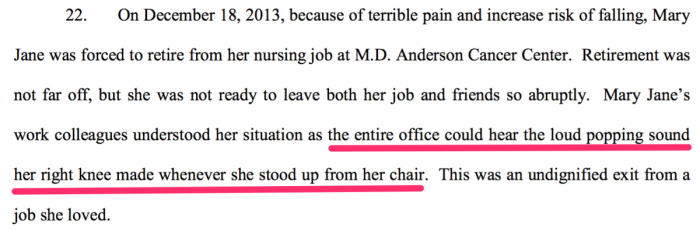

On October 21, 2014, a litigation was filed against CFMS by a patient who had previously undergone surgery to replace her left and right knees with the iTotal device (the "Product Liability Lawsuit"). The Product Liability Lawsuit claims that within less than a year of each iTotal being implanted, both devices had failed and the patient was no longer able to walk. The patient alleges CFMS sold total knee replacement devices, i.e. the iTotal, that are defective. The patient had her left and right knees replaced with the iTotal implants. Her negative experience with the iTotal is described in detail.

Source: www.schmidtlaw.com/wp-content/uploads/conformis-knee-lawsuit.pdf

The primary focus of the Product Liability Lawsuit against CFMS relates to a high number of adverse events that were reported to the FDA between October 2012 and March 1, 2014 that involved one of two issues.

1. Spacer dislodgment

2. Tibia tray loosing

The lawsuit focuses on the allegation that CFMS knew of the First Product Defect and the Second Product Defect and looked to the FDA for approval to make minor modifications to the design of the iTotal rather than informing the public of the significant adverse events patients with the iTotal implant were encountering.

According to the Ortho Expert:

If the public was made aware of the full extent of these product defects they would invariably result in yet another recall. Worse yet, the design changes would likely be significant enough to require a halt of all surgeries with the iTotal for approximately 6-18 months while significant design changes were made to the iTotal and the newly re-designed implant went through the 510(k) process yet again.

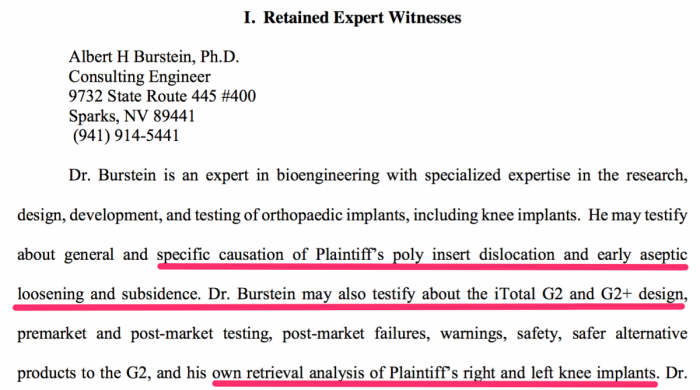

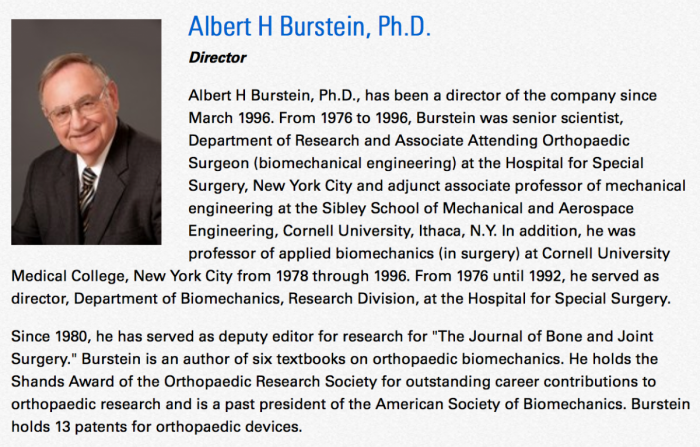

On August 14, 2015, a medical device expert, Albert H. Burstein, PhD, was identified in court records as an expert witness on the patient's side.

Source: U.S. District Court Southern District of Texas, Houston Division

Source: https://www.exac.com/investors/board-of-directors/albert-h-burstein-ph-d

It appears Mr. Burstein may testify on behalf of the patient regarding the product defects we have outlined in this report. We anticipate Mr. Burstein will explain details as to why the First Product Defect and the Second Product Defect caused the iTotal to fail in both of the patient's knees. It appears Mr. Burstein has an impressive track record. He holds 13 patents for orthopedic devices and was the co-inventor of a highly successful knee implant offered by Zimmer.

We believe Mr. Burstein may have been the first "orthopedic expert" who identified significant product defects in CFMS' iTotal. His findings have been "filed under seal" with the court thus far. We hope the seal is removed soon. If so, we believe there will be two medical device experts, namely Mr. Burstein and the Ortho Expert, who will verify the iTotal product defects.

We also noted Dr. Terry Clyburn, who is a CFMS affiliated surgeon and performed the surgeries for the patient, had some damning statements to make about the iTotal during his recent deposition. Two specific quotes from his deposition were of particular interest to us.

Source: U.S. District Court Southern District of Texas, Houston Division

We believe this litigation is moving forward, expert witness lists have been filed by both parties as of last month. A trial appears as though it will happen sometime soon. We also believe more lawsuits against CFMS are forthcoming. It is just a matter of time.

The Ortho Expert stated:

Even a poorly designed knee implant could function and not necessarily fail for a period of up to a few years.

We note that the first significant sales of CFMS devices appear to have occurred in 2012. It is now 2016. The iTotal is a poorly designed knee implant. We believe the iTotal devices that have been implanted over the past four (4) years are going to begin to fail at an even higher rate as time moves on.

3.) The Ortho Expert identifies and explains two (2) product defects in detail, both existed upon the launch of iTotal in 2011, and both still exist today

As a member of numerous Total Joint design teams and after careful analysis of the overall design of the ConforMIS Knee System it is apparent that there are major concerns with the design of the tibial insert of their design (i.e. First Product Defect). In the Orthopedic Implant Industry it is the responsibility of the manufacturing company to have a very high knowledge base and manufacturing capability to provide biomechanically sound designs and appropriate uses of the acceptable materials for the implant. When examining the tibial insert(s) of the ConforMIS Knee it is apparent that the inserts have a significant design flaw that would make the tibial inserts prone to early wear, deformation and the potential of disengagement from the tibial base plate. An example of this has led to a law suit (which has been included in this report). The manufacturer (and the engineering department) should have access to significant data bases about the properties of UHMPE (Ultra High Molecular Polyethylene) derived from over 50 years of studies, testing and clinical usage. It has been determined (without question) that UHMPE does not take shear forces and will wear quicker when put in shear. In addition if multidirectional shear forces are introduced (as in the ConforMIS Knee) the plastic will also deform. All Total Knee Replacements go through flexion and extension along with rotation (called the screw home mechanism) which puts significant shear between the metal femoral component and the plastic tibial insert. One of the major design goals is to minimize the shear forces at this articulating junction. The design that ConforMIS uses on their Total Knees does not accomplish this design goal.

The point of this information is that deformation of the plastic leads to disarticulations of the plastic from the tibial base plate (as with what happened to the patient in the lawsuit) leading to the need for revision surgery. However, as significant if not more is the shear forces put on UHMPE lead to creating particulate matter that has huge negative ramifications on the patients bone. The particulate matter is perceived by the patients bone as a foreign body so the body wants to get rid of it. Since the body can't distinguish what it is the body responds by producing Macrophages (Osteoblasts) which destroy bone. This process is called Osteolysis (destruction of bone) and should be avoided in all ways. The fact that ConforMIS utilizes a tibial insert design that is bifurcated and of odd heights (i.e. Second Product Defect) is extremely disturbing when these negative outcomes are very documented in the literature. One can only assume there are other motives for this design, particularly with the lack of documentation from ConforMIS of clinical results of their implants and technology.

Some credit should be given to ConforMIS for addressing a clever way to match implant sizing and alignment (a worthy endeavor) however, including major design flaws in the final implant that will be implanted into a patient for decades really presents a lot of questions and scrutiny - not to mention the probability of many more lawsuits.

4.) Product defects identified within this report are significant and represent potential "company killers"

CFMS is very likely insured against product defect litigations such as the one described within this report. However, it appears quite clear to us that the management team at CFMS will do whatever is necessary to avoid another product recall - which would theorectically involve 30,000+ implants, or every implant ever sold by CFMS. First, a recall that large may not be entirely covered by insurance and could actually impact CFMS' finances substantially. Second, a recall related to these two product defects would very likely require a complete redesign of the iTotal. This would mean that all CFMS operations would be shut down. All CFMS surgeons would be required to use a competing device rather then the iTotal while the redesign of the iTotal was begin completed. CFMS would again need to go through FDA clearance of the new iTotal design.

An affiliate of SkyTides spoke with a surgeon who previously experimented with the iTotal (the "Former CFMS Surgeon"). The Former CFMS Surgeon specifically addressed how he feels surgeons typically react to problems with new technology.

Surgeons don't really keep trying a new thing to make it work. One bad experience is enough to just stop.

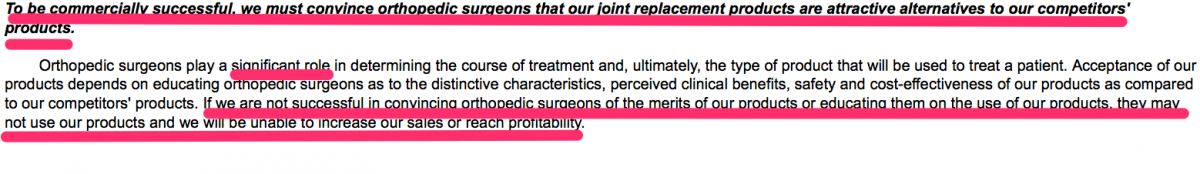

Surgeons are effectively an extension of CFMS. If surgeons do not see CFMS products as credible, reliable and safe products and agree to use CFMS products then CFMS will not survive. As outlined below in the "adverse events" and "surgeon survey" discussions, CFMS is experiencing a high rate of adverse events indicating a poor safety profile, and is clearly failing to penetrate the market of U.S. orthopedic surgeons. A massive recall and complete re-design of the iTotal would probably be the final nail in the coffin. CFMS would not be able to recover. CFMS described its reliance on its surgeons in its SEC filings.

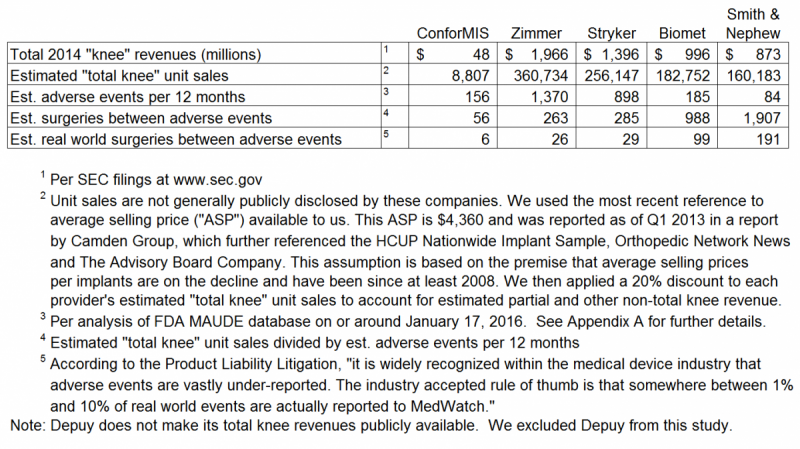

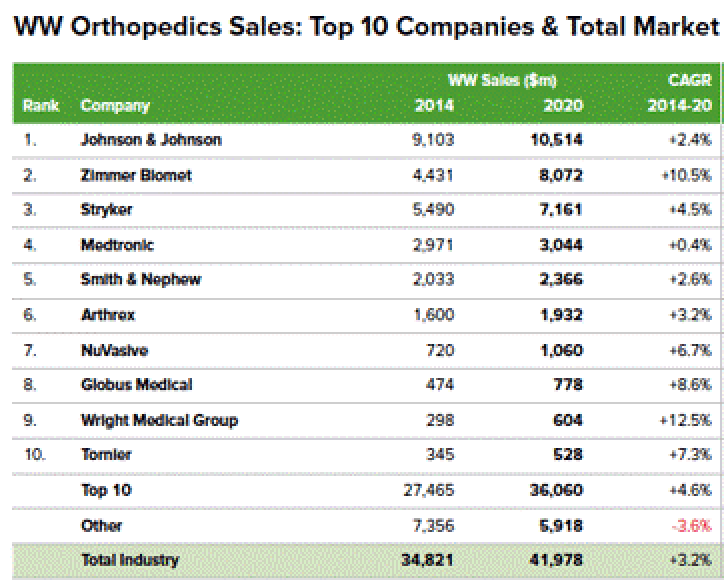

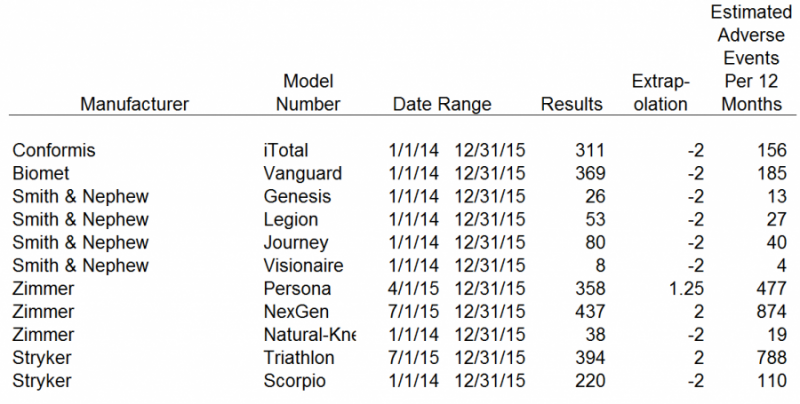

2. Comparative Study of FDA Adverse Events

The U.S. Food and Drug Administration ("FDA") regulates companies in the medical device sector. In connection with the preparation of this report, we reviewed the adverse events data in the FDA's Manufacturer and User Facility Device Experience ("MAUDE") database.

