April 5, 2016

Vocera Overview

In our view long term investors will generally become excited by a company’s prospects based on (1) the management team’s prowess, (2) technology that is innovative or provides some form of significant competitive advantage that benefits the company, or (3) an enormous market opportunity that the company has some particular advantage in as compared against its competitors.

In this report we will explain the following:

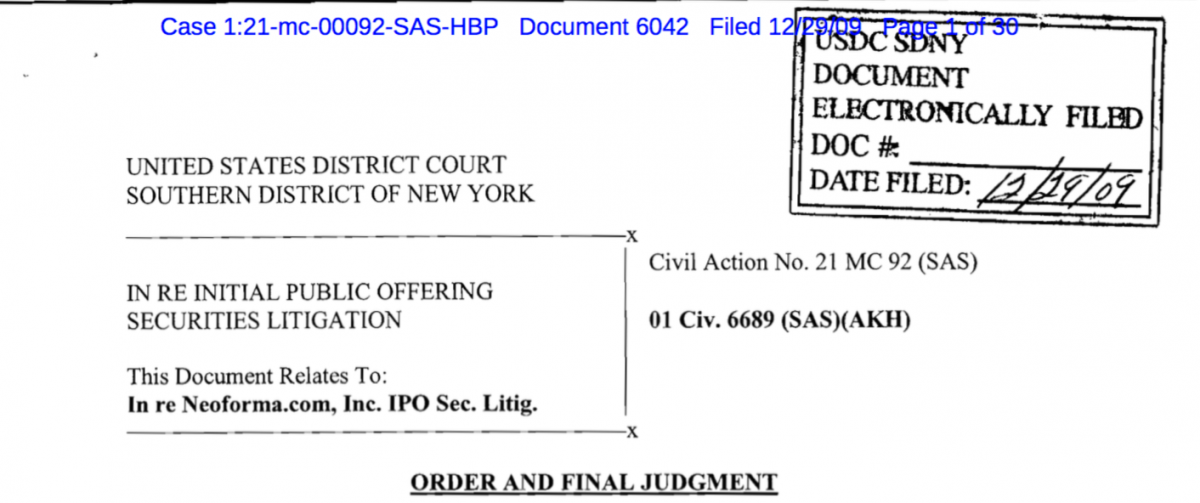

- Mr. Zollars, the Chairman of the Board of Directors of Vocera, Inc. (VCRA) is directly associated with previous settled frauds, for alleged accounting and securities laws violations, totaling $709.8 million (i.e. Neoforma $586M, Diamond Foods $123.8M). Mr. Zollars and VCRA’s current CEO, Mr. Brent Lang – both of whom were accused of fraud, appear ready to settle another securities fraud for an additional $9 million – which would bring the total “settled fraud bill” for companies affiliated with them to approximately $720 million. As if this was not enough we have calculated that of the 2 public companies Mr. Zollars has been CEO of, namely Neoforma and VCRA, those two companies have lost a combined $900 million for their shareholders as of today – this figure does not include the $709.8 million in fraud settlements which may have been paid by insurers. If a long term investor can find a reason to support someone with Mr. Zollars’ track record we welcome the argument.

- VCRA management routinely touts their technology. However, VCRA's:

► technology is approximately 5 years old

► hardware and software can not compete with 9 other competitors who have technology that was significantly updated in the last 11 months

► device does not have a touch screen

► device is incapable of keeping a “call history” for its users

► device drops voice calls routinely

► device appears to have a large base of users who despise it

► device is the costliest device of 6 devices we profiled

► installation costs for a new client is apparently the costliest install fee of the 10 systems we profiled

- The market opportunity for VCRA is much more limited than VCRA’s management will have you believe. VCRA suggests there are 6,000 hospitals in the U.S. that could use their system. VCRA does not consider that of those hospitals only about 2,000 hospitals can afford VCRA’s installation costs – according to a former VCRA executive, whom an affiliate of ours interviewed in March 2016. Further, VCRA seems to completely ignore the fact that their competitors exist and generally have long term contracts with their customers – the same hospitals VCRA suggests are readily available for VCRA to sign up. Ultimately, the market opportunity for VCRA is at best in the “hundreds of hospitals” at any given time in our opinion, rather than 6,000. This misrepresentation of VCRA’s market opportunity should be quite alarming to a VCRA long term investor. Furthermore, the current environment in which hospitals operate in is hardly rosy. Hospitals are under severe pressure nowadays to cut costs. This trend is not expected to reverse any time soon. The hospital market opportunity is not "large, desirable, or even expanding." It is contracting. VCRA suggests that its products can improve operating efficiency and save costs. Based on what we know of VCRA's product, we find this claim highly questionable. Additionally, we have identified 9 of VCRA's competitors that we believe offer a better solution for hospitals than VCRA.

I. Robert Zollars’ Associations with Fraud

Robert Zollars is the Chairman of the Board of Directors of VCRA and was formerly VCRA’s CEO.

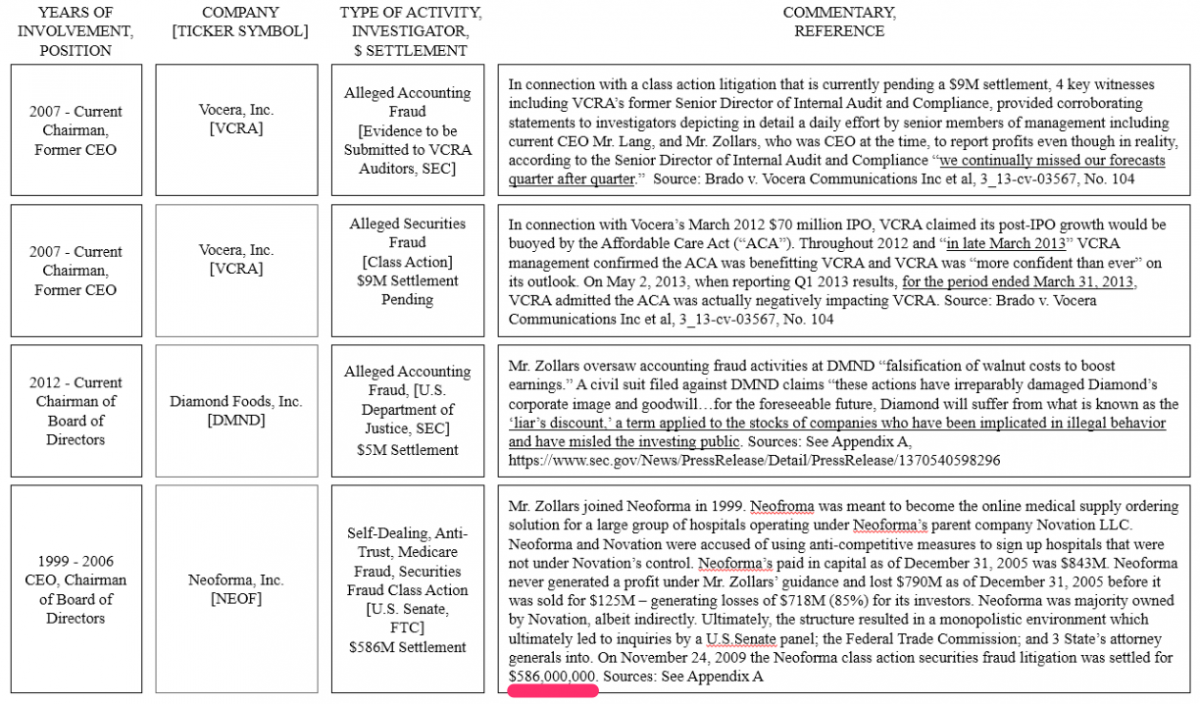

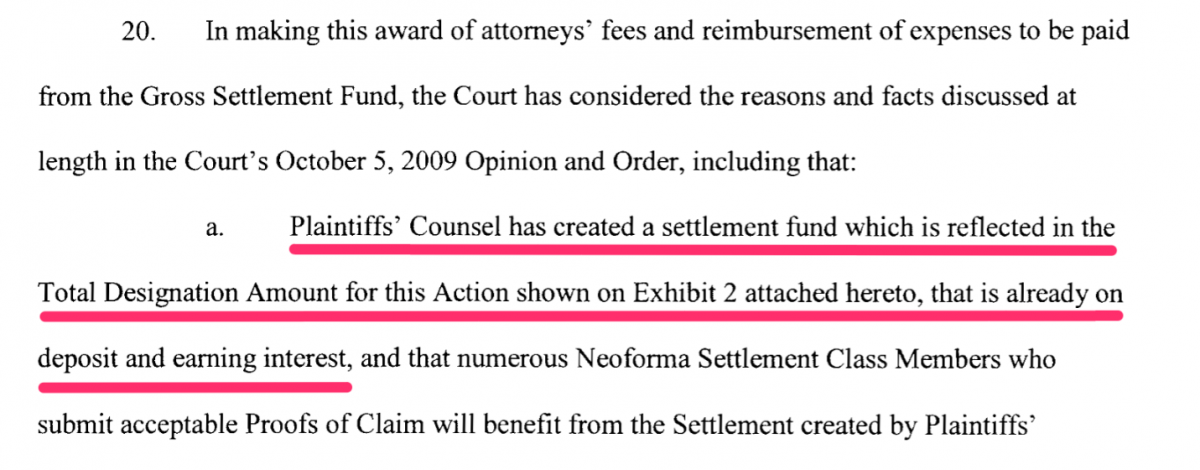

Figure 1

According to his biography, Mr. Zollars has been associated with the companies outlined in the chart below - all of which have been accused of fraud, have settled a claim of fraud, and/or have a fraud claim settlement pending, including VCRA.

We are unaware of any other report which brings to light a possible accounting fraud at VCRA. We are also unaware of any other documents or reports which tie the alleged accounting fraud at VCRA to Zollars’ prior business ventures.

Below is a summary of Mr. Zollars’s association with alleged frauds.

Figure 2

Sources: See Appendix A for detailed references including Neoforma, Inc. IPO, et al v. Neoforma.Com, Inc., et al, 1_01-cv-06689, No. 14

II. Zollars Influence Felt at VCRA, We Allege VCRA Accounting Fraud

Two class action lawsuits were filed against VCRA in 2013. The class actions were subsequently joined into one lawsuit (the “Class Action”). Mr. Zollars and Mr. Brent Lang, VCRA’s current CEO, were also accused in connection with the Class Action. Class action lawsuits are not unusual with public companies, however, the Class Action is unusual for two reasons.

- The Class Action, which alleged false and misleading statements made by VCRA’s management appears as though it will be settled for $9 million. We have reviewed the court documents associated with the Class Action in detail. The allegations of wrongdoing by management, namely Mr. Zollars and Mr. Lang, appear to have merit, as outlined in detail in the complaint and supporting documents provided by the plaintiff’s counsel, the reputable law firm of Labaton Sucharow LLP.

- The Class Action investigation uncovered additional instances of wrongdoing by management, many of which can be described as accounting fraud. We have reviewed the court documents associated with the Class Action and obtained copies of statements made by four (4) key witnesses that depict an apparent organized and aggressive accounting fraud at VCRA. We do not believe the specific information presented in this report about accounting fraud at VCRA has previously been made publicly available in one document.

The allegations and evidence outlined within the Class Action provided an overview of daily operations at VCRA. We have provided actual excerpts of the Class Action documents in Appendix B and F to this report.

