By Contributing Editor: Jay Thompson

Green Automotive Company (OTCQB:GACR) is a $100 million company that operates a very small and likely failing electric car repair shop, along with a tiny electric car dealership in the United Kingdom and an alternative fuels bus manufacturer in the U.S. It has not proven it's special vs. any other alternative fuels bus manufacturer, and has been unable to deliver on its promises to its one and only distributor. In our initial article discussing Green Automotive, we offered a variety of facts to explain why GACR's business is not what it appears to be and why GACR's stock price is likely to decrease dramatically in the near future. One investor responded to our initial article, stating that "it's a new market where logic is irrelevant and whispers and executive mystique win every time over fundamentals."

GACR is a penny stock -- that means it can be manipulated. Both Ironridge and Kodiak, and likely many others, are motivated to help the stock stay in its current trading range. But they know they can not keep the stock in this range for very long and also sell the shares they hold. Ironridge is likely to try to sell out of their shares before the S-1 for Kodiak is approved, which could be any day now. At some point soon they will sell into the bid. That will be an ugly trading day for GACR. We trust in fundamentals, but we don't trust the market to react and price stocks accordingly or timely -- especially penny stocks.

Management appears to have attempted a response to our article with a press release that we believe does little to disprove our statements and answer our concerns. More importantly, it serves to prove that GACR has no interest in being transparent with investors. Management's unwillingness to discuss profits of each business segment suggest that each of its business segments could be unprofitable. This article is meant to outline certain new information we have obtained from GACR shareholders and additional research we have completed. We will also continue the discussion, in summary, of the facts we previously addressed, and respond to management's comments regarding our initial article.

New Information - The Deeper We Dig, the Uglier This Gets

- On Dec. 11, 2013, GACR announced by press release "Green Automotive Company Subsidiary Launches Brand New Electric Vehicle." The press release was about the Mia. There are two alarming issues with this press release. First, according to this website, the Mia was created in July 2010. It is now almost 2014. This is not a "brand new electric vehicle." Second, the press release states that GACR "launched" the Mia. Well, the Mia is manufactured by Mia Electric, which does not appear to be a subsidiary of GACR. Mia Electric is a French company. The Mia is for sale on Mia Electric's website for approximately $36,000 (estimated for currency differences). Given that information, it appears GACR is simply reselling the Mia and not actually manufacturing it. Mr. Hobday stated in GACR's most recent press release that GACR has sold 10 Mias and they were delivered on Dec. 19, 2013. This is great but instead of this meaning that GACR has sold 10 Mias at a sales price of around $360,000 in total, it means that GACR has sold 10 Mias to generate a sales commission of some unknown amount that management appears unwilling to disclose. If we assume a fair commission is approximately 10%, which we believe is likely higher than the actual commission, then Mr. Hobday and GACR has spent a lot of effort to excite investors about $36,000 in revenues -- at best. Considering that Mr. Hobday probably didn't sell those Mias himself, and the salesmen are paid on commission as well, and they probably have a sales office, it seems likely GACR probably didn't even profit $10,000 from the sale of those 10 Mias. We are unsure why this should be considered newsworthy other than to mislead investors into buying GACR stock. But we may never know as GACR does not appear willing to discuss revenues per unit car or bus sales or per unit car profits relating to any of their business segments.

- The Mia electric car costs approximately $36,000. The Mia is expensive. We are very sure a car buyer would select a cheaper electric car or perhaps even a BMW or Mercedes gasoline or diesel-powered car before they will select a Mia. A review of the Mia by autocar.com fully supports these conclusions. The Mia, in any reasonable person's view, is not a bargain and is unlikely to be sold in large quantities.

- Mr. Hobday refers to the Mia as the "amazing Mia." Yet, in an interview, Tesla's (NASDAQ:TSLA) CEO, Elon Musk, states that an electric vehicle that Tesla plans to develop will cost $35,000 and double the range of today's electric vehicles to 200 miles. So according to Mr. Musk, who we believe has plenty of credibility in this regard, most EVs have a range of about 100 miles today. Mr. Hobday states in the most recent GACR press release that the Mia has a range of 80 miles. It is unclear why Mr. Hobday believes the Mia is "amazing." In our opinion, Mr. Hobday is misleading investors at the very least. We are now unsure of how far Mr. Hobday will go to build interest in GACR's stock. There must be a shortage of good news if GACR has chosen to focus his sales pitch to investors on the Mia -- an electric car GACR didn't even design or manufacture themselves.