There are numerous disclaimers associated with this database but the premise behind our use of this data is based on a claim made in the Product Liability Litigation, "the medical device industry believes that adverse event reports received from both physicians and patients are a major, and important, source of safety information." We agree with this statement fully and believe this data is a valuable resource to determine the safety profile of medical devices.

The iTotal is CFMS’ "best selling product."

We searched for adverse events reported to MAUDE that related to the iTotal, and each of the devices offered by the top five market leaders that compete with the iTotal. We used specific key words and a specific strategy to obtain the most reasonable raw data from MAUDE that we could then use to analyze adverse events encountered by patients who received an implant such as iTotal and other competing products. Our specific key word searches, overall search strategy and results, are outlined in Appendix A to this report.

We have summarized the results of our adverse events comparable study as follows. The Ortho Expert explained the key findings:

In the real world, a patient choosing to undergo a total knee replacement surgery with a CFMS iTotal implant has a 1 in 6 (i.e. 16.7%) chance of experiencing an adverse event. The chance of an adverse event occuring when using any other product by the four (4) competitors listed below decreases to a range of 0.5% to 3.8%. Adverse events with the iTotal are 32 times more likely (i.e. 191/6 = 32) than with Smith & Nephew total knee products.

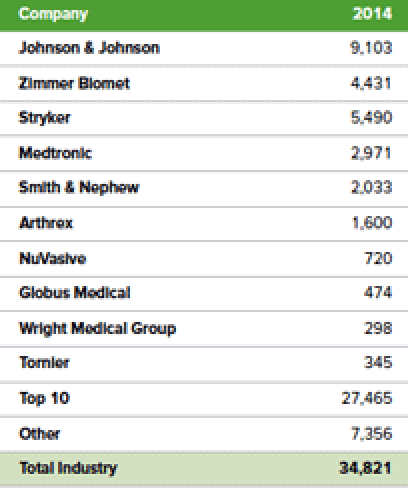

3. Surgeon Survey Shows Little Love for CFMS Primary Product, Seen as Gimmick

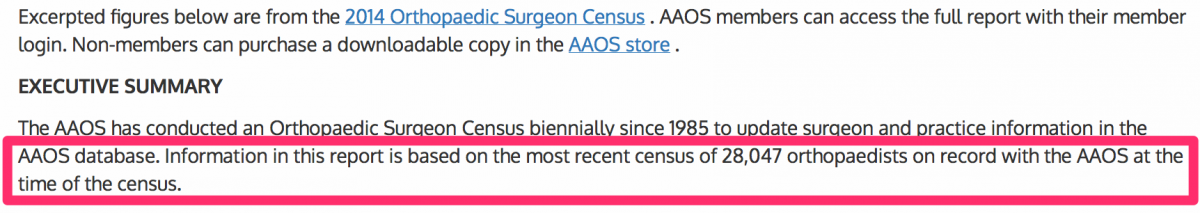

We determined there were 28,047 U.S. orthopedic surgeons. In January 2015, the American Academy of Orthopedic Surgeons (“AAOS”) produced an annual census entitled “2014 Orthopedic Surgeon Census.” The AAOS stated that there were 28,047 orthopedic surgeons on record with the AAOS.

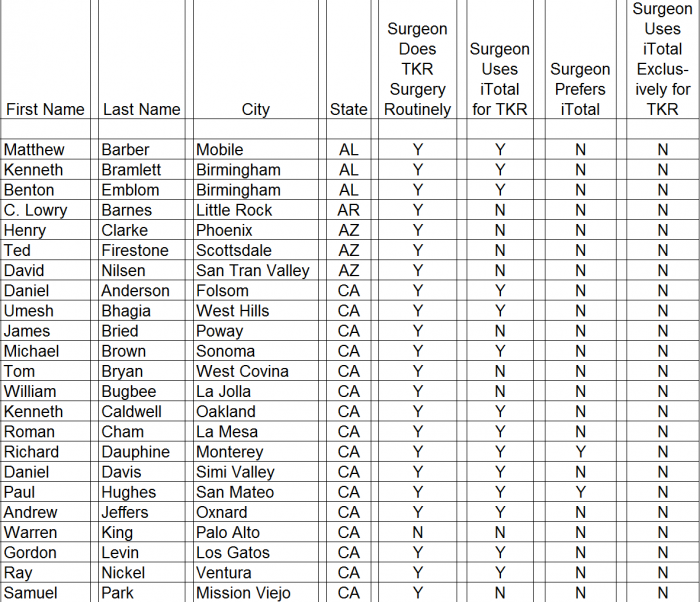

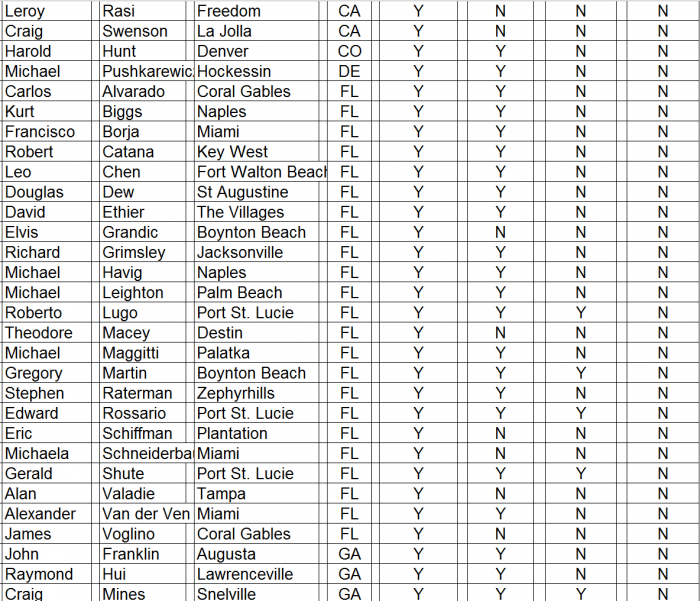

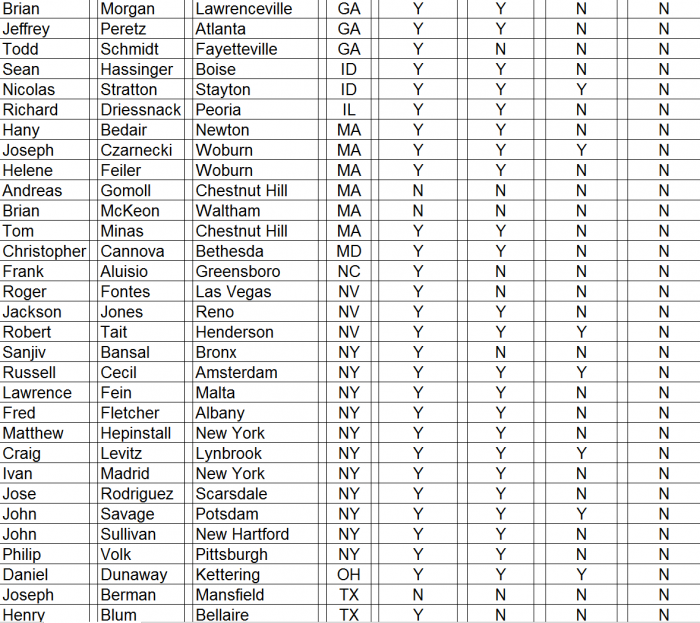

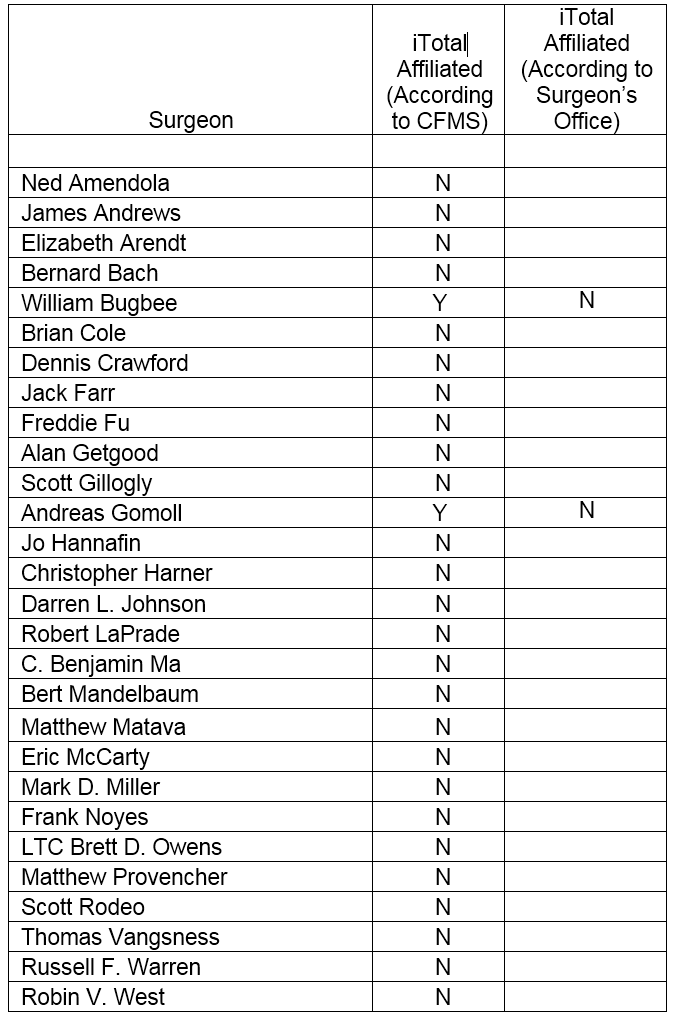

We conducted a survey of orthopedic surgeons identified by CFMS on its website during December 2015 and January 2016. The results of our surgeon survey are summarized below.

- ► CFMS affiliated surgeons totaled just 311 out of 28,047 (1%) of all U.S. orthopedic surgeons. A complete list of all 311 surgeons and the call sheet we used for each call is provided as Appendix B to this report. We presumed any surgeon using CFMS products would be listed on the CFMS website with all of the other surgeons.

► We spoke with personnel at the offices of 102 of the 311 surgeons, only 70 of 102 (69%) surgeons were said to actually use CFMS’ primary product, the iTotal.

► Only 17 of the 102 (17%) personnel said the surgeons preferred iTotal.

► None of the 102 (0%) personnel said the surgeons used iTotal exclusively.

We also considered other facts we recently uncovered and came to the following conclusions.

► The first successful iTotal surgery occurred in 2011. Management said it would “redefine the category.” The media said it was a “revolutionary surgery.” The iTotal was designed for the total knee replacement (“TKR”) market. The global TKR market is estimated to be $7 billion annually. CFMS recently projected its revenue at $64-$66 million or <1% of the TKR market (i.e. $66M / $7B = <1%) for 2015. Simply put, almost 5 years later, the iTotal has failed to significantly penetrate the TKR market and is a failure.

► A product that less than 1% of U.S. orthopedic surgeons use, and has less than 1% TKR marketshare represents a fly that CFMS’ well-entrenched $ billion competitors will swat away.

► We considered the fact that surgeons appear to be touting CFMS 3D printing in the media. We see this as a likely example of surgeons using iTotal to differentiate their surgical practice. We also believe many of these surgeons are being directly compensated either directly by CFMS or indirectly for their promotional activities. However, of the surgeons we surveyed, who are affiliated with CFMS, if only 17% of them preferred iTotal and none of them use it exclusively, then many of the CFMS affiliated surgeons may be using iTotal as a gimmick to generate business with patients. The Ortho Expert concurred with our finding. It seems very possible that iTotal is seen as a gimmick and is actually no more compelling to surgeons than any of the other products on the market. The Former CFMS Surgeon agreed that the iTotal is not superior to other products.

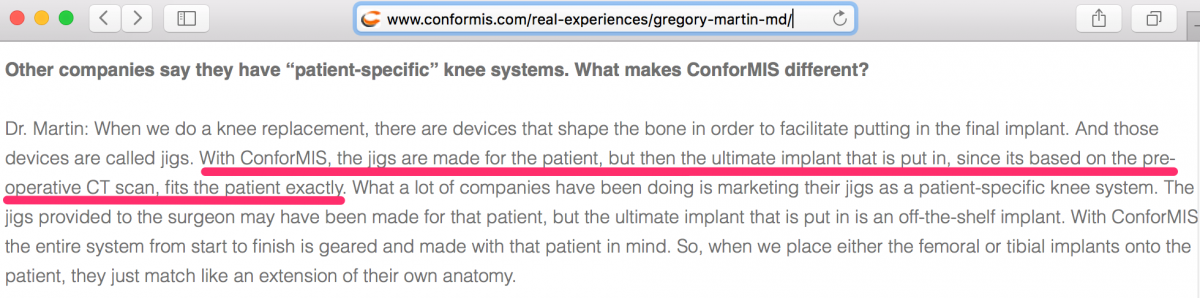

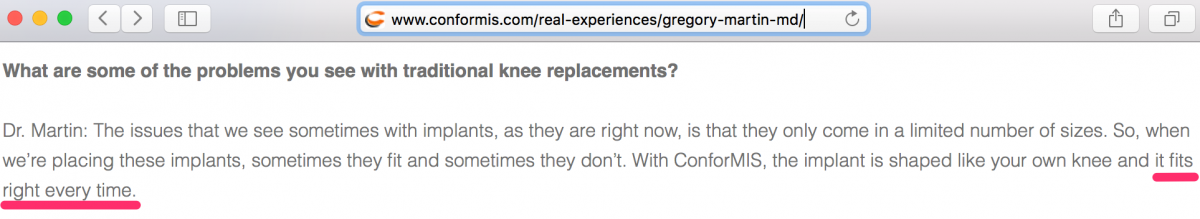

► When we spoke with personnel at the office of the most prominent CFMS key opinion leader, Dr. Gregory Martin (the “KOL”), we were told he does not use iTotal exclusively for TKR surgery. We were told the KOL “also uses Depuy.” We noted in a video interview and written transcript at www.conformis.com that the KOL does not address his use of a product that directly competes with CFMS. Why doesn’t the KOL use iTotal exclusively?