Upon our review of the court documents and other evidence we obtained about Mr. Zollars’ past, we are left with the following questions:

► In light of VCRA’s history of fraud allegations, and Mr. Zollars’ association with alleged and settled securities and accounting frauds, should current optimistic statements and projections made by VCRA be given any credence?

► If Mr. Zollars and Mr. Lang successfully executed not only securities fraud but also accounting fraud, and they have profited from such actions, what reason would Mr. Zollars and Mr. Lang have to end their apparent fraudulent activity at VCRA

Below is the key evidence we have obtained about the potential VCRA accounting fraud.

- Corroborated Evidential Statements by Four (4) Witnesses Support Claim of VCRA Accounting Fraud

A first-hand depiction of apparent accounting fraud at VCRA was provided by four (4) confidential witnesses (the “CWs”), one of whom was previously VCRA’s Senior Director of Internal Audit and Compliance. These individuals outlined actions taken by Mr. Zollars and Mr. Lang, among others, in and open and aggressive manner, on a daily basis, in management meetings attended by a group of approximately 5-6 high ranking individuals in VCRA’s conference room, to apparently fraudulently misrepresent VCRA’s top and bottom line results to the public. The CWs corroborated each other’s statements. Unless these four individuals (who do not stand to gain financially by their statements) have coordinated their stories and lied to the court, these court documents lead us inexorably to conclude that the depictions of accounting fraud by the CWs actually happened and current management, including Mr. Zollars and Mr. Lang led the accounting fraud effort.

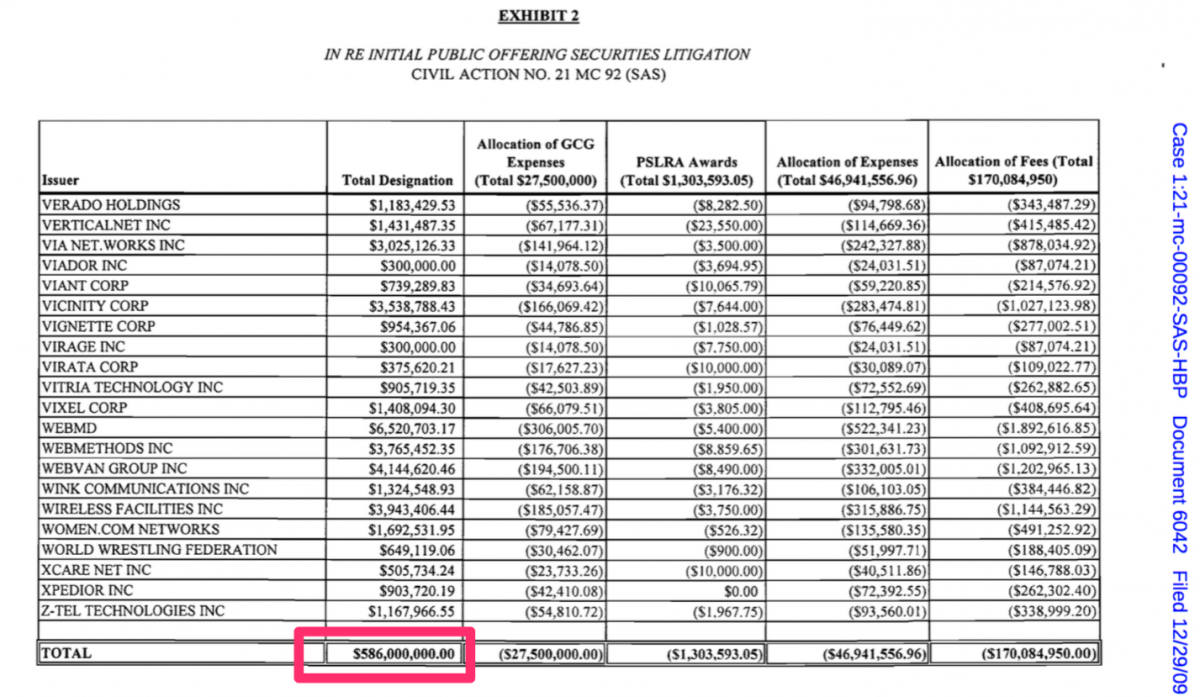

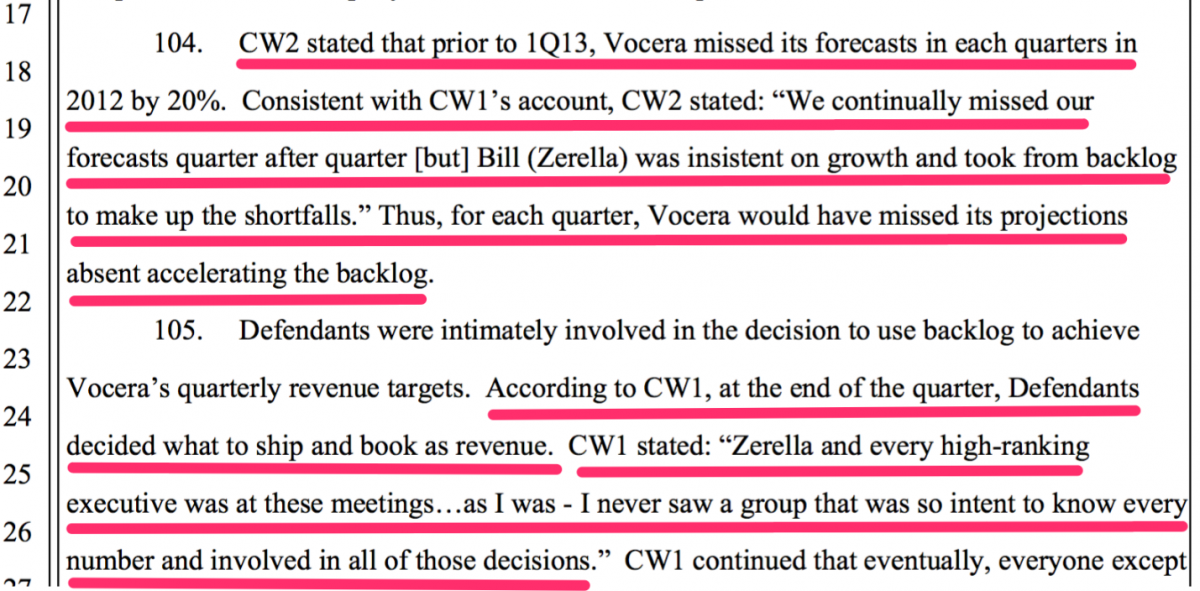

The following quotes from the Class Action were of interest to us:

• Pre-meditated effort to misrepresent:

“CW2 stated that prior to 1Q13, Vocera missed its forecasts in each quarters in 2012 by 20%. Consistent with CW1’s account, CW2 stated ‘We continually missed our forecasts quarter after quarter [but] Bill (Zerella) was insistent on growth and took from backlog to make up the shortfalls.’

Note: CW2 is referenced within the court documents as VCRA’s former Senior Director of Internal Audit & Compliance

• Massaging revenues:

“CW1 further advised that about 20% of the Company’s quarterly revenue during the Class Period came from Vocera’s pulling of revenue out of backlog, into an earlier quarter.”

• Further toying with sales:

“In order to make quarterly guidance and continue the façade that Vocera remained a ‘growth story,’ Defendants scoured Vocera’s backlog and pushed hospitals to accelerate the acceptance of shipments of Vocera products to an earlier quarter, allowing Vocera to recognize revenue sooner and meet guidance.”

• Lack of disclosure:

“Defendants were essentially robbing revenue from future quarters to allow the Company to meet guidance in the current quarter – all without telling the market that new bookings were declining and backlog was dropping.”

• Pursuing the wrong goals:

“This smoothing of revenue also created the appearance that Defendants were able to deliver consistent, on-target guidance and results.”

• Deliberate actions:

“CW1 recalled sitting in the revenue meetings [which were attended by the Individual Defendants] and listening to the executives discuss how they were going to need to utilize the backlog to achieve revenue targets.”

• Obsessive attention to fraud:

“According to CW1, Mike Hutchinson, VP of Finance, spent the majority of his time trying to figure out how to utilize the backlog to generate current revenue by accelerating shipments, or pulling backlog forward, to compensate for the Company’s shortfall in sales each quarter.”

“According to CW1, at the end of the quarter, Defendents decided what to ship and book as revenue. CW1 stated” ‘Zerella and every high-ranking executive was at these meetings…as I was – I never saw a group that was so intent to know every number and involved in all of those decisions.”

Source: See Appendix B for excerpts from court documents, Brado v. Vocera Communications Inc et al, 3_13-cv-03567, No. 104, Brado v. Vocera Communications Inc et al, 3_13-cv-03567, No. 119-3

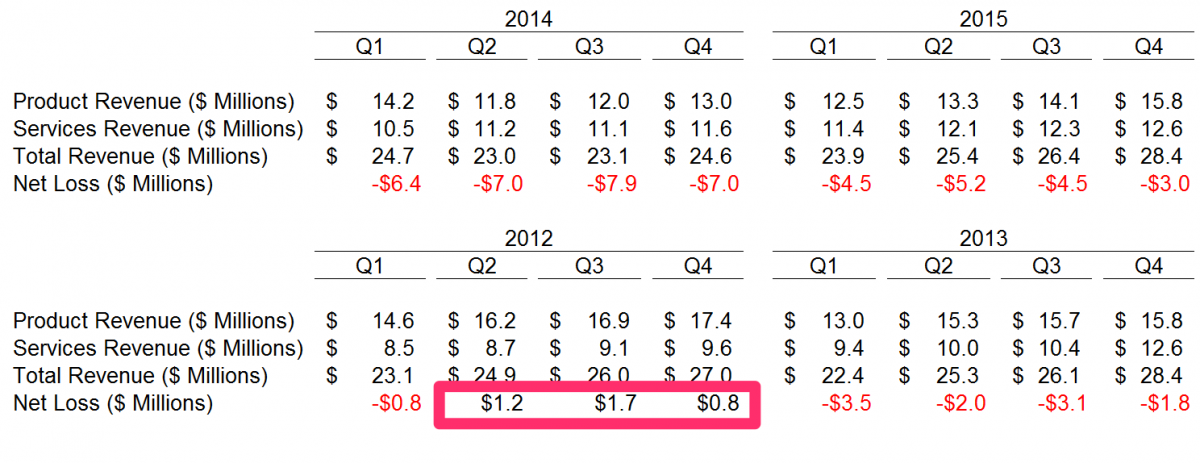

- Actual Financial Results Reported by VCRA Support Claim of VCRA Accounting Fraud

We believe the claim of accounting fraud at VCRA is supported by actual results reported by VCRA. As seen in our review of the financials below, during the time period outlined by the CWs, i.e. Q2-Q4 2012, VCRA reported profits of $1.2 million, $1.7 million and $0.8 million, respectively. Aside from those three quarterly reporting periods identified below where we have a detailed first-hand outline of potential accounting fraud, VCRA’s SEC filings have never shown a profit.

Figure 3

Source: Various public filings by VCRA at www.sec.gov

We are unable to conclude that accounting fraud is no longer occurring at VCRA. Further, we believe it is important to note that although the depiction of accounting fraud was corroborated by the CWs and the overall evidence of accounting fraud is substantial in our opinion, we don’t believe the purpose of the Class Action was to make the claim of accounting fraud. The Class Action was meant to substantiate securities fraud only, as can be viewed in the court filings. Since the securities fraud appears likely to be settled shortly, it is possible that litigation involving the potential accounting fraud could be filed shortly after the securities fraud is settled (although this cannot be known for sure).