- Management has avoided numerous chances to discuss the profitability of any of their business segments. This is a level of transparency that is so basic. This is information that should be included in GACR's SEC filings. We have provided the SEC with a copy of this article to assist them in their review of GACR, which is likely currently underway given the pending S-1 filing for Kodiak. As of now, there is ABSOLUTELY no information about profitability of the products or services GACR is selling in any of GACR's SEC filings. This is a huge red flag that can not be ignored. A public company could grow revenues forever, and possibly grow its market capitalization significantly, if profits were not a concern.

- Subsequent to our initial article on GACR, we became aware of some additional information that should add to further downward pressure on the stock. It appears that GACR's management have been delaying the release of a large number of shares of GACR for the last few years. On December 24, 2013, these shares became officially eligible to be resold into the market. This is just one of the numerous examples of short term downward pressure that exists in GACR's stock or will soon exist. If there are many old shareholders who feel similar to the one who filed a report at ripoffreport.com, then the 1,000,000+ additional shares of GACR that are now eligible to be sold into the market, along with Kodiak and Ironridge, will possibly push the stock price of GACR downward in dramatic fashion.

- Mr. Hobday referenced in the most recent GACR press release that Newport was currently "building bus number 41." That statement does not mean anything to an investor. Newport could be building the first 41 buses still and not delivered even the first bus and that statement would still be OK -- but the way it is presented leaves a lot of room for manipulation of the facts. Newport contractually agreed to deliver 70 buses by Sept. 30, 2013. That was three months ago. Investors want to know how many buses Newport has delivered, and accepted by Don Brown, and what the revised timeline is given that Newport breached the original terms of the contract with Don Brown. Also, it would be great to explain to the investors what the average sales price of the buses will be and if these buses are being sold at a profit or not, and how much that profit was. GACR should know these figures or have a very good idea of them given that the buses are supposedly pre-sold. On that note, if they are pre-sold, as Mr. Hobday contends, it would be great if GACR disclosed the quantity of each bus model that was pre-sold, the average sales price of each order, the expected delivery date, the anticipated profit on each sale, the payment terms, the payments that have been made thus far to GACR, the credit terms given to customers, GACR's policies with regard to the extending of credit to customers, and perhaps most importantly, fully explain the relationship with Don Brown. Is Don Brown a shareholder of GACR? Is Don Brown being compensated in any way for placing orders for Newport buses? What is the commission structure? How does that impact profitability?

- Mr. Hobday seems to have referenced a process that takes 90 labor hours per week to complete. We do know what that process actually is and what he is inferring. The statement is extremely confusing and seems as if it could mislead investors that a bus can be manufactured in 90 labor hours. We doubt very much that a bus can be manufactured by Newport that quickly. We refer to the production delays and breach of contract terms that occurred in 2013 thus far.

- Mr. Hobday states that Liberty has been in business for over seven years and that it "continues to grow." Liberty generated $126,086 in revenues in the nine months ended Sept. 30, 2013. After being in business for seven years and only being able to generate just over $100,000 in revenues from one customer in that reporting period, we would hardly consider this a successful venture. Yet GACR states that Liberty is "one of the leading EV technology businesses." Mr. Hobday's qualifications as a successful entrepreneur, investor or executive in the EV space continue to be questionable.