Detailed results of our survey:

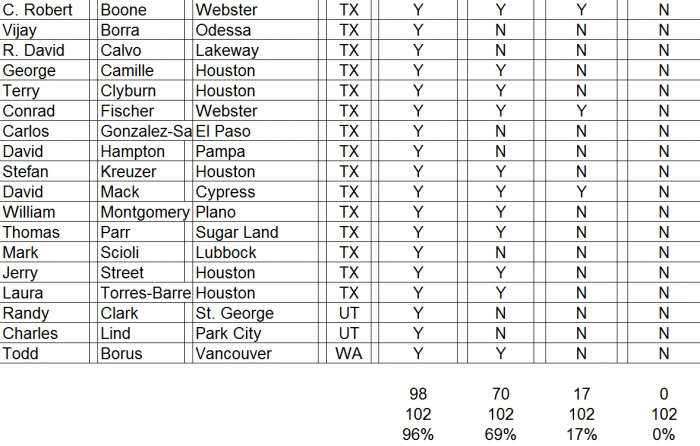

4. 5 Recalls in 7 Years

We reviewed the various recalls by CFMS. We noted that there have been 5 recalls in 6 years. CFMS had recalls 1, 2 and 3 in 2009, 1 recall in 2012 and 1 recall in 2015. CFMS’s CEO, Dr. Lang, has downplayed the impact of recalls. However, the reality is that CFMS has exhibited a pattern of ongoing poor execution. Ultimately, any suggestion that poor results, recalls, missed delivery dates, miscommunication or other issues don’t negatively impact customer or surgeon relations is a hollow statement. An overview of the various CFMS recalls is below.

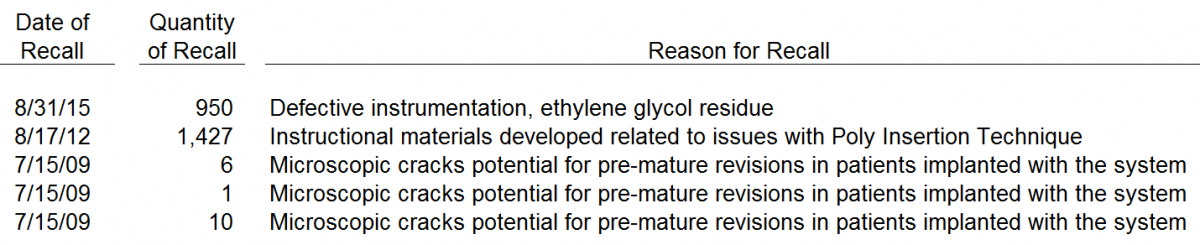

5. “Patient-Specific” Promotion Ignores Existence of Other Custom Knee Products

The narrative promoted by CFMS that they have a significant technological advantage over large entrenched market leaders generating many billions of dollars in annual revenues is a common narrative. CFMS is yet another small technology company making grandiose claims without definitive data to support those claims. According to a September 2015 report by EvaluateMedTech, the top five (5) global orthopedic device companies are as follows:

Source: http://www.qmed.com/mpmn/medtechpulse/top-orthopedic-firms-and-trends-20...

CFMS promotes the iTotal as the “only patient-specific total knee replacement available on the market today.” Ultimately, the iTotal is a custom knee. The Former CFMS Surgeon specifically addressed competing custom products as follows.

Competitors have custom guide process which frankly is just another tack at the same problem...Depuy and Biomet have custom cutting guides which is the same as Conformis.

We reviewed the product offerings for each of these leading companies and determined that each of them, with the exception of Medtronic, has a patient specific or “custom solution” for TKR. Further, as the images below show, using CT Scans and 3D imaging to improve the fit of knee implants is not something that is unique to CFMS. The reality is that everyone, or at least four (4) of the top five (5) market leaders, has similar products. The difference is that all of these competitors appear to envision their primary product offerings, the off-the-shelf knee replacement implants, which were developed and continually improved over the last 50 years, as still being preferred in the marketplace. Our surgeon survey results and the failed market penetration of iTotal in general, support this view. CFMS appears to be the only company that has decided to forego the traditional knee or off-the-shelf product category and focus 100% of its effort on a patient specific or custom knee product. CFMS has in effect picked a fight with not one but at least four (4) goliaths in their industry and has come to battle with claims of superior technology that can’t be definitively supported. In our view, every advantage appears to be held by Johnson & Johnson, Zimmer Biomet etc. CFMS is but a fly, ready to be swatted away by dominant market leaders.

Visual references to the various custom knee solutions offered by Depuy, Zimmer, Stryker and Smith & Nephew are below.

Source: https://www.depuysynthes.com/hcp/knee/products/qs/TRUMATCH-Personalized-...

Source: http://www.zimmer.com/medical-professionals/products/knee/persona-knee.html

Source: http://phx.corporate-ir.net/phoenix.zhtml?c=118965&p=irol-newsArticle&ID...

Source: http://www.smith-nephew.com/professional/products/all-products/visionair...

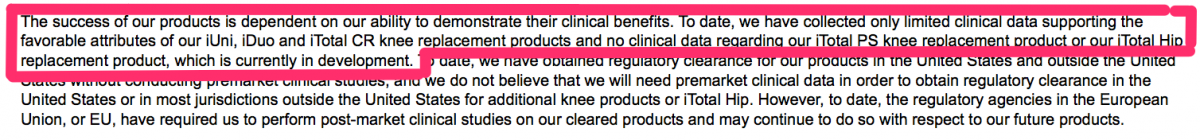

6. No Definitive Data After Almost 12 Years

We previously noted the iTotal was launched after clearing the FDA through the 510(k) "loophole." Amazingly, CFMS to this day still lacks definitive data after almost 12 years of operations. We wonder if CFMS may not completely believe it will be able to show definitively that its iTotal improves the patient outcome and is “better” than competing products.

The Ortho Expert stated:

It is widely accepted within the healthcare field that the effectiveness of a medical device concept is fairly meaningless until such concept is supported by credible independent clinical data that is published in a peer reviewed orthopedic journal. I don’t see how any product in the orthopedic field could ever become “best in class” without definitive data supporting the claim. The question is why has CFMS been unable to produce definitive data?

Alternatively, assuming iTotal does in fact improve the patient outcome, CFMS may not survive as an entity long enough, while competing against its entrenched, dominant competitors. Additional substantial dilution seems as though it will be necessary soon in order to keep CFMS alive. Even still, news of definitive data may come too late.

We obtained a copy of a December 7, 2015 sell side report prepared by Cannaccord Genuity (the “Sellside Report”). The Sellside Report noted that “primary outcome” data from three clinical studies highlighted by management would be available in “1H2017” and “Q4/18” respectively. We are not sure of the clinical trial design of these studies but if the past is any indication of the future, these clinical studies will be paid for by CFMS, performed by CFMS affiliated (and therefore not independent) surgeons, and will not be publishable in a leading peer reviewed journal. In that instance, where the data is not presented in a leading peer reviewed journal, the data is essentially useless.

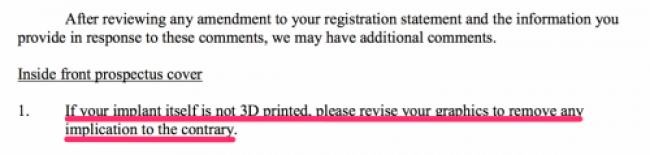

7. 3D Printing Promotion

CFMS has been touted for its purported ability to “3D print” orthopedic joint replacements, specifically total knee implants. During its the initial public offering (“IPO”) process CFMS attempted to infer that its implants were 3D printed. The SEC realized this and slapped CFMS on the hands.

It appears CMFS kept its 3D printing claims out of its SEC filings. We believe their roadshows and other IPO-related activities must have made mention to its purported 3D printing capabilities as the narrative of the CFMS IPO, in the media and between investors, was all about 3D printing.

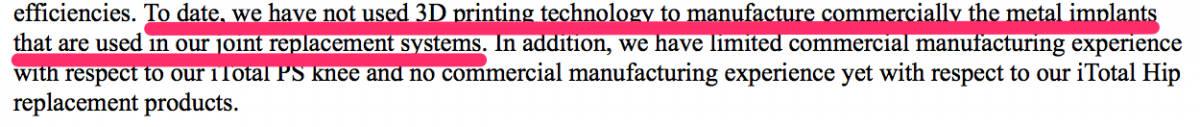

The “3D printing” narrative was trumpeted in the media during the IPO process in the summer of 2015. Since the CFMS IPO, references to 3D printing capabilities have continued on various media platforms. Investors, some of whom are prominent, have touted CFMS’ purported 3D printing capabilities as a primary reason why they invested. Surgeons affiliated with CFMS have conducted interviews with media outlets to promote their affiliation with CFMS 3D printing capabilities. Amazingly, the fine print included within CFMS’ latest Form 10-Q filed with the SEC on November 9, 2015, states “to date, we have not used 3D printing technology to manufacture commercially the metal implants.” CFMS does not offer any implants that are not primarily metal.

The Ortho Expert had the following thoughts on claims about CFMS technology being “3D printed.”

As highlighted in this report, the claims by Conformis surrounding the 3D printing topic are at least very confusing. They state point blank that they don't use 3D printing on their metal implants. They don't mention the plastic portion of the implant. If they do 3D print the plastic portion this would not be a significant technical accomplishment. This would mean that this technology is used only a total of 30-35% of their knee components. It appears the Conformis knee fits all the criteria that is the industry standard for "off the shelf" TJA implants. Their claim of some sort of design and manufacturing supremacy has little and/or no merit.

CFMS reminds us of another public company that promoted itself as a 3D printing trailblazer. Organovo Holdings, Inc. (“ONVO”) was touted as a company with revolutionary 3D printing technology that would allow it to print human tissue. Investors finally realized its claims were greatly exaggerated. ONVO shares are down from a high of $12.50 on October 15, 2013 to $2.16 as of January 8, 2016 – a decline of 83% (i.e. $12.50 - $2.16 = $10.34/$12.50 = 83%).

It seems to us that once investors become aware that CFMS is not actually 3D printing its metal implants then shares of CFMS will collapse. We believe this collapse could occur more sharply than ONVO because CFMS has actually admitted to its inability to 3D print its products.

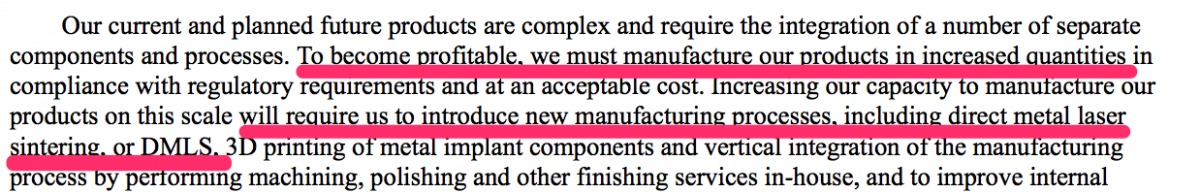

8. DMLS – According to Management this is the Key to CFMS Profitability

CFMS plans to use direct metal laser sintering (“DMLS”) to 3D print its implants. CFMS implants are made primarily of metal. We note that the “femoral component” of the iTotal is clearly made of metal.

CFMS stated that it must manufacture its implants using DMLS in order to reach profitability. We believe this is true because CFMS is a small company. CFMS' manufacturing of its implants, which are all custom, is much more labor intensive and less profitable than the entrenched market leaders who utilize economies of scale to produce implants at extremely low cost and have the surgeons do the majority of the customizing of the implant during surgery. Ultimately, CFMS is so small as compared to the market leaders that it will not be able to compete on a level playing field. It needs an advantage. That advantage is supposed to be DMLS 3D printing.

Although we understand why CFMS would attempt to use DMLS 3D printing, it is our view that CFMS has downplayed the significant challenges it faces if it attempts to develop DMLS 3D printing of its implants. The DMLS Expert stated:

I do not believe a custom knee implant has ever been produced at commercial scale using DMLS 3D printing.

DMLS 3D printing is not a “plug and play” technology whereby CFMS can simply buy DMLS machines and 3D print its metal implants. According to the DMLS Expert, DMLS 3D printing is highly dependent on the skill level of the technician using the DMLS hardware and software. There are a limited number of experienced DMLS technicians in the world. CFMS has to find the right personnel and keep them. We don’t believe any company, including CFMS, has ever produced a custom knee implant at commercial scale using DMLS 3D printing. We see little reason to believe that CFMS, given the product defect issues, current products failing in the marketplace, 5 recalls in 7 years, a limited budget and a likely lack of any high quality experienced DMLS technicians on staff, will be the first company to achieve this significant milestone.

Another issue with DMLS is that the technology uses sintering to “print” the metal. According to the DMLS Expert, this process produces metal parts with rough surfaces. We are unsure how CFMS plans to polish and smooth out the rough surfaces generated by the sintering process.

According to the Ortho Expert:

Smooth, pristine surfaces are required on the largest surface areas of the implant.

Further, we are unsure if this polishing and smoothing process will alter the accuracy level of the implant – thereby negating the primary benefit supposedly offered by CFMS technology.