We also noted that VCRA did not restate its financials for the quarterly reporting periods in which the accounting fraud claim exists. We believe VCRA’s auditors, the reputable Deloitte & Touche LLP, were previously unaware of the accounting fraud claim. We believe this because of our direct experience working for and with “Big 4” and other smaller auditing firms over the past decade or so. The review of court documents associated with active, settled or terminated litigations are not reviewed by auditors as a standard audit practice - in our experience. On or around the date of this report, the San Jose, California and national (i.e. New York) offices of Deloitte & Touche LLP have been informed of this report.

III. Insiders Appear to Have Sold Over $200,000,000 Worth of VCRA Stock Since IPO

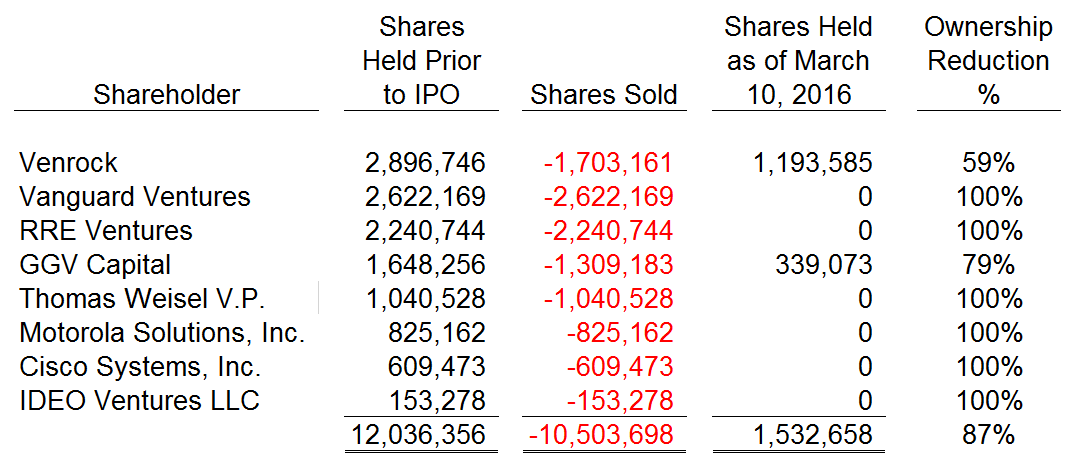

- Silicon Valley investors and strategic partners have sold out of most of their VCRA shares.

We calculated sales of approximately 10.5M shares by Silicon Valley venture capitalists and former VCRA strategic investors. We estimate these shares were sold for an average of approximately $20.00 per share, resulting in estimated proceeds for these investors of $210M.

Figure 4

Source: This analysis assumes investors who did not report holding any shares as of December 31, 2015 did not own any shares of VCRA. We reviewed all Form 13 and Form 4 filings for these individuals at www.sec.gov for the period from March 31, 2015 through March 10, 2016 and https://www.sec.gov/Archives/edgar/data/1129260/000119312512137594/d2067....

Additional related notes:

1.) We noted Motorola Solutions, Inc. was previously a significant shareholder and strategic partner of VCRA but is now a competitor – and appears to have sold out all of their VCRA shares.

2.) We noted that several investors, including Venrock and GGV were represented on VCRA’s Board of Directors, and were personally sued in connection with the Class Action. Venrock and GGV have been aggressive sellers of VCRA stock in the past few years. We presume that these investors had insider information about the Class Action claims, and potential accounting fraud. VCRA did not make the public aware of the accounting fraud claim. We have not seen it discussed in any SEC filing by VCRA. We are left to surmise, therefore, that Venrock and GGV traded on the basis of their insider, non-public information.

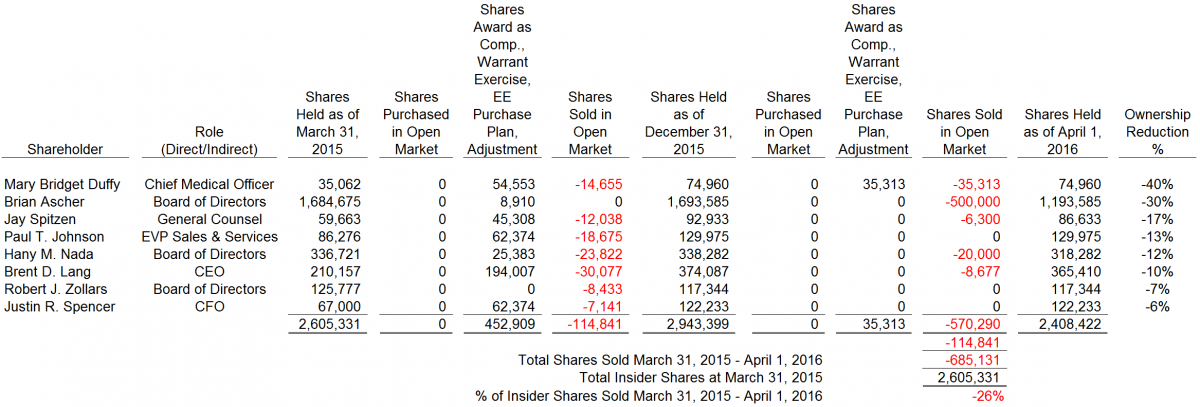

- Insider sales over last 12 months show aggressive consistent selling

We reviewed all insider transactions in the shares of VCRA from March 31, 2015 through April 1, 2016. There has not been one open market purchase of any shares of VCRA by an insider during that time period. However, during that time period the insiders listed below sold 26% of their holdings in VCRA. The Chief Medical Officer is selling the most aggressively. In a vacuum, without even considering any other facts presented in this report, this constant and significant sale of VCRA shares by insiders should give all VCRA investors concern. We calculated sales of 685,131 shares were sold by insiders in this time period – at the same time, quarter after quarter, Mr. Lang presents optimistic growth for the foreseeable future. We estimate these shares were sold for an average of approximately $12.00 per share, resulting in estimated proceeds for these investors of $8.2M.

Figure 5

Source: Various SEC filings, including Form 4, Form 10-K, Form 424 etc.

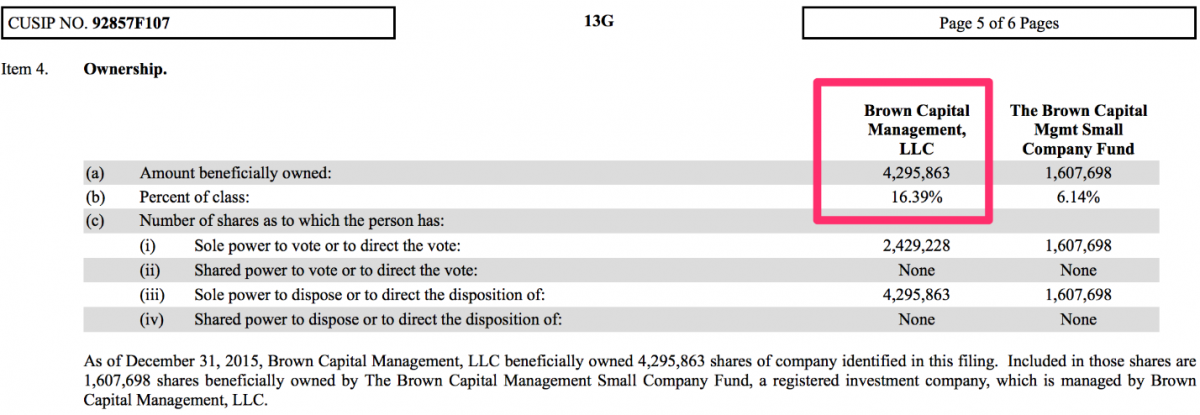

- Majority shareholder is Silicon Valley and advanced technology outsider

In our opinion, it is a matter of substantial concern for the future of a company where that company bills itself as having world-class technology but is majority-owned by an investor with limited if any expertise in high technology. We noted this in our last report on Conformis. VCRA’s majority shareholder is a Baltimore-based money manager that appears to be a fine institution. However, Brown Capital does not appear to have even one employee who has any experience in high technology in or outside Silicon Valley, to the best of what we can discern. Everything else in this report considered, we would be hesitant to take Brown Capital’s lead in investing in VCRA. One wonders if Brown Capital knows something we don’t know – or for that matter Motorola, Cisco, Venrock, GGV, Vanguard Ventures, RRE Ventures, or Thomas Weisel don’t know?

Figure 6

Source: https://www.sec.gov/Archives/edgar/data/885062/000139834416009974/fp0018...

IV. VCRA Product Doesn’t Stack up Against Competition

All discussions about Vocera’s sole product have been developed from direct conversations with an expert in the telecommunications and wireless space (the “Telecom Expert”). The Telecom Expert’s biography is provided in Appendix C to this report.

VCRA was founded in 2000. VCRA offers its customers, primarily hospitals, with a communication platform that relies on a network of VCRA-installed wireless hotspots (“WiFi”) within each hospital. The communication challenges within each hospital are individual and particular to each institution, due to the differences in the structural layout of each hospital and inherent limitations of WiFi-based communications. The B3000 device (the “B3000”), as shown below, was launched in 2011 and is provided by VCRA, along with a network management software solution to purportedly provide communication between nurses, physicians and others within a hospital.

Figure 7

Figure 7

Source: http://www.vocera.com/product/vocera-communication-badge

Summary:

► VCRA’s sole product is the oldest wireless device (i.e. 2011) being offered by the top 10 competitors (“Top 10”) we profiled in this report.