- GACR points to their development of an electric 4x4 Range Rover that was estimated to cost $261,000 per unit in 2008 in a failed transaction with a potential buyer, and participation in "major projects" associated with Epsilon and refers to relationships with Volkswagen, Fiat and Michelin to create the perception of credibility within the EV space. We doubt very much that there are many buyers that want to pay $261,000 for an electric Range Rover. If profits are not a concern I'm sure Liberty is not the only company in the world that can be build an electric Range Rover. Creating an electric vehicle that no one wants to buy is not impressive. Also, these global automotive leaders do not need assistance from GACR in any way. We doubt very much that these global leaders would also share technology with GACR. GACR does not reference any licensing or other formal business relationships with any major global automotive company in any of its SEC filings. None of these supposed successes or relationships have produced any meaningful revenues or sales of electric vehicles. Information about these relationships is very limited. Management has used the references to hype GACR's stock but has failed to quantify or explain with any detail, what the participation in Epsilon means for GACR going forward.

- GACR refers to the G-Wiz as "ever popular" yet does not reference anything other than the 1,000+ G-Wiz cars that were sold by GoinGreen prior to GACR's acquisition of GoinGreen. Mr. Hobday, if GoinGreen sold 1,400 G-Wiz cars prior to 2011 and now almost in 2014 there are still only 1,000+ G-Wiz cars on the road in the U.K., how could you possibly refer to the G-Wiz as being popular?

- GACR states that Newport's first electric bus will be presented at a tradeshow in Las Vegas in February 2014. It appears as though we were correct and Newport has yet to sell any electric buses.

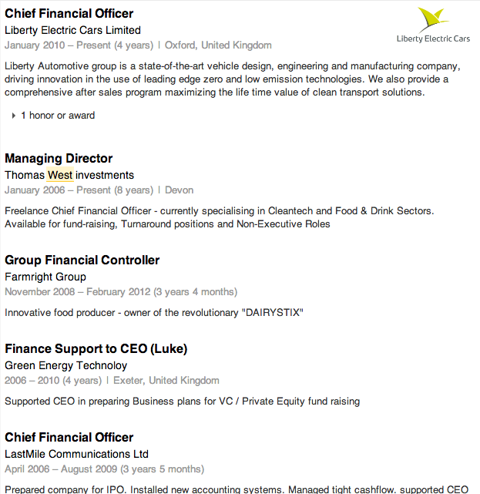

If these are the "major achievements" of GACR for 2013, then it seems there were no actual major achievements at all. In fact, there was just a lot of bad news in 2013. GACR declined providing specifics on any successful startups or M&A transactions that its CEO or CFO have previously participated in. Management does not seem to understand that their credibility is a major reason why investors would buy or sell GACR. We are going to provide some specifics about Mr. West below, including his his LinkedIn profile below.

The following is a quick summary of the status each of these companies has today. Mr. West has disclosed three companies he was previously associated with that are failures and no longer operating. Perhaps GACR will be his fourth. He appears to hardly be an "invaluable" resource as Mr. Hobday suggests in the most recent press release. On Dec. 30, 2013, Mr. West seems to have completed the third restatement of GACR's 2012 financials. There are more adjustments and restatements in the filing that was made with the SEC than we have ever seen before. After completing our due diligence on him and seeing this latest restatement, Mr. West does not have credibility in our eyes.

- Farmright was in administration. Administration is a form of bankruptcy in the U.K. defined and explained here.

- Last Mile was in liquidation. Liquidation is also a form of bankruptcy in the U.K. and is defined and explained here.

- Green Energy Technology appears to have been a failure. Its CEO, Luke Dowell, is now employed by Jaguar Land Rover according to his LinkedIn bio.

Information Previously Discussed

The following is a summary of the facts we stated in the initial article that management has not responded to. As a result, we believe management agrees with these statements.

- GACR is massively overvalued, with a price-to-sales ratio of approximately 600% that of Tesla and 9,800% of the other 13 electric car manufacturers we identified in our initial article.

- GACR has never generated a profit from operations or reported net income.

- GACR has spent only approximately $7,000 on research and development in the 33 months ended Sept. 30, 2013, yet it claims GACR is an innovator.

- The CEO and CFO of GACR have no specific experience or success within either the electric vehicle or automotive sector.

- Powabyke is a failing $335,895 acquisition.

- The Ironridge transaction was not a long-term investment. Ironridge was issued 7,700,000 shares of GACR at a cost basis of $0.07 on Dec. 4, 2013. In our initial article we noted this was a 77% discount to the current market price. Ironridge can sell all of these shares at any time. Investors should expect Ironridge to continue selling these shares even when GACR's stock is already declining.