Ultimately, we believe DMLS is cost prohibitive for CFMS – unless the CEO decides to dilute shareholders again.

1) Outsourcing

DMLS can be outsourced to contract manufacturers. However, when we spoke with several DMLS contract manufacturers in January 2016 it became clear to us that CFMS would never be able to outsource its DMLS manufacturing. DMLS is primarily used to 3D print a metallic product in mass quantity. DMLS is not heavily used nowadays for single prints of single-design 3D products whereby each product manufactured is unique in its size and shape. Each implant made by CFMS is unique in size and shape. As a result of the need to size and shape each implant, contract manufacturing can not offer CFMS an efficient and reasonable cost per implant. Outsourced contract DMLS manufacturing is prohibitive for CFMS.

2) In-house manufacturing

In order to successfully 3D print its custom implants, CFMS must develop in-house DMLS manufacturing and finishing systems. We envision CFMS facing significant challenges if it attempts to use DMLS to 3D print its implants. First, CFMS explained that it plans to bring its current traditional machine manufacturing processes in-house. That in itself is challenging for any small company. CFMS may fail or face setbacks in its attempt to do this. Second, CFMS will need to spend a significant amount of capital to acquire DMLS hardware and software. A build-out of infrastructure will be necessary to allow for in-house manufacturing with DMLS and finishing systems. The DMLS Expert told us that CFMS should purchase the EOS M290 (the “M290”). This is the most advanced DMLS machine that CFMS could purchase today.

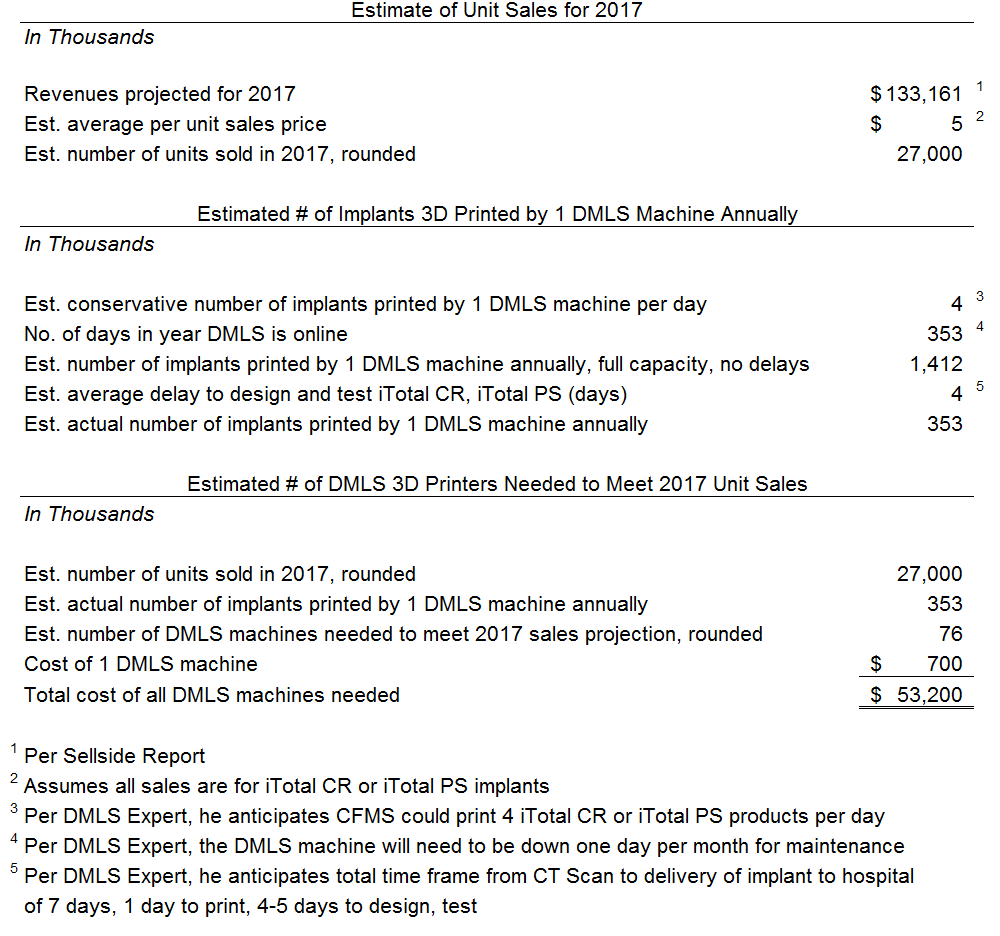

3) Even an in-house manufacturing platform using the M290 is prohibitive

The cost of the M290 is $700,000.

We know that there are software costs to consider as well and have been told those costs are approximately $20,000 annually. Infrastructure costs and buildout of the manufacturing area will also be costly. However, for conservatism’s sake we will only consider the cost of the M290 in our analysis below.

This analysis suggests that if CFMS plans to meet its 2017 forecasted revenues using DMLS then CFMS would have to purchase 76 DMLS machines costing at least approximately $53 million. We estimate the software costs, finishing equipment and manufacturing area buildout will cost at least another $20 million, conservatively. All in, to meet its 2017 forecast using DMLS, CFMS would need to spend at least $73 million. As of the date of this report we estimate CFMS had approximately $128 million - see the "Valuation" section. We do not believe management would allocate 57% ($73/$128 = 57%) of its current capital for DMLS given its current continuing losses and negative cash flows – especially given that losses are projected by management until at least 2019. The only way to afford DMLS without jeopardizing the company's continued existence is to complete another substantial capital raise. We considered CFMS’ forecasted losses of $145 million for the next four years and assumed conservatively that CFMS would need $100 million to realistically give DMLS the best chance of success. We believe management would only raise capital if it covered the losses for the next four years of $145 million, the $100 million for DMLS, and a cushion of $100 million. Ultimately we believe CFMS should attempt a $345 million capital raise it if wants to actually commit to a DMLS platform. However, we are highly doubtful that the market will provide that level of capital at a reasonable valuation.

4) CFMS tests of DMLS at its facilities could succeed but full commercial operations may not succeed.

Simply put, because each DMLS 3D print job is unique, CFMS can not run the same program within the M290 DMLS machine every time it runs a print job. Each print job will require its own print program designed by the technicians. As a result of there being no "standard" print program that can be run over and over again to print mass quantities of the exact same product, CFMS implants will have a higher risk of error each and every time they are printed, as compared to standard mass-produced products. The testing phase that may resolve errors for standard print programs and will allow standard prints to be completed with very little error. The testing phase for CFMS printed products will only resolve errors for the particular print job currently being tested. The test and adjust process, or trial and error process as some call it, will continue every time CFMS prints a product.

9. “Fits the Patient Exactly” and “Fits Right Every Time” Promotions are Obvious False Claims

CFMS and its surgeons suggest that the iTotal “fits the patient exactly” and even say it “fits right every time.” CFMS appears to operate within the TKR market based on this general premise that their devices are perfect etc. The thing is…as we explain further below, there is no definitive data to suggest first that iTotal is better than competing products. Claims that iTotal fits “exactly” and “fits right every time” are dubious at the very least and may very well represent intentional misinformation propagated by CFMS. We refer to these two statements in this report as the Primary False Claim and Secondary False Claim, respectively.

The Ortho Expert responded to these claims as follows:

These claims are quite lofty and unrealistic. It is well recognized that performing a total joint replacement is considered to be a very high level of carpentry. Many factors go into the successful result of a TJA which includes the alignment and sizing. To give credit to Conformis they have focused in on very technical and important steps to theoretically improve clinical results. The concern for these claims relates to stating that because of their technology "it fits perfect every time". The fact is that the outcome they are professing is quite improvable if not actually impossible. The mismatches to an exact fit are numerous and will be detailed further in this report but issues in manufacturing tolerances, mal-aligned CT scans, surgeon skill level and unrecognized pathology are indeed challenges to this claim. In addition there are multiple technical issues when using imaging as the basis of your technology. X-Rays, CT scans and MRI's are all prone to magnification, operator and patient movement errors not to mention the possibility of software glitches.

Note: Additional commentary regarding false claims by CFMS is provided in Appendix C to this report.

10. Surgeons Promoting CFMS Online Have no Track Record in Innovation

There are numerous innovative leaders in orthopedic devices. We obtained a list of 28 orthopedic leaders and noted that none of them are affiliated with CFMS’ iTotal. We noted of the 28 orthopedic surgeons listed, the CFMS “find a doctor” database at www.conformis.com provided the contact information for 2 of these 28 surgeons. We contacted Dr. Bugbee and Dr. Gomoll’s offices on or about December 29, 2015. We asked the surgeon’s personnel which TKR product the surgeon used. Dr. Bugbee's office did not identify Conformis as a product they use. Dr. Gomoll's office stated that Dr. Gomoll does not do TKR surgery. The leading innovators in orthopedics appear to have shunned CFMS.

We then reviewed the various online statements, Q&A sessions and videos on the CFMS website. We researched the surgeons quoted or otherwise presented on the website. It appears to us that not one of the various surgeons promoting CFMS products on its website have any significant track record of innovation in orthopedics or any other field. We believe the surgeons on CFMS’ website are being compensated directly or indirectly by CFMS. As a result, we anticipate they will speak positively about CFMS. We believe the lack of involvement of prominent innovative orthopedic surgeons is alarming at the very least, considering the hype surrounding the product, and lack of response from the leaders in the field.

Industry Issues

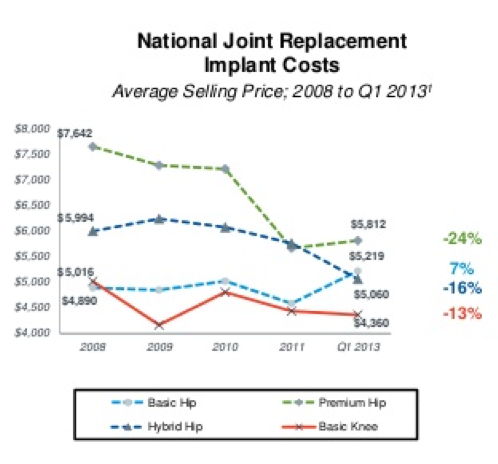

1. Total Joint Replacement Price Erosion

A number of market trends for total joint replacement ("TJR") have been negative for some time now.

The Ortho Expert stated:

There is not one trend I can think of in the TJR market that is positive news for CFMS or any other company in the space right now. These are dark days. Price erosion of joint replacement implants has been occurring since at least 2008. I believe the trend actually started around 2005 but there seems to be no verifiable data available to support that claim. Either way, my research has indicated CFMS is paid approximately $4,000 for its iTotal on average. The CEO explained that CFMS is currently offering iTotal at the same rate as off-the-shelf products because that is all that Medicare will reimburse. Medicare does not consider iTotal to be a product worthy of a premium rate.

2. Discounted Bundled Pricing

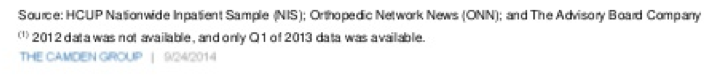

The top 10 orthopedic device manufacturers generated approximately $27 billion in sales in 2014.

According to the Ortho Expert, these companies each sell thousands of unique products to U.S. hospitals but more importantly in this case, they sell a variety of products within all clinical disciplines that exist within hospitals. The broad and diverse product lines offered by these large companies provides hospitals with an opportunity for one-stop shopping. Hospitals are in constant crisis mode nowadays as the entire healthcare system is being forced by the ACA to cut costs. Group Purchasing Organizations (“GPOs”) and hospital mergers are further centralizing the decision making and procurement processes. The end result of the hospitals being forced to cut costs, and the ACA and GPO pressure on costs, is that the average price per implant CFMS and others can charge will continue trending down.

3. Medicare is Stressed, CFMS Survival Dependent on Proof of Superior Definitive Data

Proof that CFMS products improve the patient outcome is critical – yet CFMS has no credible independent clinical data to speak of. The Medicare and Medicaid systems (“Medicare”) are under increasing scrutiny as a result of the “Pay-for-Performance” programs included within the Affordable Care Act. In addition, most TKR surgeries are performed on patients who are covered by Medicare. As a result, although it is well understood that the potential patient population is increasing as the baby boomers age, this growth is not without repercussions. Medicare total costs are going up. Savings must be found by decreasing per unit costs. We don't believe this environment suits CFMS.

The Former CFMS Surgeon stated:

The market for new implant vendors is not as robust as it has been because of pressure to use preferred vendors with lower pricing. Conformis thus has to be orders of magnitude better to justify in this environment and it just isn't.

4. Construct Pricing – CFMS May Get Kicked out of Hospitals

Hospitals are being driven to not only cut costs but also to cut the number of companies the hospital contracts with. This effort is meant to simplify operations but ultimately it is causing hospitals to choose to do business with larger companies with broader product lines. Smaller companies such as CFMS are being “kicked out of hospitals.” The Former CFMS Surgeon confirmed this trend and its direct implication on CFMS operations.

Hospitals are moving towards preferred vendors w/better prices and no hospital has CFMS on that list.