► VCRA device is the only device out of 6 we profiled that does not have a touch screen

► VCRA’s device is the most expensive device offered by the Top 10 (i.e. $1,100)

► VCRA’s platform is apparently the most expensive to install of the Top 10 (i.e. $300,000+ on average)

► 3 of 6 competitors profiled have devices with unlimited range due to their ability to operate on LTE cellular, WiFi and perhaps other communication platforms, VCRA’s sole product has the shortest range (i.e. 300 ft)

► VCRA’s device has the smallest screen size, closest competitor’s screen is approx. 2.8X, yet VCRA’s device is the costliest device by 3.7X

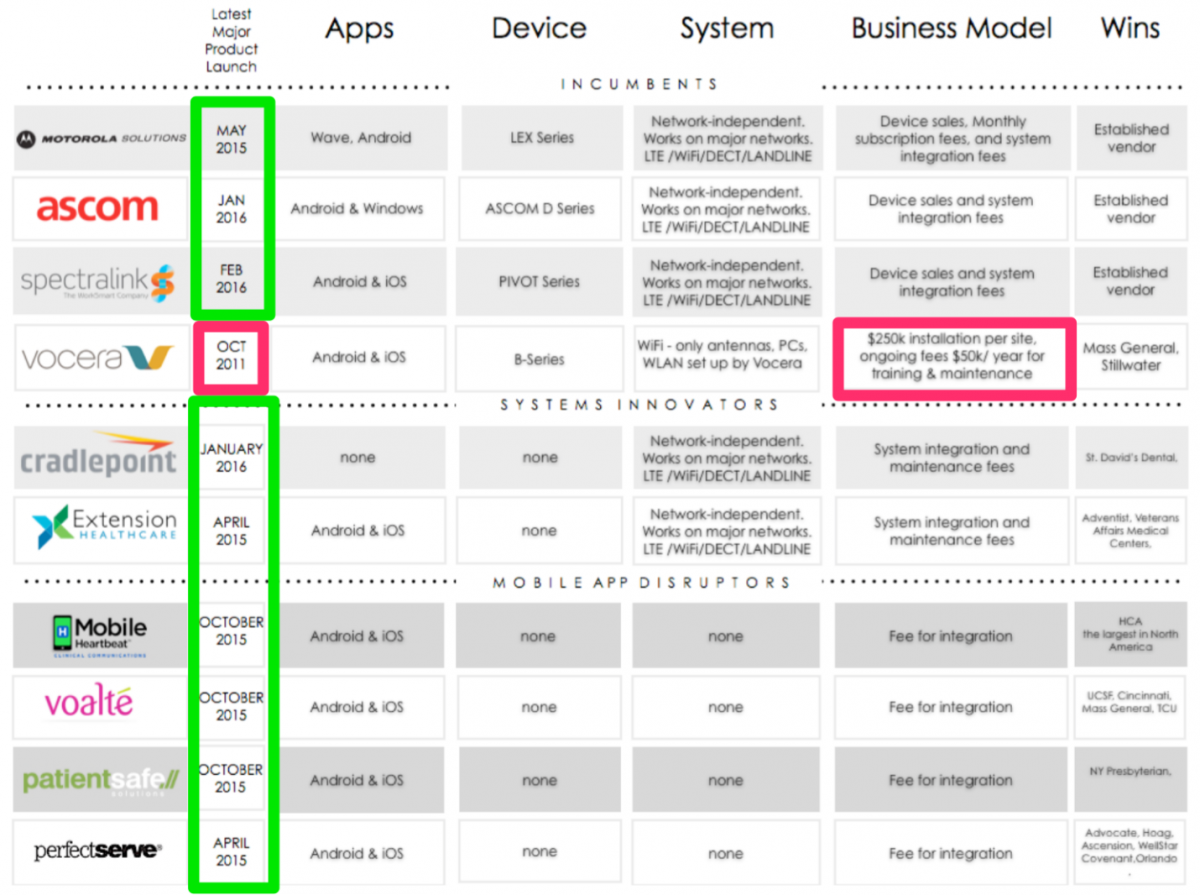

Despite the fast pace of technology and cellular device product rollouts, VCRA has not had a major product launch since 2011. VCRA is already in last place in the Telecom Expert’s view. The various charts below were developed to visualize the current competitive landscape.

Figure 8

Sources: See Appendix D

The major system attributes for each competitor are outlined below. The Telecom Expert sees VCRA in last place in nearly every category.

Figure 9

Sources: See Appendix D

The Telecom Expert stated:

VCRA has the most expensive device on the market yet VCRA’s device is the least sophisticated product. Among all of its other limitations, perhaps most alarming is that VCRA has the only device of the six devices we profiled that does not offer a touch screen. The phrase, “we now live in a touch world” was once novel, but now it’s just common sense. VCRA is obsolete by every measure we considered.

Figure 10

Sources: See Appendix D

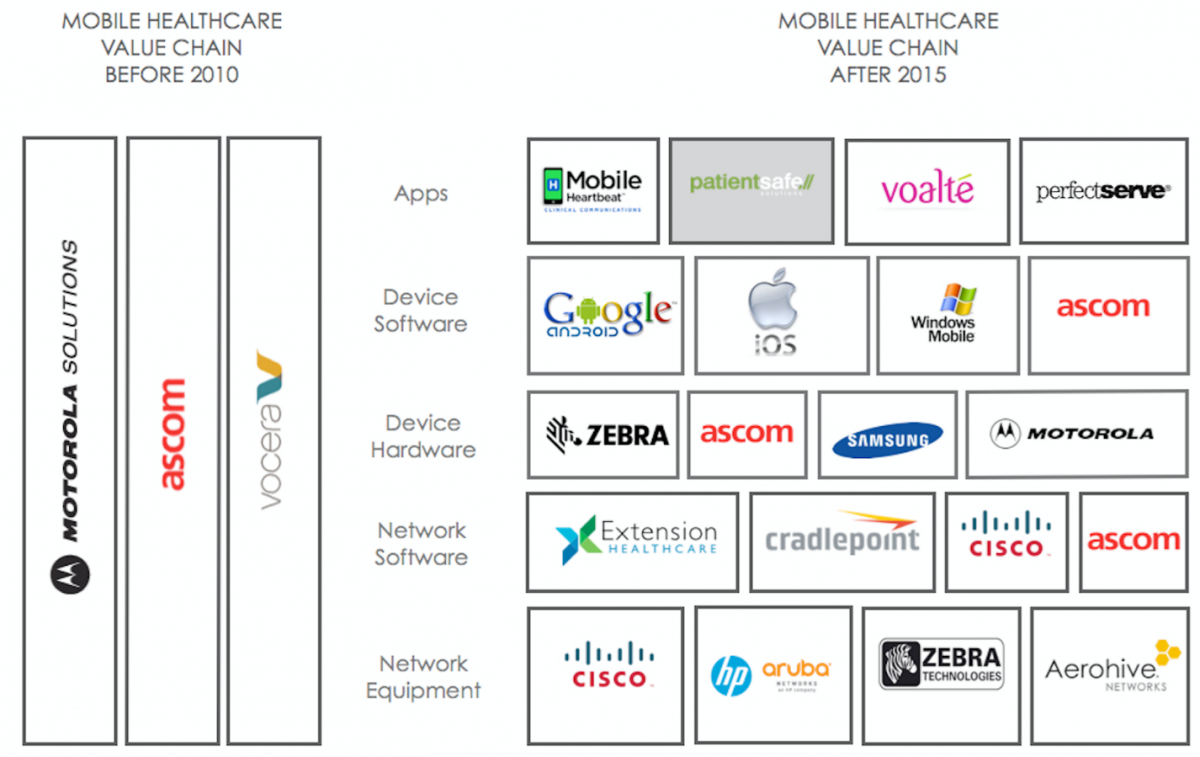

In 2010, prior to the entrance of all of 6 of the competitors we profiled in this report, the market depended on Motorola, Spectralink, Ascom and Vocera for device software, device hardware, network software and network hardware. Now, much like the PC industry, the cellphone industry and many others, this industry has undergone (just recently, i.e. in December 2015 and January 2016) a defragmentation where strong competition is arising to focus on a specific section of the value chain, i.e. apps, device software, device hardware, network software, or network hardware. VCRA appears to be moving slowly to determine what section of the value chain they want to participate in. It is quite clear to us that they will not win if they continue to try to be “all things wireless communications in healthcare.” However, we don’t see an area of the value chain where they are a leader or could be a leader. This is one of the primary reasons we see VCRA as a zero. We don’t envision VCRA succeeding in any one section of the value chain outlined below.

Figure 11

Sources: See Appendix D

V. VCRA Product Issues - User Complaints are Plentiful

The Telecom Expert spoke with the Former Executive, who was previously involved with over a dozen installations on behalf of VCRA. When asked of the nurses and doctors perception of VCRA, the Executive was quite blunt.

“Doctors hate these things.”

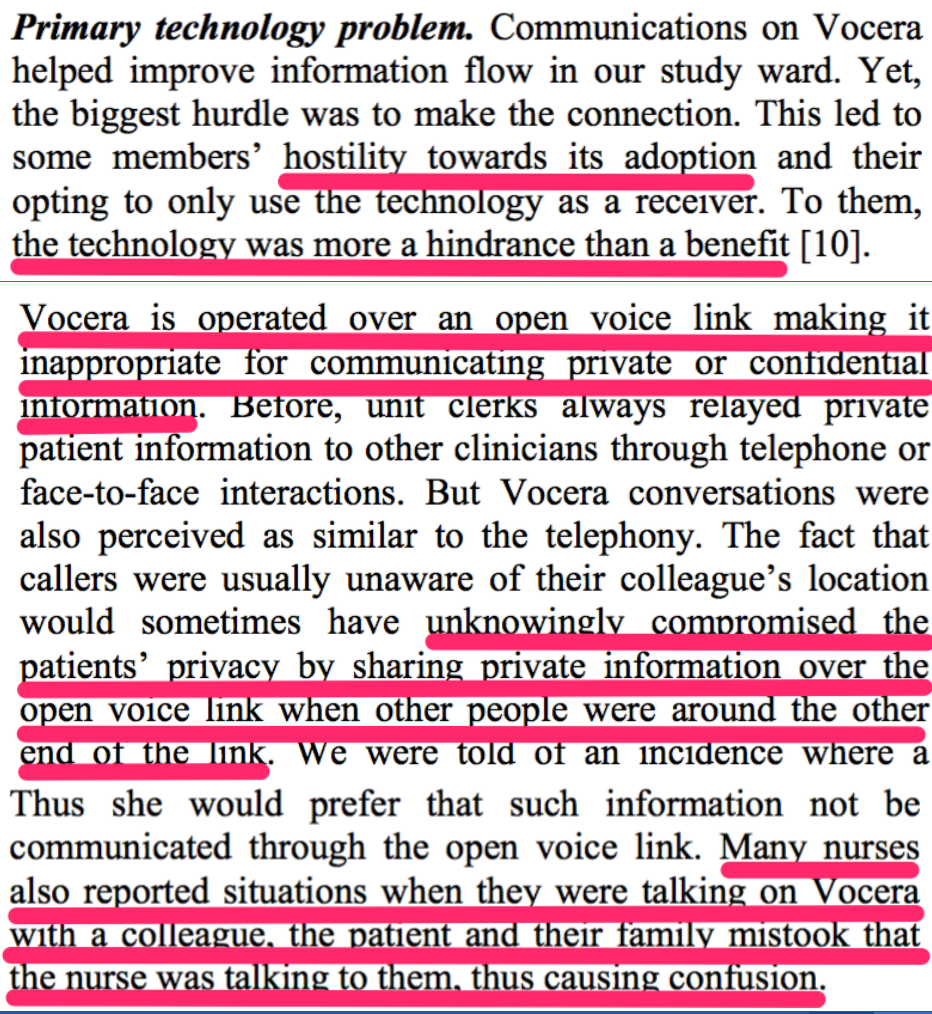

VCRA appears to be operating in an environment where the men and women who lead the daily operations of each of VCRA’s potential customers are harboring a growing antipathy towards VCRA’s sole product. A study by Charlotte Tang and Sheelagh Carpendale, both of whom are professors at the University of Calgary, further highlighted the negative and sometimes hostile view users have of VCRA’s B3000.

Figure 12

Source: http://www.charlottetang.ca/pmwiki/uploads/Main/ACM-CHI-2009.pdf

We will not discuss the voice recognition software and hands free capabilities offered by VCRA in this report other than to say the following:

1. We believe it is clear VCRA is not a leader in voice recognition software or wearable device design. We believe the 15 known defects also spell out just how un-workable the voice recognition system appears to be.

2. As Professor Tang outlines in her analysis – we don’t see hands free communications as being entirely appropriate in a hospital setting due to privacy concerns.

When considering the apparent technical immaturity of VCRA’s devices and the pervasive issue of patient privacy in the hospitals VCRA serves, we can’t begin to fathom how users will ever feel comfortable using VCRA’s B3000 device.