- GACR's bus manufacturing subsidiary, Newport, refers to Don Brown as a customer. Don Brown is a distributor and is under no obligation to actually purchase 432 buses from Newport.

- Newport delivered approximately 10 buses to Don Brown between January and September 2013. A total of 70 buses were scheduled to be delivered during this time period. This is a breach of the contract with Don Brown that has not been previously disclosed to GACR investors.

- Don Brown has also breached the agreement with GACR by not maintaining 12 buses in its inventory at all times.

- Management continues to overhype its stock every chance it gets.

- Newport has yet to deliver an electric-powered bus and has no orders for an electric-powered bus yet it refers to itself as "America's EV Specialist" on its website.

- Liberty has just one customer.

- The pressure on GACR's shares should mount if and as soon as the SEC approves the 25 million shares being registered for Kodiak.

- An additional issuance of 361 million common shares to the holders of the Series A Shares was possible as of Sept. 30, 2013. This represents dilution to the current common stock shareholders of 91%.

- Upon an issuance of common shares to the holders of the Series A Shares, GACR's stock declined 68%.

Management's Responses

Management has argued just a few of the facts we stated in our article. We outline our current thoughts below.

- If the G-Wiz was an expensive car then perhaps a car repair shop could generate significant profits. It is not. It is listed on GoinGreen's website for resale at between $2,700 and $4,200. If any substantial repairs are needed for the G-Wiz, the car will simply be considered totaled and the owner would not spend anything more than the current value in order to make repairs. Mr. Hobday states that there are 1,000 G-Wiz's "under GACR's care" in a recent press release. Even if every G-Wiz Mr. Hobday claims his company takes care of were to undergo repairs each year that matched the value of the cars (i.e., they were totaled), and assuming they were all valued at the high end, the revenues for GACR would be $4.2 million. We have no idea what the profitability of a repair shop is. We have no interest in an investment in a car repair shop of any kind. We doubt GoinGreen has actually served anywhere near 1,000 G-Wiz's in any recent fiscal year. GACR's SEC reporting suggests this is true. It seems more likely that low-end unwanted G-Wiz cars will just simply be considered totaled and will be scrapped when repairs of any significance become necessary. In our opinion, the GoinGreen repair shop is highly unlikely to generate any substantial revenues or profits. Further, we estimate net profits on the resale of the 1,000 G-Wiz vehicles would max out at $500 per G-Wiz, just over 10% of the high end of the price range on the website. This net profit is estimated after commissions are paid to the salesman, which we assume are generally 30% of the gross profit on the sales. This suggests that GoinGreen's revenues from sales of used G-Wiz cars could not exceed $500,000 in any fiscal year. Profits would be miniscule. However, since the business began deteriorating in 2010, we believe GoinGreen has sold just a small number of used G-Wiz vehicles. The actual revenue figure is far less than $500,000 and the resale of G-Wiz cars, which likely have very little demand in the U.K.

- GoinGreen is a failing acquisition. Management responded to this statement by suggesting that GoinGreen, for which GACR purchased for $565,290, is now a repair shop and resells an outdated, unwanted, first generation electric vehicle, the G-Wiz. It is interesting to us that GACR provides no sales figures in its SEC filings and when questioned for details, GACR has refused to provide further details. This is simple. GACR should tell investors the following information:

- How many cars GoinGreen has sold during each reporting period?

- Which cars were actually sold?

- What type of propulsion each car sold relied on?

- What is the sales commission GoinGreen earned on each car sold, by model number?

- What is the net profit GoinGreen earned on each car sold, by model number?

- How many salesmen are employed by GoinGreen?

- Does GoinGreen have a sales office?

- How many cars, and which models, has GoinGreen provided maintenance on, for each reporting period?

- What are the revenues, gross profit, and net profit for GoinGreen's repair shop for each reporting period?

- The fact that this information is not provided is alarming. GACR seems as if the management know how to talk and get by within the electric vehicle sector in order to conduct some business but they are far from adequate in executing a business plan and tracking the success of that execution.

Comments

Add new comment