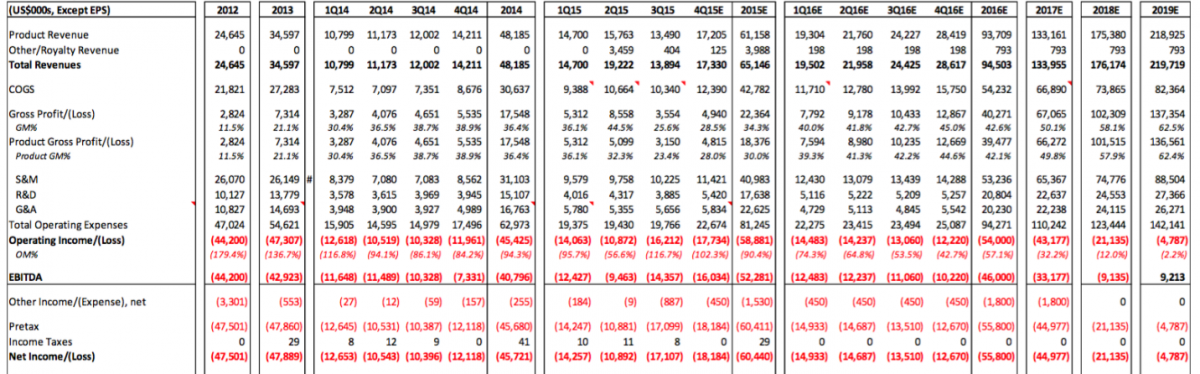

CFMS Cumulative Losses $310+ Million, Losses Forecasted in 2016, 2017, 2018, 2019

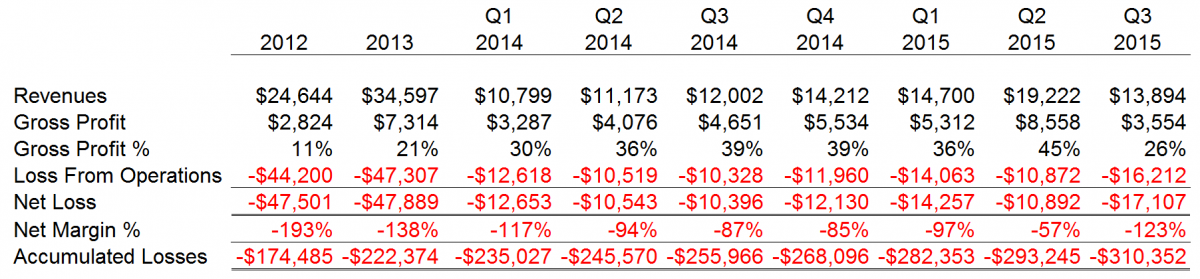

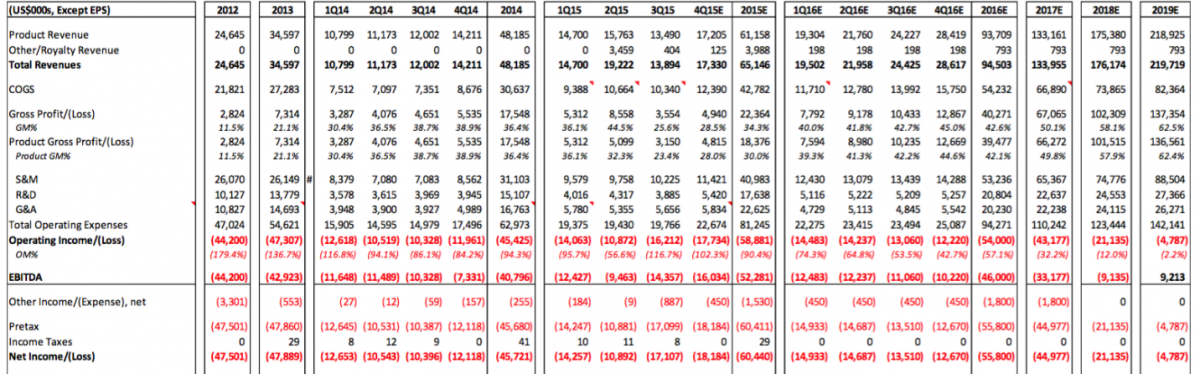

Since 2004, CFMS has sustained cumulative losses of approximately $310 million. We noted wild swings in gross profit % and net margin % that we believe are representative of a manufacturer that is struggling to acquire marketshare in a mature sector, contain costs while competing against entrenched competitors and implement in-house highly advanced manufacturing operations. CFMS explained its recent poor results for September 30, 2015 were due to the recall announced on August 31, 2015 and related manufacturing issues.

CFMS financial results for each period disclosed to the public thus far by CFMS are as follows.

Source: Various Form 10-Q and Form S-1/S-1A filings at www.sec.gov

Source: Sellside Report

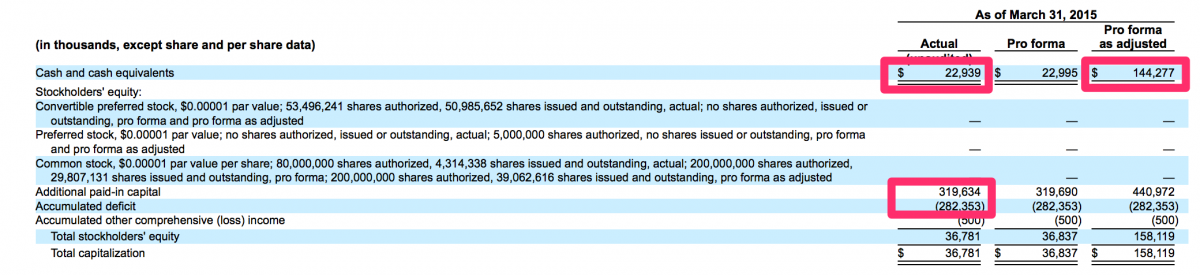

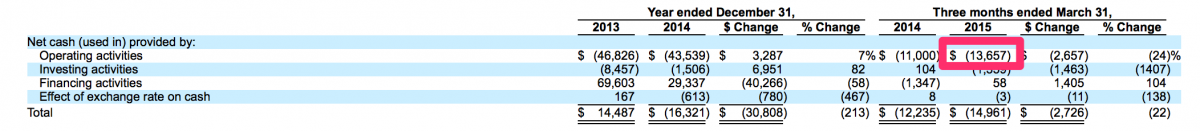

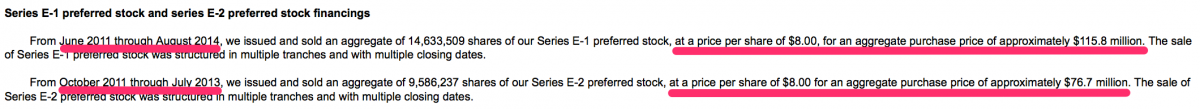

IPO in Lieu of Bankruptcy

It is quite counter-intuitive but in this world we live in, a public offering can actually be a viable method to stave off bankruptcy. This is something that management of the over-the-counter and pink sheet stocks of yesteryear are well aware. In many cases, a failing private company may have been organized with good intentions and its management may have at one time been legitimate businessmen. However, when forced with a possible bankruptcy or a demise of some other nature, these good intentions are routinely dismissed in favor of businessmen retaining some form of legitimacy. In this case, specifically the case of CFMS and its July 1, 2015 IPO, the management of CFMS were likely considering bankruptcy should their IPO not succeed. Through March 31, 2015, CFMS had raised approximately $320 million and generated losses of approximately $282 million. CFMS had approximately $23 million in cash at March 31, 2015 and had approximately $14 million in cashflows used in operations for the three months ended March 31, 2015. Therefore, CFMS used approximately $4.67 million of cash in operations per month during the three months ended March 31, 2015. At that rate, if the IPO had not been successful, CFMS may have run out of cash by August 31, 2015 and could have been bankrupt today rather than being listed on the NASDAQ with a market value of just over $500 million.

Source: http://www.sec.gov/Archives/edgar/data/1305773/000104746915005782/a22252...

CFMS Touts Advanced Technology but R&D Spending is Low

We noted the various strong commentary CFMS has used in the public markets to describe their products and technology in general. In our experience, the tell-tale sign that a tech company’s tech is not as advanced as they say it is, is when their R&D expenses are a low percentage of total operating expenses. In this case, according to the Sellside Report, CFMS R&D expenses will be approximately 21.7% (i.e. $17,638 / $81,245 = 21.7%) of total operating expenses for 2015. CFMS is spending the majority of its cash on sales and marketing activities. Approximately 50.4 % (i.e. $40,983 / $81,245 = 50.4%) of CFMS total operating expenses were spent on sales and marketing. These ratios are not the signs of a successful, potentially dominant tech company that CFMS envisions itself as.

Self-Dealing CEO Doesn’t Believe in CFMS Stock, Serial Capital Raiser

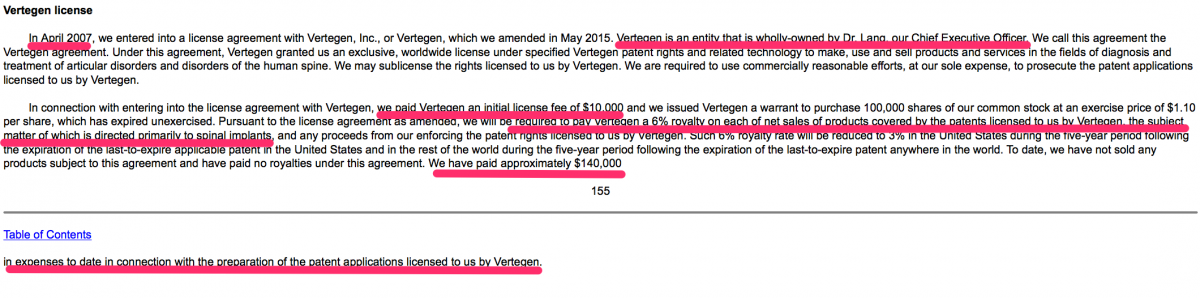

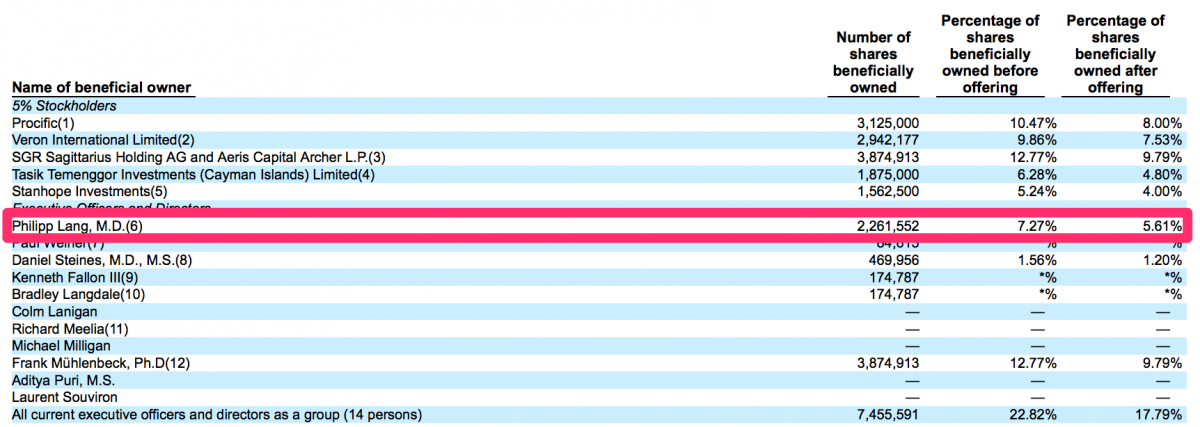

Dr. Lang wholly owns Vertegen, Inc. (“Vertegen”), a private company. It appears as though he began his self-dealing efforts in April 2007 when Dr. Lang, being the founder of CFMS, appears to have caused CFMS to enter into an agreement with Vertegen. We reviewed CFMS’ public disclosures at www.sec.gov and noted the following transactions that we believe are examples of self-dealing by Dr. Lang.

► April 2007: Vertegen was paid $10,000 by CFMS

► April 2007: Vertegen was issued a warrant to purchase 100,000 shares of CFMS common stock at $1.10 (the “Warrant”), shares and price adjusted for subsequent 2 for 1 stock split

► April 2007: Vertegen would receive a 5% royalty on all CFMS sales that utilized Vertegen intellectual property (the “IP”), primarily related to spinal implants

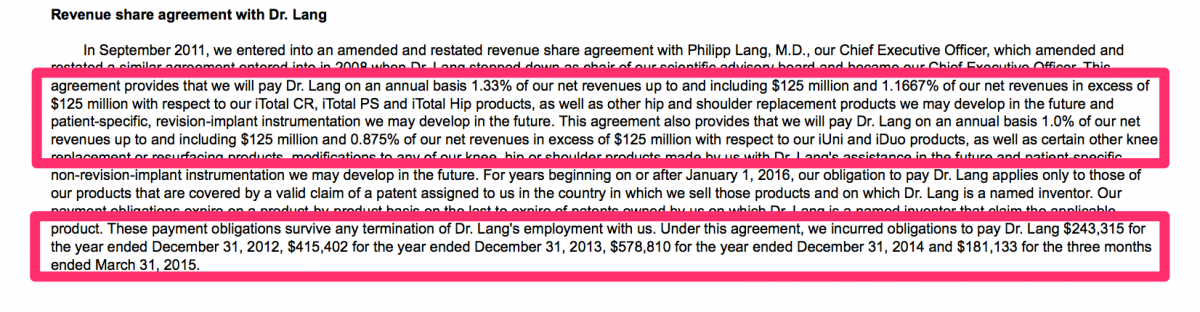

► January 2008: Dr. Lang executed his first revenue sharing agreement with CFMS in which he was to be personally paid a royalty on sales of CFMS products.

► September 2011: Dr. Lang executed an amended revenue sharing agreement with CFMS in which he was to be personally paid a royalty on sales of seemingly every product CFMS sold at rates between 0.875% and 1.33%

► May 2015: Dr. Lang caused CFMS to execute an amended agreement with Vertegen such that Vertegen would thereafter receive a 6% royalty on all CFMS sales that utilized the IP.

Although it remains highly questionable if any intellectual property rights of any true value were received by CFMS from Vertegen, what is most interesting to us is that Dr. Lang, as the sole owner of Vertegen appears to have decided not to exercise the Warrant.