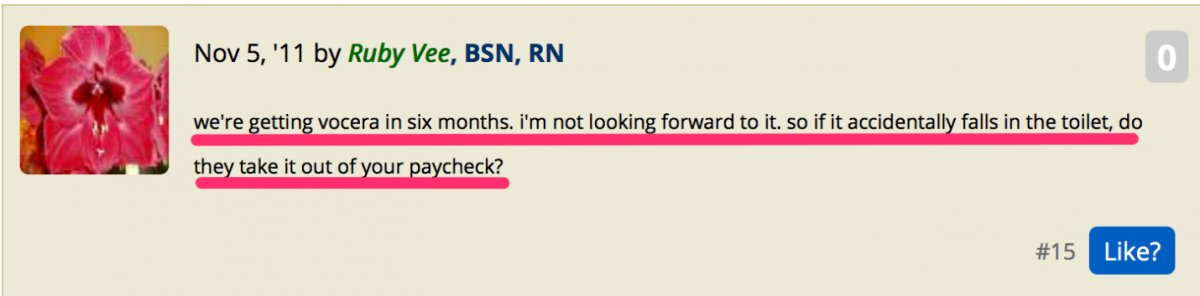

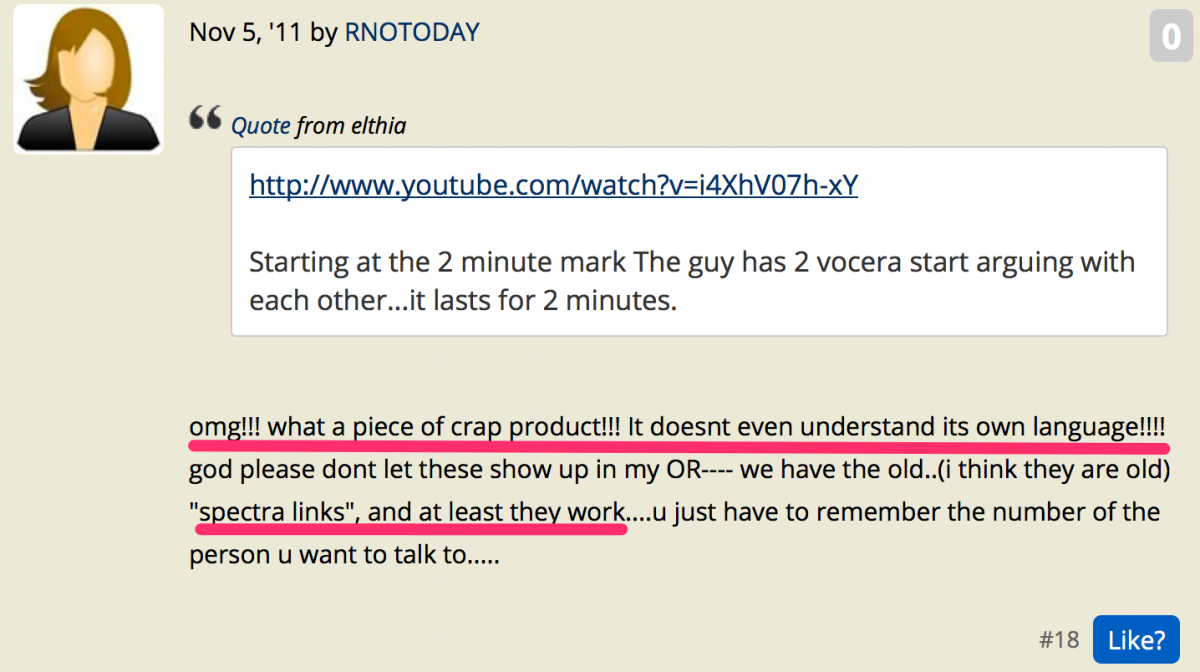

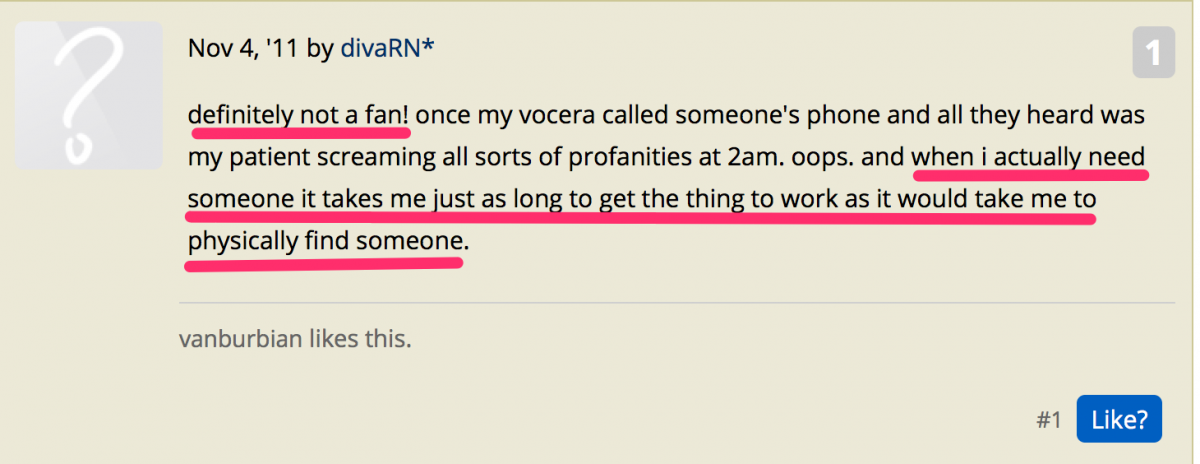

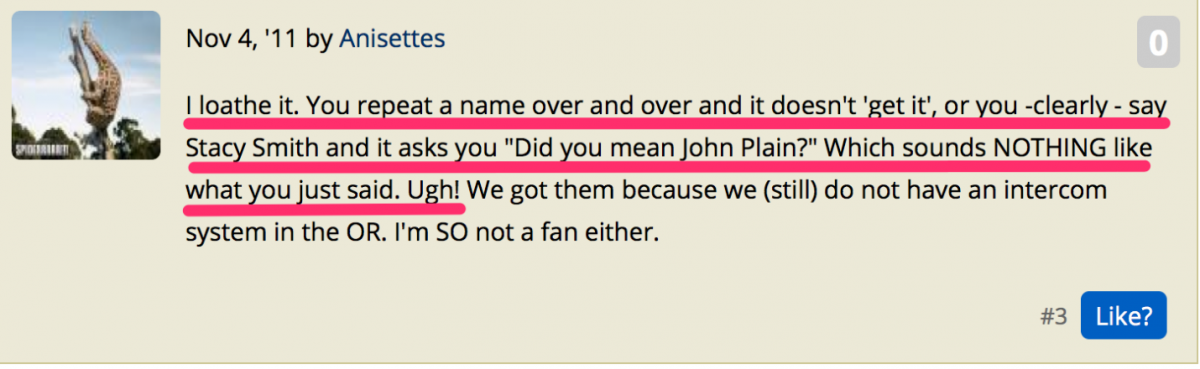

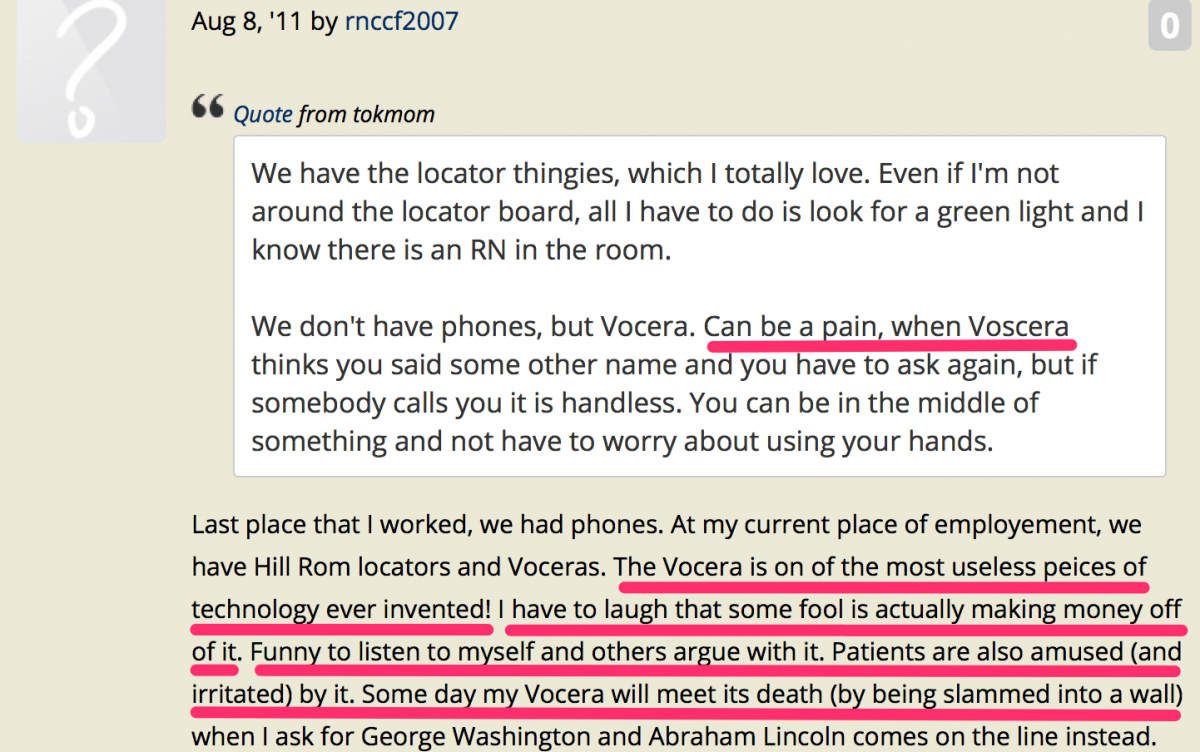

Nurses have filed numerous complaints about VCRA’s product. A few examples of these complaints are provided below.

Figure 13, collectively

Source: http://allnurses.com/gsearch.php?cx=partner-pub-9350112648257122%3Avaz70...