The exercise price of the Warrant was $1.10. Dr. Lang allowed it to expire unexercised on April 10, 2013, less then 3 years ago. At the time, between 2013 and 2014, Dr. Lang was selling CFMS shares to investors at $8.00 per share.

We wonder why Dr. Lang did not see value in exercising the Warrant? Did Dr. Lang not believe in his company enough to exercise the Warrant and purchase shares at even $1.10? He sold shares to investors at $8.00 and pocketed $300 million for CFMS. Over the years those same investors have acquired shares in multiple offerings that now have an average cost basis of $10.98. All the while for some reason, Dr. Lang did not believe in CFMS stock.

In addition to the Warrant, CFMS agreed to pay Vertegen $10,000 and would cover all patent filing costs associated with certain intellectual property Vertegen licensed to CFMS. As of June 2015, it appears those costs have now totaled $140,000. In addition to these cash payments, CFMS still owes Vertegen a 6% royalty on products sold by CFMS that utilize Vertegen patented technology for spinal products. We note it is now 8+ years later and CFMS we’ve seen no sign of CFMS ever having developed any technology related to the spine. What was the business purpose of this transaction then? It seems the only rationale would be self-dealing for the benefit of Dr. Lang.

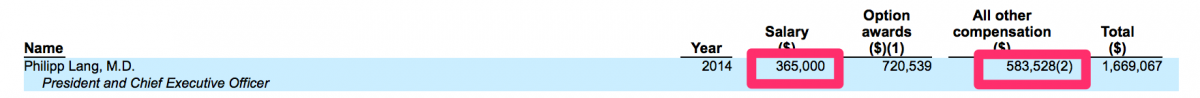

Dr. Lang is the founder of CFMS yet only owns 5.61% of CFMS.

Dr. Lang earned more compensation in 2014 from a revenue share agreement with CFMS ($578,810) then he did from his base salary ($365,000).

We have never seen a NASDAQ-listed company maintain a compensation policy such as this – one that rewards a company’s CEO for its top line growth and ignores any measure of profitability or other financial metrics. Dr. Lang is clearly conflicted in his daily decision making processes. His own personal interests are served by selling more products – at whatever sales price he can get away with. Its no wonder that CFMS offers its products in the market at the same or similar price as off-the-shelf products. It is highly unlikely the interests of the CFMS shareholders will align with Dr. Lang.

We wonder if Dr. Lang’s revenue share compensation is clawed back when a recall occurs or does he retain the compensation even though the products have been returned? Given Dr. Lang’s track record, we believe he likely retains the compensation – at the expense of the shareholders.

It is clear to us that Dr. Lang is a self-interested individual that has no use for or belief in CFMS stock. The Vertegen Agreement, revenue sharing agreements and serial capital raising prove that. Dr. Lang could have sold the relevant IP owned by Vertegen to CFMS in exchange for equity. He could have requested a share of equity at the execution of the revenue sharing agreement or even equity awards based on revenue targets or unit sales. He chose cash instead.

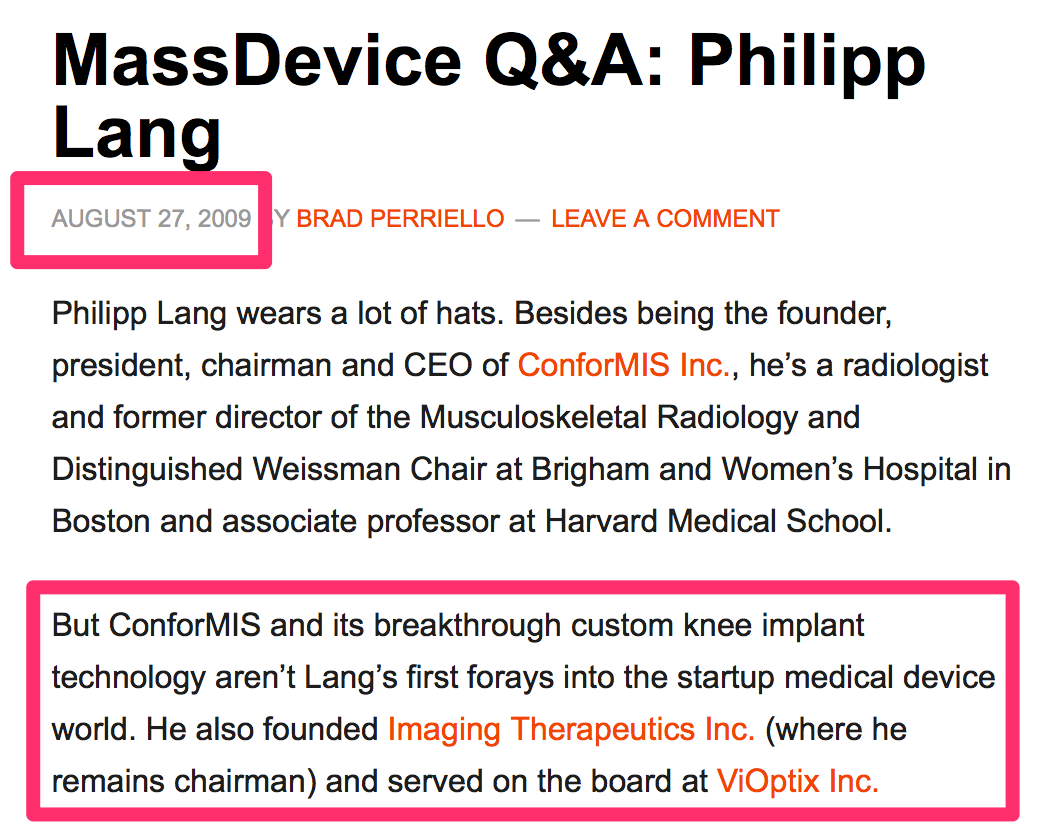

We researched Dr. Lang’s track record. It appears he has never been involved in the development of any medical devices other than those that CFMS offers. We did note that he was previously involved with ViOptix Inc. (“ViOptix”) and Imaging Therapeutics (“ImaTx”).

It appears ViOptix is still operating today – though it does not appear to have successfully raised capital in several years and has not been acquired. As a result, we wonder if it is a successful company or not. We noted that Imaging Therapeutics Inc. was renamed ImaTx and acquired by CFMS in 2009.

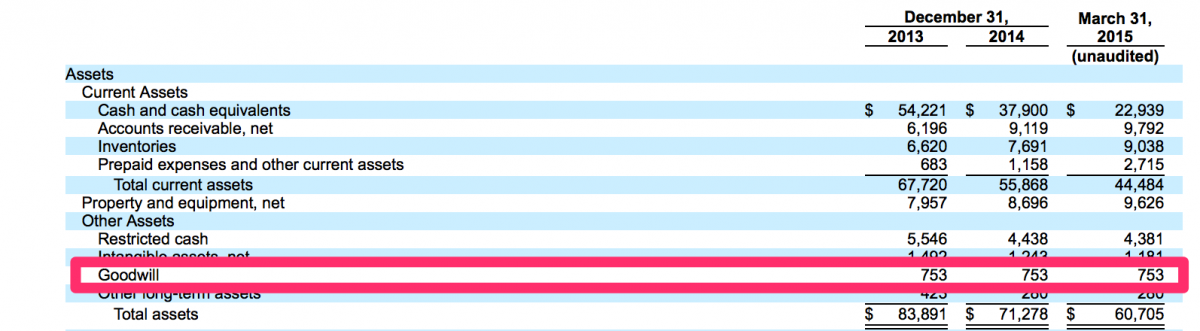

It appears approximately $753,000 of goodwill was generated as a result of the ImaTx acquisition.

We are not sure if the business model outlined in the image above relates in any significant way to CFMS such that an acquisition of ImaTx would make business sense. What was the business purpose of this acquisition? We also noted that CFMS was organized in 2004. CFMS acquired ImaTx in 2009. It seems odd that 5 years passed before CFMS decided it would make sense to acquire ImaTx. We wonder if Dr. Lang acquired ImaTx for the sole purpose of ensuring that his track record with startups was not tainted. Perhaps the easiest thing to do if you want to hide a failed startup is to reorganize it and merge it into another startup. We think this may have happened with ImaTx – though we have no proof of this. However, if it is true than this would be yet another example of a management team that appears to make business decisions with no regard for the common shareholder. After all, Mr. Lang is at the least, a highly aggressive member of management looking to siphon off as much wealth as possible from CFMS. It would hardly be surprising if he used CFMS capital to hide the failure of a startup he previously ran.

In the absence of a plan to hide what appears to be a prior startup failure, perhaps Dr. Lang was only interested in the compensation he received from CFMS in exchange for his ownership in ImaTx. We searched for any record of who received $753,000 in value as a result of the ImaTx acquisition but were unable to find any records. We will venture a guess…Dr. Lang received a large cash payout for the acquisition of ImaTx.

Obvious Transparency Issues

In our review of CFMS SEC filings, we noted that management has chosen not to disclose well known technological limitations associated with technology utilized by the CFMS platform. For example, it is a well-known fact that 3D printing involves an inherent error rate. Additionally, both CT scans and 3D printing, especially DMLS 3D printing, require human interaction. As a result, human error is also inherent in the CFMS manufacturing process.

Further, the Ortho Expert made an interesting observation:

A pre-operative CT scan should be accurate yes, but once the surgeon makes the first cut into the patient’s remaining knee bones, which is necessary in order to secure an implant provided by CFMS or any other provider, the accuracy of the CT scan/implant is immediately degraded as the first cut has forever altered the patient’s remaining knee bone.

We noted that CFMS does not disclose this inherent unavoidable error rate that is involved with the CFMS surgical process. On that basis alone, in our opinion, securities fraud claims could be made. However, we also note that this inherent error rate also further confirms that the Primary False Claim and Secondary False Claim are in fact false claims.

Management has also elected not to disclose unit product sales, unit product costs and perhaps most importantly, product returns – all of which we believe would severely damage the CFMS narrative given to investors. CFMS acknowledges the importance of its product sales mix, as seen below, but chooses to omit any disclosures about unit sales or unit prices.

We question whether each of the products offered by CFMS are actually profitable on an individual unit basis. The fact that this information is not made available to investors in CFMS SEC filings is in our opinion highly questionable.

The Ortho Expert also questioned the way product returns are handled with his comment below.

The KOL alluded to the fact a CFMS product may be delivered to the surgeon but may not ultimately be usable by the surgeon if unexpected issues were encountered when the surgery was underway. These issues could involve either or both soft tissue or bone. It is unlikely a surgeon would just cancel the surgery since a revised CFMS device would not be available for several weeks. As a result, I believe the CFMS device would be discarded and a competing Traditional Knee Replacement device would be used instead. I wonder how often this “reject” occurs where CFMS products are discarded and furthermore, who pays for the reject? Surely the patient will not be held responsible for this.

Yet again, the information discussed here is extremely important for investors to understand. The rate of product returns/discarded products is a key indicator of the various measurements CFMS could use to determine the true success rate that CFMS is achieving – both with patient outcomes and its own manufacturing process. We wonder how CFMS believes it is reasonable to exclude this information from the shareholders.

Dilution Appears Inevitable and Perhaps Imminent

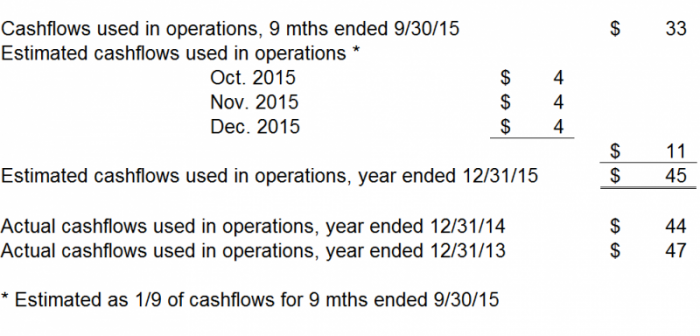

We note CFMS had $139 million in cash as of September 30, 2015. We noted that CFMS did not include any forecasts of cashflows in the Sellside Report. We found this quite surprising given that cashflow is perhaps the most important factor to forecast for any manufacturer. We wonder if CFMS has any cashflow forecasts or if management does not wish to share them because the truth is that $139 million is not enough cash. CFMS has big plans and talks a big game. We believe they don't have the cash to execute on those big plans. We estimate that CFMS used $11 million in cash in Q4 2015. We conservatively assume cashflows used in investing and cashflows used in financing were $0 and $0 for Q4 2015, respectively. As a result, we estimate CFMS had $128 million in cash as of December 31, 2015, as follows.

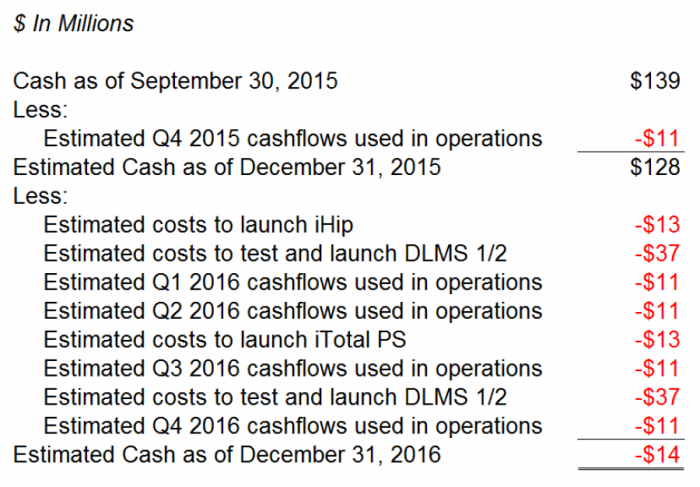

We anticipate CFMS will attempt to implement DMLS into its manufacturing processes in 2016. We believe the costs to implement DMLS machines and other in-house manufacturing processes will be approximately $73 million during 2016. We also expect CFMS to fully launch two new products in 2016, the iHip and the iTotal PS, respectively. We believe a conservative estimate of the costs to be incurred with these launches is $25 million. We have estimated CFMS will incur half of the DMLS costs and half of the iHip/iTotal PS costs in the first half of 2016, and the remaining costs in the second half of 2016. Even though CFMS appears to be adding significant complexity to its business model and manufacturing systems in 2016, we are conservatively estimating cashflows from operations will not increase substantially. We have estimated, as shown in the chart below, that CFMS will run out of cash, using our conservative assumptions, at some point in Q3 or Q4 of 2016.

We caution investors that management will likely be forced to undertake an effort to raise capital that could result in substantial dilution during 2016. We estimated CFMS will run out of cash in Q3 or Q4 2016 if no capital raise is completed by then. We note CFMS appears to have a $10 million credit line. We do not see this line of credit as being significant enough to impact this analysis. We believe management would be wise to avoid trying to raise capital when cash balances are approaching $0. Therefore, we believe a raise will be initiated in Q1 or Q2 2016. However, we are doubtful CFMS will succeed in raising cash at a price per share anywhere near the current stock price for the variety of reasons outlined within this report.

Valuation

We see no value in the CFMS platform and related products. The iTotal product defects appear not only real but substantial. It appears as though they will force CFMS to re-design their primary product. The top innovative surgeons appear to have no interest in CFMS. There is a reason for their lack of interest – we believe it is because CFMS technology is based on a flawed technical premise and involves too many complexities that could result in size and shape errors in the implant devices. CFMS management have a track record of overstating the benefits of their products. They do a great job marketing the company and its products - albeit with the use of many false and dubious claims. Those skills definitely helped them get this far. However, we’ve seen this before. We don’t believe it will end well. The first iTotal surgery was performed almost five years ago. It was hailed as a product that would “redefine the category.” It surely has not done so and now appears to be generating adverse events at the highest rate in the industry, or at least among the CFMS and the top four (4) competitors, excluding Depuy. Furthermore, we believe the cost structure of the product will never allow it to actually compete with off the shelf standardized products. Lastly, the writing is on the wall. The ACA is forcing the issue. Smaller companies like CFMS are being discarded by the marketplace.

We note CFMS had approximately 41.4 million shares outstanding as of October 30, 2015 and an additional 6 million shares were potentially issuable. Therefore, CFMS had approximately 47 million shares outstanding as of October 30, 2015 - on a fully diluted basis. We refer to fully diluted share counts because the majority of the options and warrants are currently "in the money." In the short term we believe shares of CFMS should trade at cash, which we estimated at $128 million as of December 31, 2015, or approximately $2.50 (i.e. $128 million / 47 million, rounded to nearest half dollar). We note that this price target should decrease substantially each quarter as a result of the continuing substantial losses and cash outflows being reported by CFMS. Our target price is $ZERO. We believe this will be reached by December 31, 2016 at the latest.

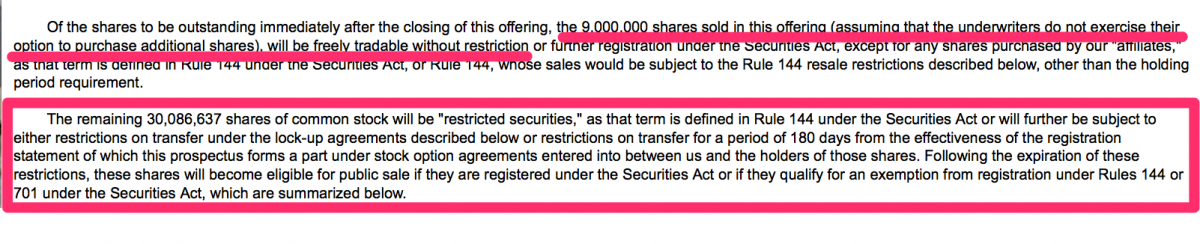

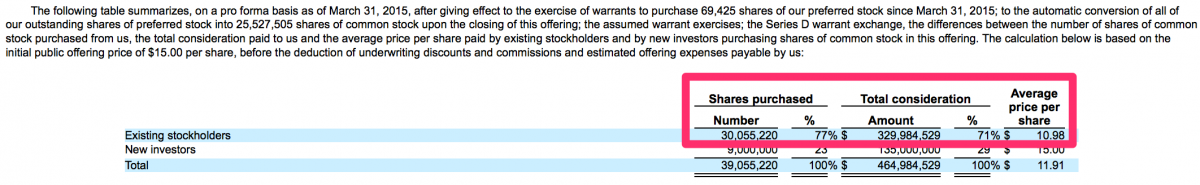

Free Trading Shares

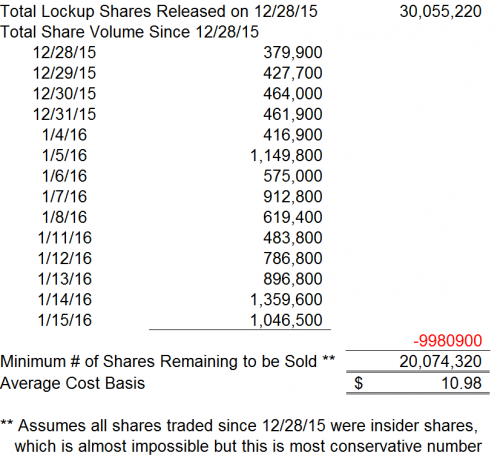

CFMS’ shares recently dropped below the $15.00 IPO level. We believe there are multiple reasons why short term pressure exists on CFMS shares. The CFMS IPO lockup expiration was on December 28, 2015, where a total of 30.1 million shares just became freely tradeable – this is 72.7% of the outstanding shares and 291% of the prior float. We believe the float has been incorrectly stated on several finance sites but should have been 10.35 million shares as of December 27, 2015.

We note according to its July 1, 2015 prospectus, the cost basis of CFMS’ existing shareholders is $10.98. These shareholders were unable to sell their shares until December 28, 2015.

We note according to its July 1, 2015 prospectus, the cost basis of CFMS’ existing shareholders is $10.98. These shareholders were unable to sell their shares until December 28, 2015.

We believe CFMS employees and the key shareholders previously noted within this report are well aware of the product limitations and overall struggles CFMS has endured not only this year but since at least 2009, when the first product recalls were announced. We expect many employees and key shareholders to attempt to exit their positions in the coming weeks. Their attempts to exit could result in a dramatic downside move in shares of CFMS.

Thus far, since December 28, 2015, we noted the daily volume of CFMS shares has increased. However, even assuming these investors were the only “sellers” of shares on the trading days since December 28, 2015, there still remains 20.1 million shares available for these investors to sell. These shares could all be sold as the price of CFMS stock approaches $10.98. We note the downside to $10.98 is approximately 19.9% as of January 15, 2016.

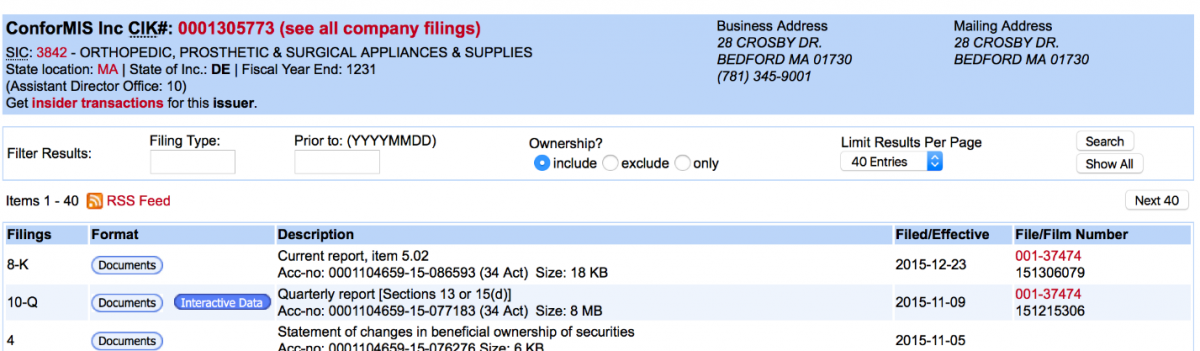

However, we note that many of these investors that held these shares are substantial shareholders and may be required to file Form 4 and Form 13 upon the exchange or sale of any of their shares. We note that no Form 4 or Form 13 filings have been made since December 28, 2015.

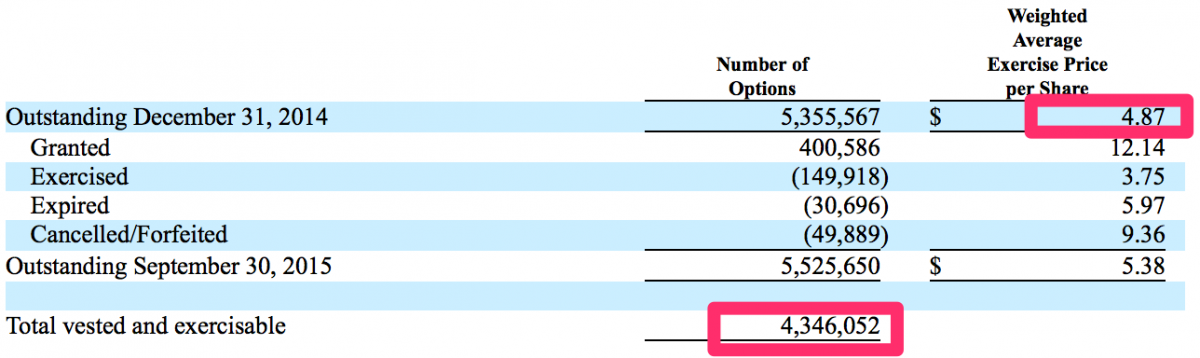

We also noted there are approximately stock options 4.3 million CFMS stock options (10% of current o/s shares) fully vested + exercisable at approximately a $4.87 average price per share (64.5% downside from the current stock price). These option holders have significant profits, approximately $38.1 million (i.e. $13.71 - $4.87 = $8.84 x 4.3 = $38.1), in these options. As CFMS’ stock price declines the option holders, including the CEO who holds a majority of these options, will be pressured into exercising and selling their stock. This could have yet another effect of increasing downside pressure on CFMS shares.

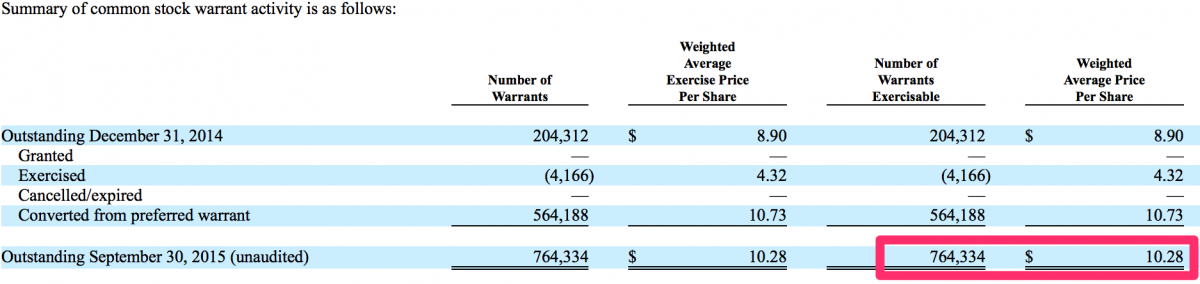

We also noted there are approximately stock options 0.8 million CFMS stock warrants (2% of current o/s shares) fully vested + exercisable at a $10.28 average price per share (25.0% downside from the current stock price). These warrant holders have significant profits, approximately $2.7 million (i.e. $13.71 - $10.28 = $3.43 x 0.8 = $2.7), in these warrants. As CFMS’ stock price declines the warrant holders, including the former majority shareholders, who hold a majority of these warrants, will be pressured into exercising and selling their stock. This could have yet another effect of increasing downside pressure on CFMS shares.

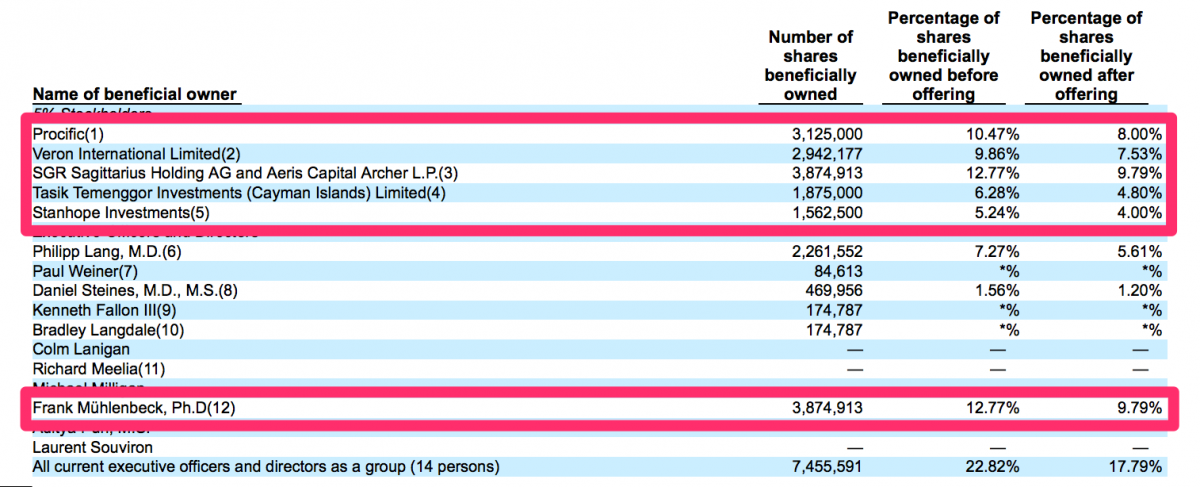

Key Shareholders Have No Known Ties to the Medical Device Sector

We researched each of the 5% shareholders listed in the most recent prospectus filed by CFMS and found none of them have any particular ties or known credibility within the medical device sector.