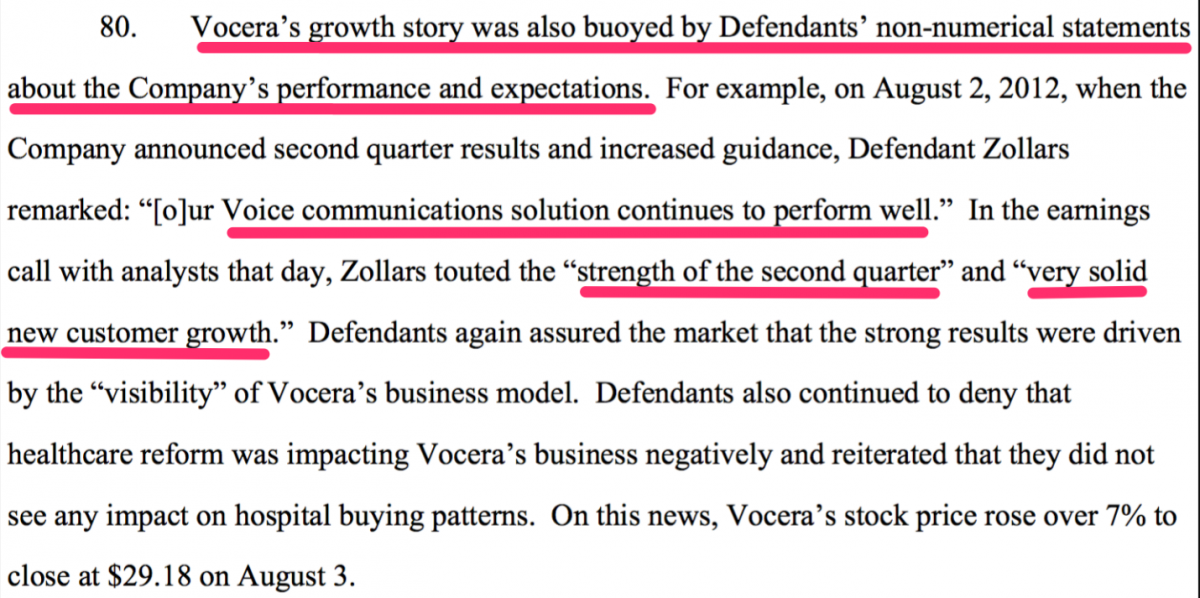

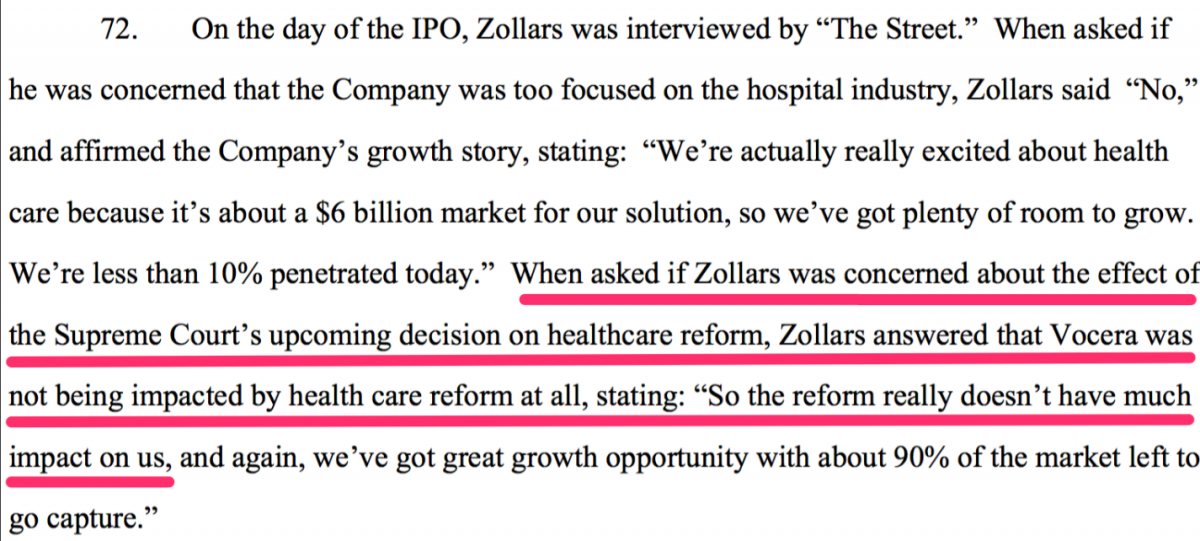

VI. VCRA Does Not Regularly Discuss Customer Churn - or any Other Negative Issues

Mr. Zollars and Mr. Lang, as recently as February 2016, have routinely used “non-numerical statements” to describe the business prospects of VCRA. Given the allegations of securities fraud and detailed descriptions of accounting fraud that have been corroborated by several former employees, we don’t believe any “non-numerical” statements made by Mr. Zollars or Mr. Lang should be considered credible. If the statements are not backed up by figures or other forms of analysis then it appears likely the statements are being made with a deceptive or promotional motive in mind.

The Class Action spelled out this issue. VCRA has a history of using “non-numerical statements” to support its story.

Figure 14

Source: Brado v. Vocera Communications Inc et al, 3_13-cv-03567, No. 104

VCRA commentary to investors seems as though it is always 100% positive, whereas the negative aspects of the business seem to always be hidden from the public. When considering that and Mr. Zollars or Mr. Lang’s history, we don’t see how a long term investor can become comfortable with VCRA.

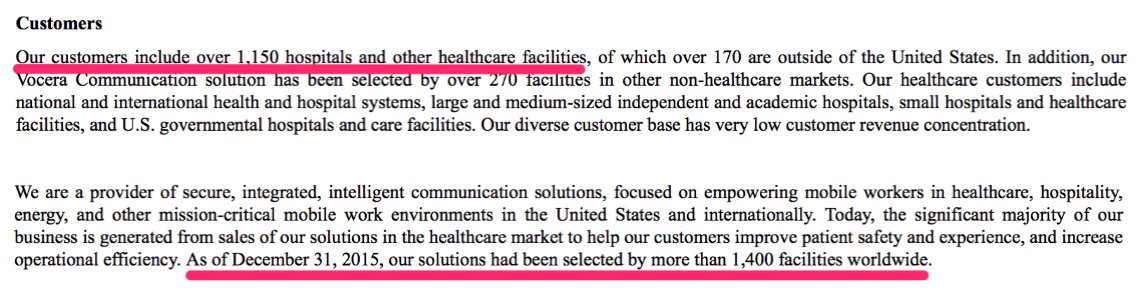

The best example of this is below. As far as we have seen, VCRA has never fully explained its “customer churn”, i.e., the number of customers that VCRA adds and loses each reporting period. This is a sign that there is some negativity in this respect, otherwise we believe VCRA would discuss this topic openly.

Figure 15

Source: https://www.sec.gov/Archives/edgar/data/1129260/000112926016000024/vcra-...

VCRA explains that its product had been selected by more than 1,400 facilities. We presume this means that in the aggregate, since its inception, VCRA has had a total of 1,400 customers. VCRA also touted that it had over 1,150 customers as of December 31, 2015.

Simple math suggests that approximately 250 customers or 18% (i.e. 250/1400) have spent the considerable capital needed to install VCRA’s sole product only to then dispose of it once they began using it.

If the average installation cost for these 250 customers is $300,000, which is on the low end of the average installation range (further below we note evidence that it was $360,000 in 2011 and $300,000-$350,000 in 2016) then that means that VCRA’s former customers have decided they do not want to continue using VCRA’s product but they also “threw away” approximately $75,000,000, collectively, when they switched to competitors’ products. That is quite telling in our opinion. In other words, if medical facilities are willing to part, collectively, with $75,000,000 for the pleasure of not having to use VCRA’s dinosaur product, this says more about the product itself than any ink we could possibly spill. Given the enormous costs to switch providers, we can only surmise as to the number of hospital customers who have not switched from VCRA but who would given a chance at a do-over. Certainly many of the individuals responsible for selecting VCRA are essentially forced to support the continued use of VCRA in their hospital for fear of being held responsible for possibly being one of VCRA’s customers who has wasted $300,000 on an inferior, outdated product. If this is accurate, perhaps the true portion of the 1,400 customers VCRA has worked with that do not wish to continue using VCRA’s product is significantly higher than 18%.

VII. VCRA Sells to Uninformed Customers, Franciscan Alliance Provides False Sense of Hope

On January 6, 2016, VCRA issued a press release announcing a new sale. The sale was to a new customer, the Franciscan Alliance. Mr. Dick Roskam, M.D., Chief Medical Information Officer of Franciscan Alliance, was quoted in the press release.

On March 18, 2016, an affiliate of SkyTides spoke with Mr. Roskam.

Mr. Roskam made the following statement:

“We looked around… they obviously have a patent on voice technology…texting has unfortunately become quite common in healthcare and a lot of it is done through apps that are not secure…the big players are Voalte and Vocera”

Mr. Roskam made the following statement in response to a question asking if he spoke with Mototorola or Ascom – whom we have previously identified as leading incumbents in VCRA’s sector.

“No we didn’t talk to them.”

Analysis:

First, Mr. Roskam confirmed that he did not speak with Motorola and Ascom – two of the leaders in this industry. Second, he suggested VCRA has a patent on voice technology – they do not. VCRA licenses the voice technology from Nuance Communications, along with anyone else willing to pay Nuance a royalty fee. Third, Mr. Roskam seems to believe VCRA is the only company capable of secure text messaging. On March 30, 2016, we checked Apple’s iTunes store and found 32 apps that provide secure text messaging. Further, we searched for “best apps for secure text messaging” at www.google.com and came across a list of the top 5 secure mobile messaging apps. Not surprisingly, VCRA is not listed here. It is no secret that secure text messaging is a key attribute of any wireless device or platform provided to users in a hospital setting. VCRA is not alone in offering secure texting and in our view is clearly not a leader in this specific space.

In summary, it appears to us that Mr. Roskam was grossly misinformed as to the strengths and limitations of VCRA’s product. Perhaps kudos are due to VCRA’s marketing and sales staff, or perhaps the Franciscan Alliance is the latest in a string of customers sold an objectively and calculably inferior product.

Perhaps VCRA benefits from being able to sell to the creamy market of physicians and nurses who are, demographically, inexperienced in the competitive telecom marketplace. We question if VCRA has ever sold its sole product to a knowledgeable IT manager who was aware of the 9 other competitors we have profiled in this report, and actually considered how VCRA’s product compares.

During a conversation with the Telecom Expert, the Former Executive confirmed that most of VCRA’s sales were to nurses who we presume have severely limited experience in IT matters.

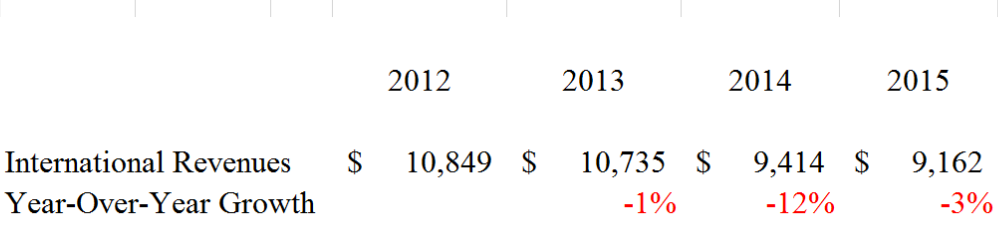

VIII. VCRA’s International Opportunity is all Hype

Since 2012, VCRA has been promoting its opportunity for international expansion. However, VCRA’s international sales have actually been declining each year.

Figure 16

Sources: https://www.sec.gov/Archives/edgar/data/1129260/000112926016000024/vcra-..., https://www.sec.gov/Archives/edgar/data/1129260/000112926013000003/vcra-...

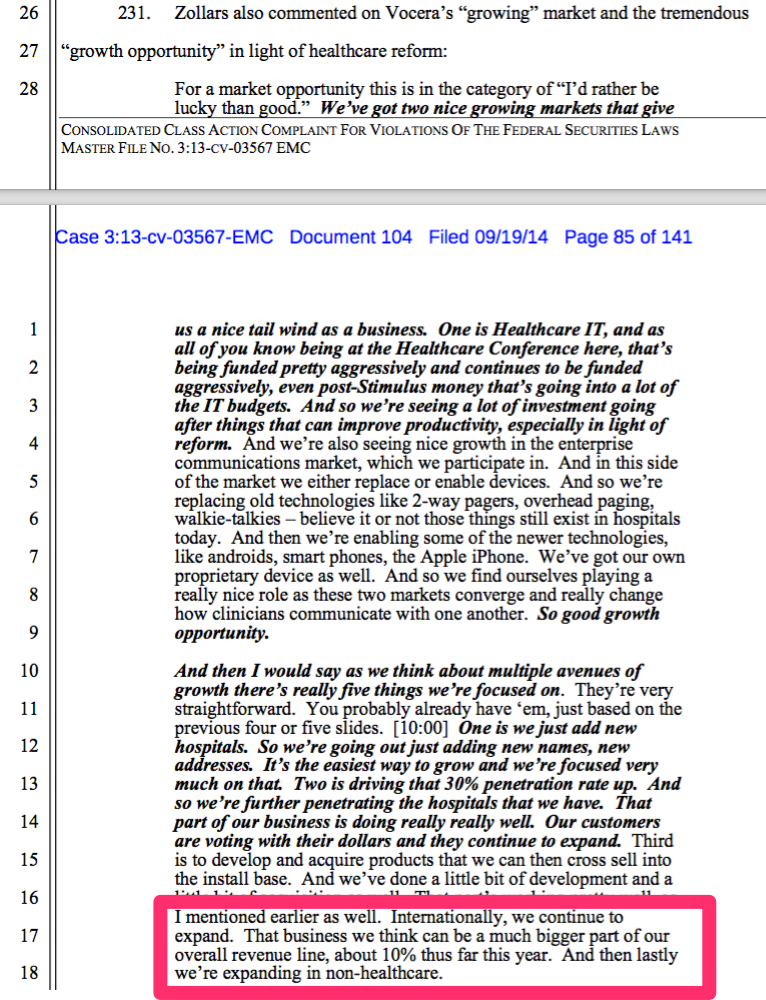

However, since 2012, and as recently as February 2016, VCRA management have repeatedly promoted the theme that international growth would drive VCRA’s business in the future. The following are excerpts from the Class Action court documents and a recent earnings call on February 11, 2016 (the “Earnings Call”), respectively.

January 7, 2013, Mr. Zollars:

Figure 17

Source: Brado v. Vocera Communications Inc et al, 3_13-cv-03567, No. 104

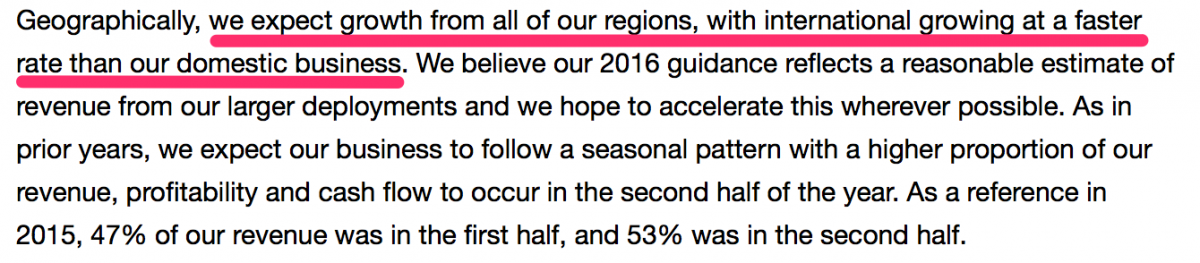

February 11, 2016, Mr. Lang:

Figure 18

Source: http://finance.yahoo.com/news/edited-transcript-vcra-earnings-conference...

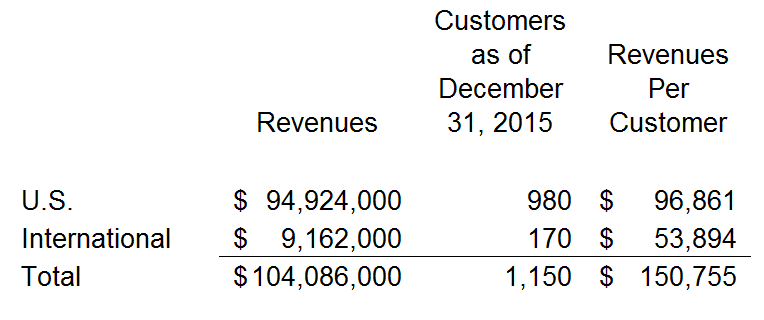

Lastly, we thought possibly some historical or trend-identifying financial ratios would support Mr. Lang’s ongoing, repetitive, and yet un-fulfilled claim that international growth is going to be a big factor for VCRA. We considered the following financial analysis:

Figure 19

Source: https://www.sec.gov/Archives/edgar/data/1129260/000112926016000024/vcra-...

We found two interesting outcomes from our analysis of the financials included in VCRA’s 2015 annual report.

1. Mr. Lang, in promoting the opportunity for growth in international markets, apparently dismisses the fact that international sales have been declining since VCRA first suggested (4 years ago) that international growth would be a key opportunity for VCRA.

2. Revenues per customer for the international customer base are less than U.S. revenues per customer by a wide margin (U.S. is $97,000 which is 177.8%, almost twice as profitable, of international revenues per customer of $54,000)

Mr. Lang should explain to the public why he continues to believe international growth is a major opportunity and why he expects international growth “at a faster rate than our domestic business.” Hopefully he considers an argument that does not involve just non-numerical useless commentary.

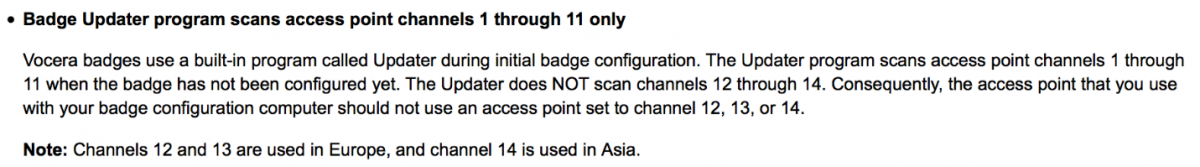

The Research Notes included comments that relate to this topic as seen below. The Telecom Expert provided his view thereafter.

The product does not work in Europe and Asia.

We are wondering how VCRA plans to compete in the international markets when the Product does not work in Europe and Asia? Those are two very large markets – especially for wireless technology.

IX. Mr. Zollars Influence Looms Large, Mr. Lang’s Questionable Claim of Increased Deal Size

Mr. Lang, as recently as February 11, 2016, during the VCRA earnings call stated:

“The average deal size is definitely going up.”

We thought we would check and see if this statement was true. The Class Action stated that the average deal size was $360,000 back in 2011, as seen below.

Figure 21

Source: Brado v. Vocera Communications Inc. et al, 3_13-cv-03567, No. 104

However, according to an analyst report from Craig Hallum dated March 3, 2016, the average deal size “a couple years back” was $250,000. We presume Craig Hallum obtained their data from VCRA.

Figure 22

Source: Craig Hallum March 3, 2016 Analyst Report

So someone appears wrong here. Either the numerous learned attorneys who brought the Class Action are wrong or Mr. Lang is wrong. It should suffice to say that, to our knowledge, none of those attorneys have given us any cause to doubt their veracity. Mr. Lang on the other hand – well we’re not sure what truth means to him.

X. VCRA Product Issues – CTO Outlines 15 Known Defects

On December 17, 2015 Vocera published release notes for its Product (the “Release Notes”). According to the Telecom Expert,

As the reader is possibly aware, “release notes” are common within the tech industry and generally provide the latest information about defects the company has discovered, addressed and fixed, either through internal sources or user comments.

However, VCRA is different from almost all other similarly situated tech companies. The Telecom Expert reviewed the Release Notes and focused on the “known issues” and “known limitations” sections of the Release Notes. The following is the table of contents for VCRA’s release notes.

Figure 23

Source: http://www.vocera.com/ts/updates/rnotes/ReleaseNotes_vs_4.4.2.html

The Telecom Expert’s summary of the “known issues” and “known limitations” content is as follows:

These release notes constitute a sharp departure from the industry standard. VCRA has acknowledged in the Release Notes that the Product has numerous significant defects and that VCRA has not fixed these defects. These do not appear to be new defects. Many of the defects we noted appear to have existed for quite some time – at least since 2008. VCRA’s product should not have been available in the marketplace.

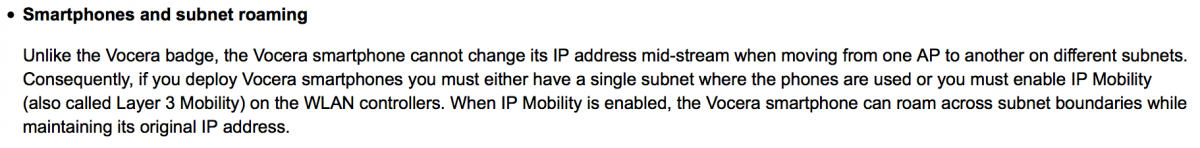

The Telecom Expert has reviewed the Release Notes and has labeled these 5 items outlined below as “defects” rather than “known limitations” and “known issues.” His complete detailed analysis of each of the 15 defects is provided in Appendix E to this report. Each of the defects is provided in a separate screenshot from Vocera's website. The Telecom Expert’s comments are bolded and underlined and presented below the screenshot for each defect.

Product defect #1

Product defect. This is a technically sophisticated way of saying that the Vocera system does not allow devices being used on the system to “roam” from one WiFi hotspot to another without dropping its connection to the system. You cannot have a commercially viable wireless product that does not allow you to go wherever you need to go throughout a hospital without dropping calls etc. This is a mobile product that restricts mobility. The point of wireless is mobility.

Product defect #2

Product defect. This is similar to a frozen screen on a laptop. However this is a lot more dangerous. In this instance, the device is used to help professionals provide urgent care in life and death situations.

Product defect #3

Product defect. The product simply doesn’t work seamlessly when you walk from one building to another. By the company’s own description, the performance drops while the device searches for an open channel. In the normal course of using a modern wireless device no manual intervention should be necessary to create a connection. Software should scan for open channels automatically.

Product defect #4

Product defect. Device and network fail to accurately capture and identify the voice of the subscriber. There isn’t a fail-safe way to verify that someone is who they say they are. This opens up a long list of questions related to patient privacy compliance laws, especially HIPAA. There are no safeguards against misidentification of the proper user. The VCRA voiceprint technology is inconsistent in an environment where privacy is a regulatory requirement.

Product defect #5

Product defect. Call history has been around for 20 years. It is incomprehensible why call history is not supported by VCRA.

Source: See Appendix E for a complete review of 15 known product defects

XI. -5.07% Combined Annual Growth Rate 2012-2015

VCRA is the epitome of a stalled, stagnant business that is ripe for a challenge by well capitalized competitors. In our opinion, VCRA insiders know what is truly happening at VCRA – and they are not buying shares in the open market. To the contrary, they are selling, and in our opinion - some of them are selling as fast as they can.

Below are high level financials for each quarterly reporting period from January 1, 2012 through December 31, 2015.

Figure 25

Source: Various Form 10-Q and Form 10-K filings at www.sec.gov

We noted that the only profitable quarters reported by VCRA were in 2012. This time period happens to coincide with the potential accounting fraud depicted by several former VCRA employees, including the former Senior Director of Internal Audit and Compliance.

XII. Summary and Valuation Discussion

VCRA has one product and one supplier for that one product. In the event market conditions change – and they are obviously changing right now in our opinion – VCRA may not be able to adapt to the market’s demands efficiently and quickly. Competitors with robust product portfolios and diversified supply chains have a significant advantage over VCRA right now. If VCRA encounters declining sales of its sole product, for whatever the reason or reasons may be, VCRA will have no other revenue stream to support the decline in sales for its current product.

Despite in-depth review and due diligence, we see no value in VCRA's technology, product portfolio, or other assets, with the exception of cash and cash equivalents, for the reasons outlined in this report. On February 22, 2015 VCRA announced its cash and cash equivalents as of December 31, 2015 totaled $116.8 million. As of March 11, 2016 VCRA had 26,435,787 shares of common stock outstanding. We believe VCRA's common stock is currently worth $4.50 per share (i.e. $116.8/26.4, rounded to the nearest half dollar). Long term, and possibly within 2016, we expect one of two outcomes for VCRA:

1. VCRA will encounter an unrecoverable sharp decline in business for the various reasons outlined in this report. We believe the most significant impact in 2016 will be from the proliferation of new competitors who are attempting to replace VCRA in hospitals by offering well-tailored apps on smartphones. If these apps begin to take more marketshare - we note in our competitive review that they already have signed several high quality customers - then current customers and potential new customers could either just select these other competitors rather than VCRA or perhaps even worse, new customers may demand VCRA provide the installation of its system for free or at a discount. Considering that there is potentially no or minimal install cost for app competitors who make use of cellular connections or existing WiFi connections, VCRA may have no choice but to offer installations at heavy discounts or even for free. That would be a very costly development – and VCRA may not have a choice but to accept the fact that is has to offer a free or heavily discounted installation. Negative cashflow will begin to threaten VCRA’s continued existence if this begins to occur.

2. VCRA will attempt a sizable capital raise, diluting shareholders by at least 50% in our view, in order to execute an aggressive turnaround plan that will include (1) a segregation and gradual disposal of its current 16-year old “patch-worked” WiFi-only platform, and (2) the design and commercialization of a modern LTE/WiFi (system agnostic) platform to replace VCRA’s current platform.

VCRA’s cash burn increase due to reasons mentioned in this report include but are not limited to competitive pressures. In the event of either of the two outcomes listed above actually occurring, VCRA investors could suffer significant loses, either as a result of the stock price declining upon disappointing financial results or through dilution.

Appendix A – Robert Zollars

Robert J. Zollars served on our Board from May 2006 until the Company was acquired in June 2007 by affiliates of Madison Dearborn Partners, LLC. He rejoined our Board in September 2007 and currently is a member of the Compensation Committee and the Nominating and Governance Committee. Mr. Zollars has been the Chairman and Chief Executive Officer of Vocera Communications, Inc., a wireless communications systems company, since June 2007. Prior to Vocera Communications, he served as the President and Chief Executive Officer and a Director of Wound Care Solutions, LLC, a private equity backed business serving the chronic wound care segment of healthcare, from June 2006 through April 2007. From June 1999 until March 2006, Mr. Zollars was the Chairman and CEO of Neoforma, Inc., a healthcare technology company focusing on the supply chain. Prior to joining Neoforma, he was the Executive Vice President and Group President of Cardinal Health, Inc., where he was responsible for five subsidiaries. From 1992 until 1996, Mr. Zollars was the President of the Hospital Supply and Scientific Product distribution businesses at Baxter International Inc. Mr. Zollars currently serves as a Director of Diamond Foods, Inc., InterAct911 Corporation and Silk Road Technology Inc. In the past five years, Mr. Zollars also served on the Board of Reliant Technologies, Inc. He is the Chairman of the Center for Services Leadership at Arizona State University. He holds a Bachelor of Science degree from Arizona State University and a master of business administration degree from John F. Kennedy University. Mr. Zollars’ current and prior experience as a chief executive officer, extensive senior management experience in various positions within the healthcare industry, and board member experience at other companies, along with his independence, make him a valuable member of our Board of Directors.

Source: https://www.sec.gov/Archives/edgar/data/1129260/000117494715000642/b4062...

Content regarding Diamond Foods:

https://www.sec.gov/News/PressRelease/Detail/PressRelease/1370540598296

http://investor.diamondfoods.com/phoenix.zhtml?c=189398&p=irol-newsArtic...

http://www.sec.gov/Archives/edgar/data/1320947/000119312512046902/d29742...

http://www.wsj.com/articles/SB10001424052702303848104579310690154877108

https://globenewswire.com/news-release/2012/11/14/505261/10012613/en/Dia...

Content regarding Neoforma:

https://www.sec.gov/Archives/edgar/data/1096219/000119312505052468/d10k.htm

https://www.sec.gov/Archives/edgar/data/1096219/000119312506045162/dsc13...

https://www.sec.gov/Archives/edgar/data/1096219/000119312506039803/dex99...

http://www.sec.gov/Archives/edgar/data/1096219/000101287002001994/ddef14...

http://www.nytimes.com/2003/05/30/business/hospital-supplier-says-audito...

http://www.nytimes.com/2004/08/21/business/wide-us-inquiry-into-purchasi...

http://www.prnewswire.com/news-releases/new-report-questions-value-of-ne...

http://www.forbes.com/forbes/2000/0403/6508122a.html

http://projectavalon.net/forum4/showthread.php?75490-Report-of-Racketeer...

http://www.prnewswire.com/news-releases/new-report-questions-value-of-ne...

Source: Neoforma, Inc. IPO, et al v. Neoforma.Com, Inc., et al, 1_01-cv-06689, No. 14

Appendix B – Accounting Fraud

Source: Brado v. Vocera Communications Inc et al, 3_13-cv-03567, No. 104

Appendix C – Telecom Expert

The Telecom Expert is a mobile telecom systems expert who has developed and configured every generation mobile technology networks from the most recent 5G developments, going back to the earliest digital switching systems in the early 1980s. He is currently consulting to companies on potential 5G multi-Gbps applications for fixed and mobile communication networks in the 3400-3600 MHz, 3700-4200 MHz, 14500-15350 MHz and 27500-28500 MHz. These networks are expected to eliminate distinctions between what we now know as cellular, dispatch, WiFi, and cordless phones for businesses and consumers. He was part of the AT&T Network Systems division, which became Lucent and is now Alcatel. He developed Class 4/5 switching applications for the 5ESS-2000 version that power half of all voice calls in North America. He also installed the first Nortel DMS-100 switches which supported the early Intelligent Network functions (AIN, CS1-R, ETSI INAP). He was once the technical coordinator of interoperability between mobile networks in the U.S. and other countries on behalf of North America. He developed many VoIP applications that run on Cisco ATA and SIPURA SPA-2000 using SIP protocol on a broadband connection.

Appendix D – Competitive Review

VCRA

http://psqh.com/vocera-debuts-new-communication-badge

Motorola

http://www.motorolasolutions.com/en_us/products/lte-user-devices.html

http://www.motorolasolutions.com/en_us/products/lte-broadband-systems.html

http://www.motorolasolutions.com/en_us/products/voice-applications/wave-...

Ascom

http://www.ascom.us/en/nt-lte-suite

http://www.ascom.com/ws/en/index-ws/systems-division/ascom-unite/solutio...

Spectralink

http://telecomreseller.com/2016/02/23/spectralink-unveils-next-generatio...

http://www.mobilitytechzone.com/lte/news/2014/10/02/8047943.htm

Cradlepoint

https://cradlepoint.com/products-and-services

https://cradlepoint.com/white-paper/4g-lte?ls=Adwords&gclid=CKTV5vvvv8sC...

http://innovation.verizon.com/content/vic/en/innovation-labs/allProducts...

Extension Healthcare

http://www.extensionhealthcare.com/extension-solutions/extension-engage-...

Mobile Heartbeat

http://www.tmcnet.com/usubmit/2015/10/19/8263150.htm

http://www.mobileheartbeat.com/products/mobile-heartbeat-overview/

Patientcare

http://www.patientsafesolutions.com/patienttouch

Appendix E - 15 Known Defects

Our Telecom Expert has reviewed the Release Notes and has labeled these 15 items outlined below as “defects” rather than “known limitations” and “known issues.” His complete detailed analysis of each of these defects is provided below. Each of the defects is provided in a separate screenshot from http://www.vocera.com/ts/updates/rnotes/ReleaseNotes_vs_4.4.2.html. The Telecom Expert’s comments are bolded and underlined and presented below the screenshot for each defect.

Product defect. This is a technically sophisticated way of saying that even when a user chooses a smartphone over the VCRA device, you cannot move in any direction you choose at any speed you choose without losing connectivity. You cannot have a commercially viable wireless product that does not allow you to go wherever you need to go throughout a hospital. This is a mobile product that restricts mobility. The point of wireless is mobility.

Product defect. This is similar to a frozen screen on a laptop, but a lot more dangerous. In this instance, the device is used to help professionals provide urgent care in life and death situations. With the smartphone app, this also represents a violation of Android and Apple policy. Both Apple iOS and Android phones have strict rules against apps that interfere or prevent incoming and outgoing calls or texts. VCRA’s apps run the risk of being removed from iTunes and other app stores as a result.

Product defect. The product cannot roam from one location to another seamlessly without losing connectivity. VCRA needs high system reliability and quality of service levels to sell to hospitals. They simply do not have either.

Product defect. The product simply doesn’t work seamlessly when you walk from one building to another. By the company’s own description, the performance drops while the device searches for an open channel. In the normal course of using a modern wireless device no manual intervention should be necessary to create a connection. Software should scan for open channels automatically.

Product defect. Device and network fail to accurately capture and identify the voice of the subscriber. There isn’t a fail-safe way to verify that someone is who they say they are. This opens up a long list of questions related to patient privacy compliance laws, especially HIPAA. There are no safeguards against misidentification of the proper user. The VCRA voiceprint technology is inconsistent in an environment where privacy is a regulatory requirement.

Product defect. Incomplete or misunderstood speech could have dire consequences in a hospital.

Product defect. Unresponsive hardware. High failure rates in life and death situations are simply unacceptable. The professional needs to be able to grab the product and spring into action without concern that the product is charged.

Product defect. This level of defect could impede the ability of the staff to respond or carry out their duties.

Product defect. Unresponsive hardware. The product should not have been released with this kind of defect.

Product defect. Call history has been around for 20 years. It is incomprehensible why call history is not supported by VCRA.

Product defect. This level of audio degradation compromises the ability of the user to interpret information. This is a major risk in a medical care environment.

Product defect. This level of defect could impede the ability of the staff to respond or carry out their duties.

Product defect. This level of defect could impede the ability of the staff to respond or carry out their duties.

Product defect. This level of defect could impede the ability of the staff to respond or carry out their duties.

Product defect. Having to open two internet browser sessions at the same time to accomplish one task is just one more example of the numerous inexplicable defects that create barriers to VCRA acceptance by IT administrators.

We consider these defects to be definitive. We see no basis for anyone to contend otherwise. While conducting our research we identified several other issues we considered as “defects.” However, we did not have definitive evidence to support our claims and decided against presenting those defects within this report.

Appendix F – Securities Fraud

Source: Brado v. Vocera Communications Inc et al, 3_13-cv-03567, No. 104

Comments

Add new comment