We noted Procific is a wholly-owned subsidiary of the Abu Dhabi Investment Authority ("ADIA") – according to SEC filings by CFMS and others. We are not aware of any particular expertise the ADIA may have in medical devices. Veron International Limited is a Hong Kong-based investment fund that appears to invest across a broad mix of industries. The website for Aeris Capital A.G. simply states that the firm “acts as financial advisor to the investment interests associated with a European family.” Dr. Muhlenbeck appears to be associated with Aeris Capital AG. He does appear to have some medical device experience. Though, we noted his experience appears to have been with private companies – none of which appear thus far to have developed successful businesses. Again, this investor hardly seems like a specialist in the medical device sector. The latest prospectus filed by CFMS describes Stanhope Investments as “a wholly owned subsidiary of Abu Dhabi Investment Council.” Similarly to the other investors listed here, we are not aware of any expertise the Abu Dhabi Investment Council may have in the medical device space. We were not able to find much information about Tasik Temenggor Investments or its manager Fares Zahir. We presume Mr. Zahir does not have significant experience in the medical devices sector.

We find it odd that CFMS appears to have been unable to secure significant capital from U.S. institutional investors or investors with known credibility within the medical device sector. For whatever reason, CFMS has done well to attract investment from foreign investors who have either have no apparent expertise in the medical device sector or appear to have had limited success in the sector to date.

Management's Pitch to Investors: The Bull Case

The Sellside Report focused on the following key themes as they relate to CFMS. Our analysis is provided subsequent to each “Pitch.”

Management Pitch to Investors #1: CFMS will not generate profits in 2016, 2017, 2018 or 2019 but will generate 60%+ gross margins in 2019

The losses are about the only thing we noted within the Sellside Report that we agreed with. CFMS will not generate profits any time soon. An image of the forecasted P&L for CFMS is attached. We noted several questionable estimates and assumptions in this forecasted P&L. Perhaps the most interesting thing we noted is that the Sellside Report doesn’t seem to take into account the launches of iHip or iTotal PS and does not seem to consider the integration of DMLS into the manufacturing platform. Yes it is possible all of these costs would be balance sheet items but either way CFMS, based on this forecast below, looks to run out of cash well before 2019. It is interesting that the Sellside Report claims the outstanding shares will actually decrease in 2017-2019. We'd enjoy hearing their explanation for that - or perhaps management could explain how they will lose $145 million over the 2016-2019 timeframe and not raise additional capital (i.e. stock outstanding did not increase in this forecast which suggests that CFMS will not raise capital between now and 2019). If our assumptions are used for the iHip, iTotal PS, and DMLS projects these figures will change dramatically and CFMS would run out of cash by the end of 2016.

Source: Cannaccord Genuity December 7, 2015 report

Management Pitch to Investors #2: CFMS technology is “truly disruptive”

An associate of ours contacted the primary author of the Sellside Report on January 8, 2016, Mr. William J. Plovanic, CFA. Our associate asked Mr. Plovanic how he had determined CFMS technology was “truly disruptive?” Mr. Plovanic’s reply included references to his 20 years of experience in the orthopedic sector and claims that he speaks with industry insiders every day etc. Our associate also asked if Mr. Plovanic had conducted any surgeon surveys or similar market research as it relates to CFMS. Mr. Plovanic responded that Cannaccord had done this work prior to the CFMS IPO. He did not provide any further information.

Source: https://www.tipranks.com/analysts/william-plovanic

We noted that Mr. Plovanic appears to be successful in his stock ratings 44% of the time according to www.tipranks.com. We do not suggest that these rankings are 100% verifiable or should be viewed with a high level of credibility. However, we do note that Mr. Plovanic works on the sell side and CFMS is a former and potential client for Cannaccord. It surely is not his job to be critical Cannaccord clients – the exact opposite is unfortunately the case. The disclosures included with the Sellside Report tell the story clearly. Cannaccord global stock ratings are available for 933 companies. Of those Cannaccord has a “buy rating” on 634 companies, or about 68% of them. Cannaccord does not have a rating higher than their “buy rating.” It doesn’t seem to hard to impress Cannaccord.

Ultimately, we don’t believe Mr. Plovanic is as knowledgeable or experienced as the Ortho Expert. Additionally, we don’t believe he or Cannaccord itself has done as much research on CFMS as we have and surely does not have any incentive to be critical of a potential investing banking client. We don’t feel Mr. Plovanic has solid footing in this case. If CFMS technology was “truly disruptive” then surgeons, including leading innovators, would be waiting in line at CFMS’ headquarters vying for a chance to work with such groundbreaking technology. They are not. Also, what does Mr. Plovanic think about the product liability lawsuit? It seems he doesn't believe that lawsuit is even worth discussing. We'd enjoy understanding his reasoning for that.

Management Pitch to Investors #3: CFMS technology is “differentiated both from a technological perspective as well as a business model”

In our research we noted that 4 out of the top 5 medical device manufacturers had custom knee solutions. The primary difference between CFMS and the dominant market leaders appears to be CFMS’s 3D purported printing capabilities. Given that it appears as though CFMS is not capable of 3D printing its metal implants we don’t see this being a “primary difference” at all. Ultimately, the technology differences between all of these companies is likely very small. If one of them were able to successfully 3D print highly accurate implants then this would change. The CFMS business model is unique yes. We don’t see that as being a positive however. CFMS is the only company we’re aware of that provides custom knee implants and does not provide off-the-shelf implants. Given that off-the-shelf knees still dominate the market (we estimate 90%+) and CFMS does not appear to be the breakthrough technology management had envisioned, the lack of off-the-shelf products actually puts CFMS at a major disadvantage.

Management Pitch to Investors #4: The August 31, 2015 recall “did not impact the company’s positioning with physicians and patients.”

We spoke about this previously in this report. This statement is hollow. A history of recalls will of course impact CFMS’ positioning with physicians and patients. We'll refrain from saying what we really think about this but safe to say we see this management team as being "quite slick" - and no this is not a compliment.

Management Pitch to Investors #5: Gross margins are currently in the mid-30% range but “there is a clear pathway to GMs in the mid-60’s over the next 3-5 years”

The ACA is designed to reduce profits in the healthcare sector. This is simple. Even if CFMS were to somehow develop clinical data that proved that CFMS implants are as good as management suggests, it would still be up to the surgeons to adopt CFMS technology and premium pricing would not likely be more than 30% higher than standard pricing. Management has not rushed forward to develop data thus far. Its been almost 12 years and no well regarded innovator in the orthopedic space has alligned with CFMS. We are not sure they will be motivated to do so in the future. We find any suggestions that CFMS can double its gross margin in the current environment to be based on biased assumptions that are do not appears to be supportable by any formulaic methodology we are aware of. We presume management is making the assumption that they solve DMLS in 2017 or so. That would be the only reasonable basis for the margins increasing that substantially. However, we think the chances of CFMS solving DMLS are quite low - and therefore the chances of gross margins in the 60s is low.

Management Pitch to Investors #6: Bundled payment models are the trend, hospitals are looking for risk-sharing arrangements, CFMS is well-positioned as a result of its “long term outcomes” and economic efficiency data”

The Ortho Expert was interested in this statement. His response was as follows:

Bundled payment schemes are never good for small companies – no matter how you manipulate the conversation. Also, the “long term outcomes and economic efficiency data” reference is based on the presumption that CFMS clinical data is definitive. It is not.

Management's Pitch to Investors #7: CFMS represents a “hat trick” whereby “(1) the hospital wins with cost savings from shorter set up/break down times, short surgical times and a shorter length of stay (2) the surgeon wins with shorter surgical times and happier patients; and (3) the patient wins with higher satisfaction rates and greater functionality”

Again, this “hat trick” is based on the presumption that all of the good things CFMS says may be true about its iTotal are actually true and are definitive. As of today they are not. We don't expect definitive data any time soon, perhaps not even before 2020.

Management's Pitch to Investors #8: Clinical data is being developed to support adoption of CFMS knee products

Yes and this data will not be available until 2017 and 2018. We aren’t looking out that far. CFMS may not be a viable entity by that time.

We note that CFMS did not provide any disclaimer to inform the reader these statements are not supported by any independent credible clinical data or that the statements are just opinions and are in no way based on any factual reference or that it is not attributable to Conformis.

Appendix A - FDA MAUDE Comparative Study

We performed searches for adverse events reported to the FDA for CFMS' primary product, iTotal, and each product currently offered by the top five market leaders in the TKR implant space. We believe those market leaders are Depuy, Zimmer, Stryker, Smith & Nephew and Biomet (although Biomet was recently acquired by Zimmer). The actual top five market leaders may differ as public reporting of revenues for total knee replacement sales are not always reported by public companies (i.e. Depuy) and some private companies also have a substantial presence within the market.

Our searches were performed at the following link:

https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfmaude/search.cfm

Our inputs and results were as follows:

The search tool limits results to 500 items per search in raw data format. We attempted to obtain the longest period of data as possible within the last two calendar years, in order to compare against each set of results. Depuy, Zimmer and Stryker had more than 500 adverse events in the last 12 months. Therefore, we were not able to obtain 12 month data for those competitors. Those results were extrapolated out to 12 months. The other competitors, including CFMS, had less than 500 adverse events in the 24 months ended December 31, 2015. For those results we divided them by 2 in order to obtain a 12 month estimate of adverse events. We believe our adjustments to the raw data results obtained from the FDA MAUDE database represent a reasonable estimate of the adverse events each competitor has encountered over a 12 month period.

Appendix B - Surgeon Survey

CFMS provides a web search tool to search for surgeons who presumably offer knee replacement surgery utilizing CFMS products. http://www.conformis.com/find-a-doctor/ We attempted to utilize this search tool to estimate how many surgeons perform surgeries with CFMS products. We found that the design of the website limits the number of surgeons listed in any search to approximately forty surgeons – no matter what search terms are used. We considered that this limitation may produce a smaller list of surgeons than actually existed within the list of surgeons listed within this database provided by CFMS. In order to mitigate this possibility, we conducted a total of fifty searches utilizing the following inputs:

Address: We input the names of each of the 50 states within the domestic U.S. marketplace

Within: We selected the largest range available, 10,000 miles

Our searches were conducted on December 10, 2015, December 13, 2015 and December 15, 2015 respectively. We note that many of the surgeons listed in the search results were duplications. These duplications were not included in our list of unique names. The search results appeared to produce overlapping results such that we believe each search within each state and/or searches within neighboring states captured each and every surgeon listed within the database provided by CFMS. However, we had no direct access to a complete list of surgeons in the CFMS database. As a result, our attempt to develop this list from the search tool may have produced an inaccurate number of surgeons who are currently performing surgeries using CFMS products. Further, our searches occurred on three different dates, and this report is dated approximately a week subsequent to the date of the searches. The exact number of surgeons performing surgeries utilizing CFMS products as of the date of this report could vary as a result of timing differences, among others. Although, we do not have access to the complete list of surgeons maintained by CFMS, we see no reason why any surgeon utilizing CFMS products would not want their name listed on the CFMS website. Additionally, we see no reason why CFMS would not list each and every surgeon performing surgeries with CFMS products on their website. As a result, we believe the results of our searches produced a reasonable estimate of the number of surgeons who were performing surgeries with CFMS products on or about December 15, 2015.

Market Survey Call Sheet:

There are 311 U.S. surgeons listed by CFMS at http://www.conformis.com/find-a-doctor/ who purportedly use CFMS products. On or around December 29, 2015, we contacted the offices of over 150 out of the 311 U.S. surgeons. In most cases we ended up speaking with either the surgeon’s surgical coordinator, the surgeon’s medical assistant or a clinician in the office. We asked a series of questions designed to understand if and how these surgeons were using iTotal.

1) Does Dr. ____ routinely perform total knee replacement surgery?

2) What brand name products does Dr. _____ use for total knee replacement surgeries?

3) Are these brand name products used exclusively for all total knee replacement surgeries?

If we were told a surgeon used iTotal then we asked if the surgeon preferred iTotal.

Appendix C - False Claims Supporting Evidence

Below are specific events, statements by CFMS or claims made by the KOL on his personal website and the Ortho Expert’s response to each. We are specifically noting each response by the Ortho Expert or specific statements that contradict the KOL’s claim above.

1. Product recalls.

On August 31, 2015, CFMS announced a recall for each of its four products that were on the market at the time, the iUni, iDuo, iTotal CR and iTotal PS. This recall was actually the fifth recall of CFMS products. CFMS products were recalled in 2009 (3 separate recalls), 2012 and now in 2015. The chart below provides summarized details of each recall. A class action lawsuit is pending that alleges CFMS distributed products it knew were faulty.

The Ortho Expert’s Response:

I explained previously that TKR surgeries are highly unlikely to achieve a 100% successful outcome. As a result, describing iTotal as a product that “fits right every time” or “fits exactly” does not appear reasonable. Further, when CFMS has issued 5 recalls in 7 years – all of which were due to product defects – these claims appear invalid. These recalls directly support the assertion that the Primary False Claim and Secondary False Claim are in fact false claims.

2. A significant contradiction by the KOL.

The Ortho Expert’s response:

This is a reasonable statement. However, this statement is a direct contradiction which supports our claims that the Primary False Claim and Secondary False Claim are in fact false claims.

3. The use of bone cement suggests CFMS knows iTotal is imperfect

CFMS’s primary product offering is iTotal. We note in the “iTotal CR Surgical Technique Guide” provided by CFMS that Step 6 to be completed by the surgeon includes several actions, one of which includes the application of bone cement to various surfaces surrounding the implant.

The Ortho Expert’s Response: